This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macy’s Urged to Consider Options for Bloomingdale’s and Bluemercury Chains

December 10, 2024

Macy’s has been urged by activist investors Barington Capital and Thor Equities, to create a real estate unit and explore strategic options for its Bloomingdale’s and Bluemercury chains. They criticized Macy’s board, claiming it lacks the expertise to fully leverage the value of its real estate assets, estimated at $5-9bn. They recommended cutting capex by 50% and sought to have their representatives added to the board. They pointed to strong sales at Bloomingdale’s and Bluemercury compared to Macy’s core stores and expressed confidence in the turnaround plan of CEO Tony Spring, who took over in February. Spring aims to reduce costs by $100mn this year through store closures while expanding the locations of Bloomingdale’s and Bluemercury. Macy’s responded that it is open to reviewing its strategy and will engage with Barington and Thor. The company also intends to buy back up to $3bn in stock over the next three years.

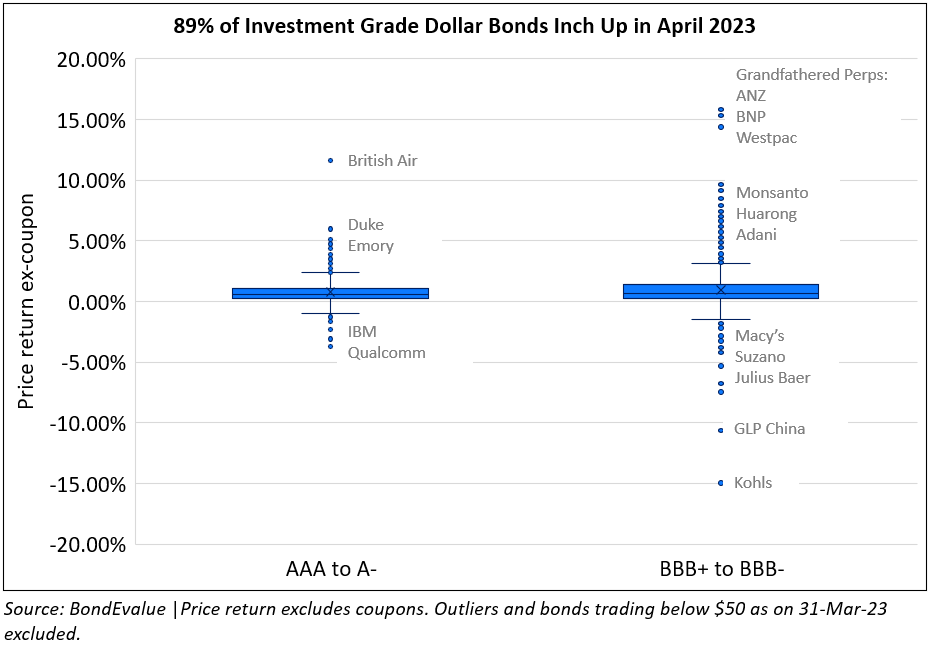

Macy’s 4.5% 2034s were trading stable at ~85 cents on the dollar, yielding 6.6%.

For more details, click here

Go back to Latest bond Market News

Related Posts: