This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

February 11, 2022

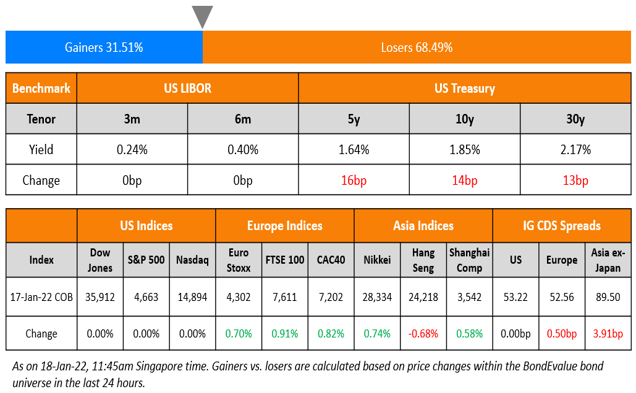

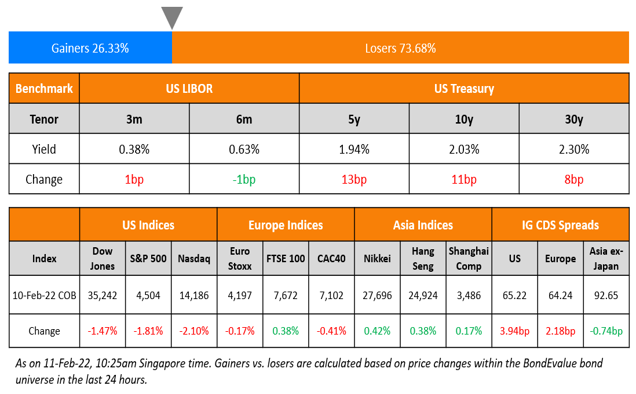

S&P and Nasdaq ended 1.8% and 2.1% lower as US inflation hit a 40Y high (details below). Sectoral losses were led by Real Estate, IT and Utilities, down over 2.5% each. The high inflation reading pushed US 10Y Treasury yields higher by 11bp to breach the 2% mark for the first time since July 2019. European markets were mixed with the DAX flat, CAC down 0.4% and FTSE up 0.4%. Brazil’s Bovespa closed 0.8% higher. In the Middle East, UAE’s ADX was up 1% and Saudi TASI closed 0.5% higher. Asian markets have opened in the green led by Nikkei up 0.42%, followed by Shanghai up 0.34%, STI up 0.22% and HSI up 0.08%. US IG CDS spreads were 3.9bp wider and HY CDS spreads were 19bp wider. EU Main CDS spreads were 2.2bp wider and Crossover CDS spreads were 9.6bp wider. Asia ex-Japan CDS spreads were 2.6bp tighter.

US CPI inflation rose 7.5% annually, its highest in four decades with Fed’s Bullard calling for a possible 100bp hike by July (see Talking Heads below). Separately, Mexico’s central bank raised its benchmark rate by 50bp to 6%, a sixth straight rate increase in an effort to control inflation.

New Bond Issues

.png)

ING Bank raised €2.25bn via a two-tranche deal. It raised:

- €1.5bn via a 5Y bond at a yield of 0.578%, 4bp inside the initial guidance of MS+4bp. The bonds received orders over €3.4bn, 2.3x issue size.

- €750mn via a 15Y bond at a yield of 1.001%, 2bp inside the initial guidance of MS+17bp. The bonds received orders over €1.3bn, 1.7x issue size.

The bonds have expected ratings of Aaa/AAA/AAA.

Citic Limited raised $1bn via a two-tranche deal. It raised:

- $700mn via a 5Y bond at a yield of 3.022%, 42.5bp inside the initial guidance of T+165bp. The bonds received orders over $4.2bn, 6x issue size. Asian investors bought 95% of the notes and EMEA 5%. Banks and financial institutions were allocated 47%, fund managers 39%, insurers and sovereign wealth funds 11% and corporates 3%.

- $300mn via a 10Y bond at a yield of 3.678%, unchanged from final guidance. The bonds received orders over $690mn, 2.3x issue size. Asian investors bought 91% of the notes and EMEA 9%. Banks and financial institutions received 43%, fund managers 37%, and insurers 20%.

The bonds have expected ratings of A3/BBB+. Proceeds will be used for general corporate purposes, including debt refinancing.

NCL Corp raised $1.6bn via a two-tranche deal. It raised:

- $1bn via a 5NC2 secured bond at a yield of 5.875%, 12.5bp inside the initial guidance of 6% area. The bonds have expected ratings of B1/B+. The new bonds are priced 77.5bp tighter to its older lower rated (Caa1/B-) 5.875% unsecured 2026s that yield 6.65%.

- $600mn via a 7Y unsecured bond at a yield of 7.75%, inside the initial guidance of 7.75-8.00% area. The bonds have expected ratings of Caa1/B-.

Proceeds, together with proceeds from exchangeable notes, will be used to redeem its 12.25% and 10.25% secured notes and to make principal payments on debt maturing in the short-term.

New Bonds Pipeline

- Zhengzhou Airport Economy Zone Xinggang Investment Group hires for $ bond

- Dongtai Communication hires for $ 65mn 180-day bond

- Kalyan Jewellers India hires for $ 5Y bond

- Electricity Generating (EGCO) hires for $ 7Y or 10Y bond

- Petron hires for $ 7NC4 bond

Rating Changes

- Fitch Upgrades Modernland Realty to ‘CCC-‘ on Completed Restructuring

- Credito Real Credit Issuer Rating Cut To ‘SD’ And Rating On CHF170M Senior Notes Cut To ‘D’ On Missed Principal Payment

- Moody’s downgrades SJM’s CFR to Ba2 from Ba1; ratings remain on review for further downgrade

Term of the Day:

Revolver/Revolving Debt

Revolver/revolving debt is a form of borrowing where the credit line has a maximum limit but the borrower can access it in any quantum based on their funding needs. In a normal borrowing, once the loan has been repaid, the borrower must take a new loan to borrow more. In revolving debt, the borrower can re-access any funds that have been paid back too. Revolving debt generally comes with a higher interest rate and does not necessarily have a fixed coupon.

Talking Heads

On Fed’s Bullard Backing Supersized Hike, Seeks Full Point by July 1

“I’d like to see 100 basis points in the bag by July 1… I was already more hawkish but I have pulled up dramatically what I think the committee should do… The CPI report “shows continued inflationary pressure in the U.S.” and “is concerning for me and for the Fed… here was a time when the committee would have reacted to something like this to having a meeting right now and doing 25 basis points right now… I think we should be nimble and considering that kind of thing.

On Credit-Hedging Surging Sending Put Options on HYG and LQD to Record

“People are making a bet that credit right now is an asymmetric bet… If everything goes right, you get your coupon, but if the Fed makes a major mistake there’s quite a bit of room for spreads to widen out. We’re not in that camp, but that’s what those bets are saying.”

On Lagarde Warning ECB Acting Too Fast Could Choke Economy’s Recovery

Raising interest rates “would not solve any of the current problems”…On the contrary: if we acted too hastily now, the recovery of our economies could be considerably weaker and jobs would be jeopardized…. The U.S. economy is overheated, whereas our economy is far from being that,” she said. “That’s why we can — and must — proceed more cautiously. We don’t want to choke off the recovery.”

On Battle for Green Bond Deals Heating Up as BNP Paribas Hits Top

Agnes Gourc, BNP Paribas’ head of sustainable capital markets

“Staying at the top of the league table is an approach we have across sustainable finance — not only bonds, and loans, but also being active in derivatives, repo markets… You can’t have a cookie cutter approach when it comes to sustainable finance… In the last two years, almost every client has had ESG on their minds”

On IMF saying Argentina agreement does not yet have a timeline – IMF spokesman Gerry Rice

“We are working very hard, as are the Argentine authorities, we’re working closely together, and we will be looking to do this as quickly as possible… adding that “I do not have a timeline.”

Top Gainers & Losers – 11-Feb-22*

.png)

Other Stories

Go back to Latest bond Market News

Related Posts: