This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

February 8, 2022

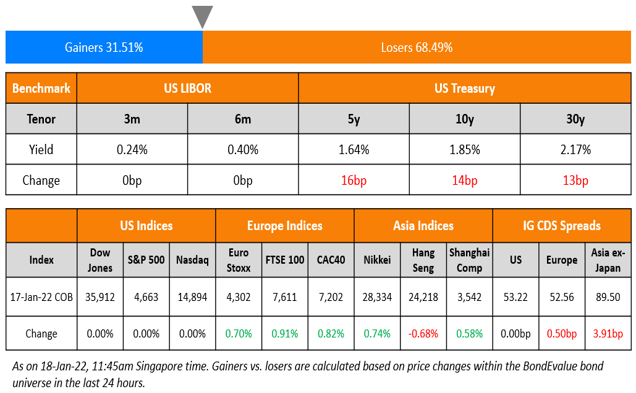

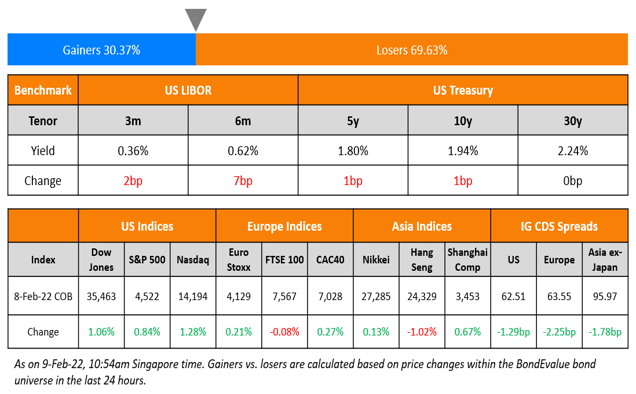

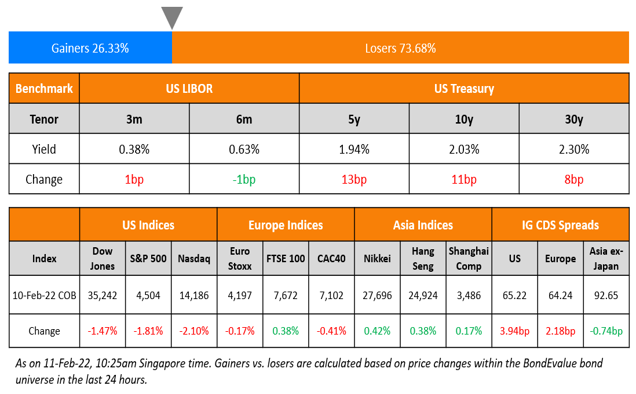

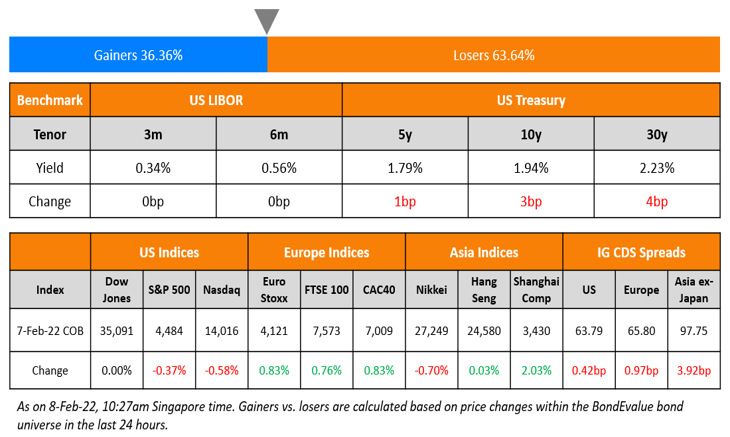

US equity markets fell with the S&P and Nasdaq ending 0.4% and 0.6% lower. Sectoral gains were led by Energy, up 1.3% while losses were led by Communication Services, down 2.2%. US 10Y Treasury yields rose 3bp to 1.94%. European markets were higher with the DAX, CAC and FTSE up 0.7%, 0.8% and 0.8%. Brazil’s Bovespa closed 0.2% lower. In the Middle East, UAE’s ADX was up 0.1% and Saudi TASI closed 0.4% higher. Asian markets have opened mixed with HSI and Shanghai down 1.54% and 0.90% while STI and Nikkei are up 0.57% and 0.24% respectively. US IG CDS spreads were 0.4bp wider and HY CDS spreads were 3.1bp wider. EU Main CDS spreads were 1bp wider and Crossover CDS spreads were 7bp wider. Asia ex-Japan CDS spreads were 3.9bp wider also.

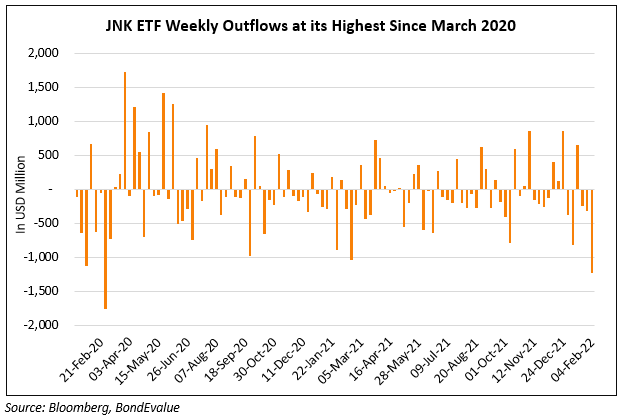

China’s Caixin/Markit services Purchasing Managers’ Index (PMI) dropped to 51.4 in January, the lowest since August 2021, from 53.1 in December. Separately, the largest junk bond ETF known as JNK saw its highest weekly outflows last week since the peak of the pandemic in March 2020.

New Bond Issues

- Kia Corp $ 3/5Y green at T+120/130bp area

.png)

New Bonds Pipeline

- Zhengzhou Airport Economy Zone Xinggang Investment Group hires for $ bond

- Dongtai Communication hires for $ 65mn 180-day bond

- Kalyan Jewellers India hires for $ 5Y bond

- Electricity Generating (EGCO) hires for $ 7Y or 10Y bond

- Petron hires for $ 7NC4 bond

Rating Changes

- AusNet Services Ltd. Downgraded To ‘BBB+’ On Ownership Change; Outlook Stable

- Moody’s downgrades AusNet’s rating to Baa1; stable outlook

- Icahn Enterprises L.P. Outlook Revised To Stable From Negative, ‘BB’ Ratings Affirmed On Strong Portfolio Performance

- easyJet Outlook Revised To Stable From Negative On Recovering Air Traffic; ‘BBB-‘ Ratings Affirmed

Term of the Day:

Fixed-for-life Perpetuals

Fixed-for-life perpetuals, as the name suggests, are perpetual bonds that offers a fixed coupon through the life of the perpetual. This structure is commonly seen in low interest rate environments as issuers entice investors with a relatively higher coupon compared to benchmarks for that currency. Investors must be wary about fixed-for-life perps as the call option to redeem the bonds typically lie with the issuer. Should interest rates rise in the future, it would be economically beneficial for the issuer to not redeem these perps and continue to pay a lower coupon for perpetuity.

Allianz decided to not redeem its 3.875% fixed-for-life perps on the first call date, which led the perps to fall ~5 points to 93.85 cents on the dollar.

Talking Heads

On Billions Are Flowing to Cash-Like ETFs in ‘Hunt’ Before Fed Hike

Peter Chatwell, head of multi-asset strategy at Mizuho International

“What this flow shows is how the chain reaction of Fed hikes and quantitative easing will take liquidity out of ‘duration’ risk assets, into the short-duration products… Until there are higher policy rates and higher term premia in U.S. T-bills, commercial paper and other short-term credit products are likely to do well from these flows… We expect this flow to become much more risk-averse after the March 16 Fed as by then, we should have higher and steeper T-bill curves.”

On Goldman, Citigroup Seeing Winning Bets Against Super-Sized Fed Hike

Strategists Jabaz Mathai and Jason Williams

Citigroup’s base case is also a quarter-point move at the March meeting, “although the pricing for a 50bp move is likely to stay sticky”

Goldman strategists including Praveen Korapaty said a way to bet against a 50-basis-point March jump would be to sell December overnight rate index swaps and buy the June version.

On ESG ‘Bubble’ Being a Risk in Crowded Climate Bet – Johanna Kyrklund, Schroders CIO

Clients want to decarbonize, but on the other side there are not many opportunities. There are not as many places to invest, and this can create a bubble. There is nothing more fundamental to economic activity than the energy transition…. We are not going down the path of exclusion. That would be tantamount to undermining the portfolio. Active ownership is a better way forward, and that is what we have been doing.”

On JPMorgan Saying U.S. Corporate Debt Could Draw More Foreign Buyers

The average U.S. investment-grade corporate bond yielded 2.93% as of Friday’s close, the highest since April 2020. And crucially for foreign investors, yields are around five-year highs even after subtracting out hedging costs. This is a potentially attractive setup for overnight investors in Asia to re-emerge as buyers of long-end high grade US corporate bonds. This latest spike in USD yields has not been met with rising hedging costs, a key difference between now and the 2018 selloff.”

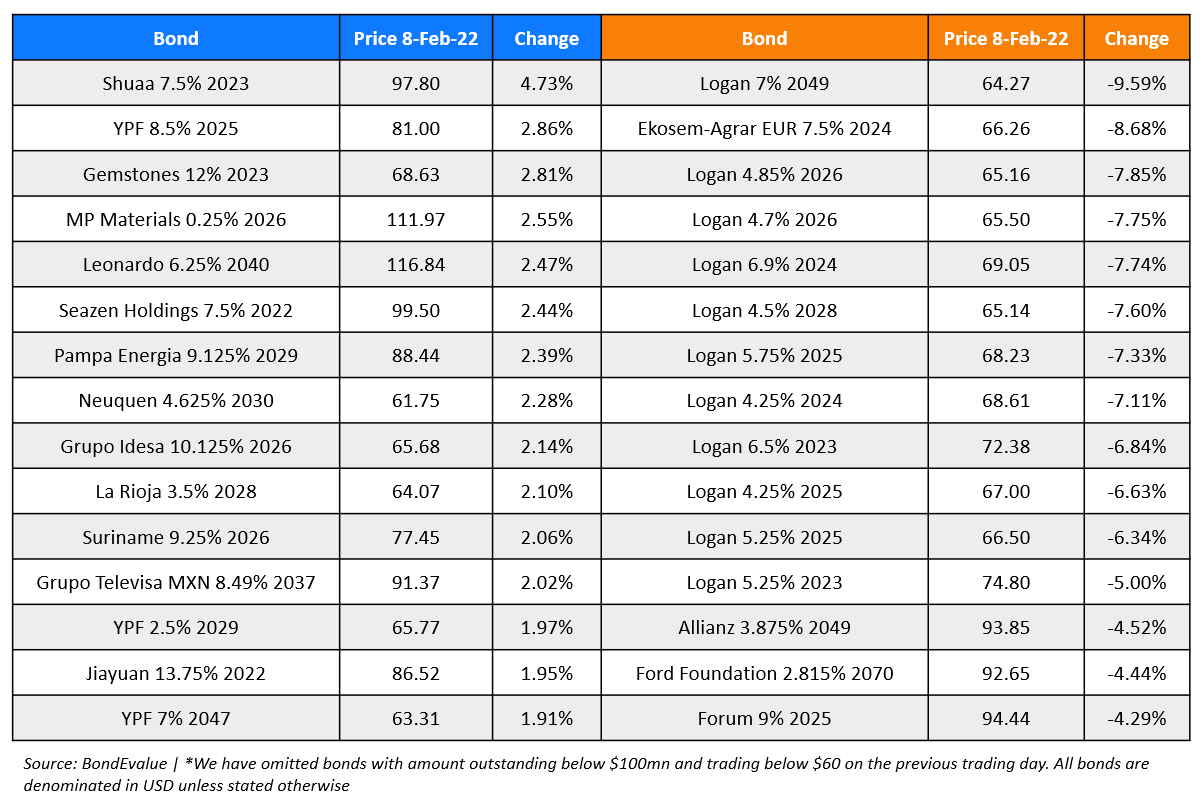

Top Gainers & Losers – 08-Feb-22*

Other Stories

Go back to Latest bond Market News

Related Posts:.png)