This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

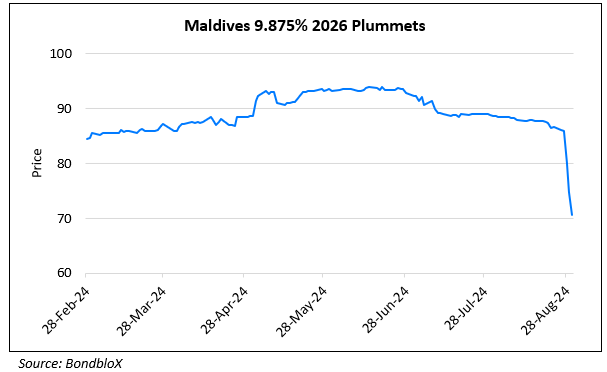

Maldives Downgraded to CC by Fitch

August 30, 2024

Maldives was downgraded by two notches to CC from CCC+ by Fitch. The downgrade reflects intensified pressures from the country’s recently deteriorating external financing and liquidity metrics, which has increased the likelihood of default, according to Fitch. Maldives’ gross FX reserves plunged by roughly 20% to $395mn in July 2024 from $492mn in May 2024, marking the lowest level since December 2016. The decline reflects persistently high current account deficits (CAD), high external debt service, and the Maldives Monetary Authority’s continued interventions to support the currency peg of the rufiyaa to the USD. The government has $50mn in sovereign external debt-servicing obligations falling due in 4Q2024 and $64mn in publicly guaranteed external debt vs. cash of only $65mn in Sovereign Development Fund. Maldives’ total external debt servicing is expected to increase to $557mn in 2025 and exceed $1bn in 2026.

Maldives’ 9.875% 2026s bond has dropped by 15-16 points over the week and currently trades at 70.7

Go back to Latest bond Market News

Related Posts: