This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Maldives’ Dollar Sukuk Rallies on China, India Positive Developments

September 16, 2024

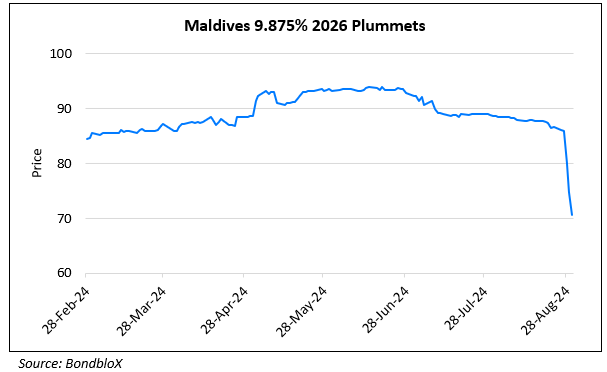

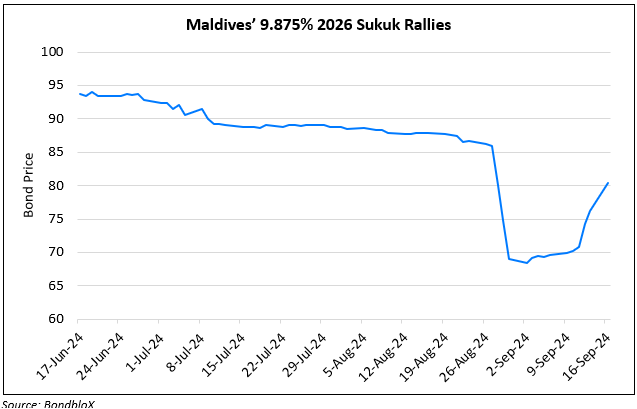

Maldives’ 9.875% 2026s have rallied by over 10 points over the last two days on positive developments. First, Maldives and China signed an MoU to strengthen trade and investment by boosting local currency settlement for current account transactions and direct investment. This development comes amid concerns earlier last week that Maldives may become the first country to default on its offshore sukuk if they fail to make a $25mn coupon payment in October. Bloomberg notes that promoting local currency settlement could help reduce the island nation’s reliance on the USD by making its transactions with China using the yuan simpler and more direct. This might also increase Chinese FDI into the nation.

Secondly, the Indian government was reported to be ready to offer emergency financial support to Maldives to avert the sukuk default, as per sources. It was noted that Maldives could immediately tap the $400mn available under the RBI’s currency swap program open to regional countries. Besides, Maldives could also seek long-term loans under an $800mn line of credit extended to them in 2019, they noted. However, there is no clarity on whether the Maldivian government has officially asked for India’s help.

Go back to Latest bond Market News

Related Posts: