This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; Talking Heads;

July 18, 2023

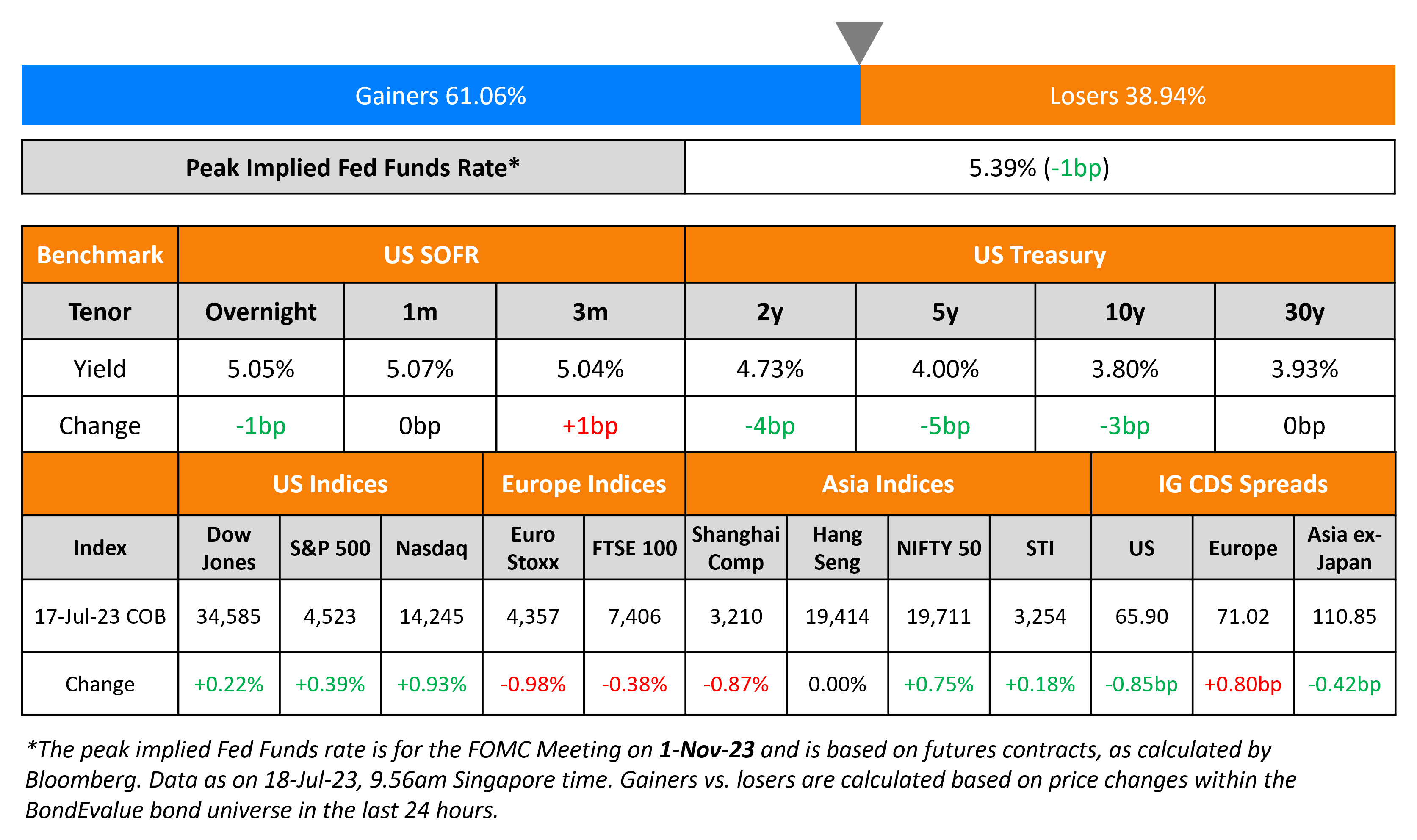

Treasury yields moved 3-5bp lower across the curve. The New York Empire Manufacturing Index fell 5.5 points to 1.1, however still higher than estimates of -3.5, giving initial indications of a possible reduction slowing in the momentum of growth. US Treasury Secretary Janet Yellen eased recession concerns in the US as a result of possible negative spillovers from disappointing growth in China by saying that she does not expect a recession, citing a persistently strong labor market. Expectations of a 25bp rate hike at the July 26 FOMC meeting currently stands at 97%, with the probability of a further 25bp hike now at 29% at the November FOMC meeting. The peak Fed Funds rate rose by 2bp to 5.40%. US equity indices ended slightly higher with the S&P and Nasdaq higher by 0.4% and 0.9% respectively. Credit spreads were tighter with US IG and HY CDS spreads tighter by 0.9bp and 5.6bp respectively.

European equity indices closed lower with European main CDS spreads 0.8bp wider and Crossover CDS were wider by 5.8bp. Asia ex-Japan CDS spreads tightened by 0.4bp and Asian equity markets have opened with a negative bias today.

New Bond Issues

-

SMBC Aviation $ 10Y at T+225bp area

New Bond Pipeline

- Masdar hires for $ 10Y Green bond

- Almarai hires for $ 10Y sukuk

- Resorts World Las Vegas hires for $ 7Y bond

- Mirae Asset hires for $ 3Y or 5Y bond

- Dar Al-Arkan hires for $ Long 5Y sukuk bond

Rating Actions

- Fitch Upgrades Ryanair to ‘BBB+’; Stable Outlook

- Brazilian Airline Azul S.A. Upgraded To ‘B-‘ From ‘SD’ On Improved Capital Structure; Outlook Stable

- Dalian Wanda Commercial Rating Lowered To ‘B+’ On Weaker Liquidity, Uncertain Listing; Remains On CreditWatch Negative

Term of the Day

Discos

Discount Perpetual Securities (Discos) typically refer to legacy perpetual floating rate bonds issued by a bank that trade at a significant discount to par value. These legacy bonds were typically issued in the 1980s and are priced equivalent to or in some cases even considered as Tier 2 capital at the issuing banks. While they may share some similar features with AT1s, risks related to non-payment of coupon and write-down for example are considered to be significantly lower. “Coupons are either cumulative or non-cumulative but are not subject to automatic restrictions in case of a maximum distributable amount buffer breach,” as per Atlanti Asset Management. Also, there is no explicit write-down or equity conversion trigger.

Rothschild is said be facing pressure from some bondholders to buyback its discos sold almost 40 years ago.

Talking Heads

On Chances of a US Recession – US Treasury Secretary Janet Yellen

“For the United States, growth has slowed, but our labor market continues to be quite strong. I don’t expect a recession…The most recent inflation data were quite encouraging.”

On the Acquisition of Credit Suisse by UBS

Guy de Blonay, investment manager at Jupiter Asset Management

“I think UBS is being rather conservative about the true extent of the benefits it can get from this politically sensitive merger…UBS is in a good position to restructure quickly, limit outflows and reduce risks…Therefore, I believe UBS looks attractive at current levels.”

Andreas Thomae, senior ESG researcher and strategist at Deka Investment

“They wouldn’t have got (the state guarantee to absorb up to CHF9bn in losses) in a normal merger…Now the authorities have waved the deal through because they had to find someone in an emergency situation…It’s an attractive deal for UBS if it goes through as planned…From UBS’s point of view, the business is a great asset, a good cash cow.”

On US Recession Fears due to the Inverted Yield Curve – chief economist at Goldman Sachs Jan Hatzius

“We don’t share the widespread concern about yield curve inversion…term premium is well below its long-term average, so it takes fewer expected rate cuts to invert the curve. In addition, as inflation cools, it opens a plausible path to the Federal Reserve easing up on interest rates without triggering a recession.”

“Credit quality expectations are improving among high-yield investors…and a big consensus calls for only a mild US recession and at most two more hikes from the Fed.”

On the Attractiveness of Local EM Assets – strategists at BlackRock

“We still think EM assets have an edge over developed market peers…Inflation is cooling enough in key EMs to allow policy rate cuts.”

Top Gainers & Losers – 18-July-23*

Go back to Latest bond Market News

Related Posts: