This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers & Losers

March 5, 2021

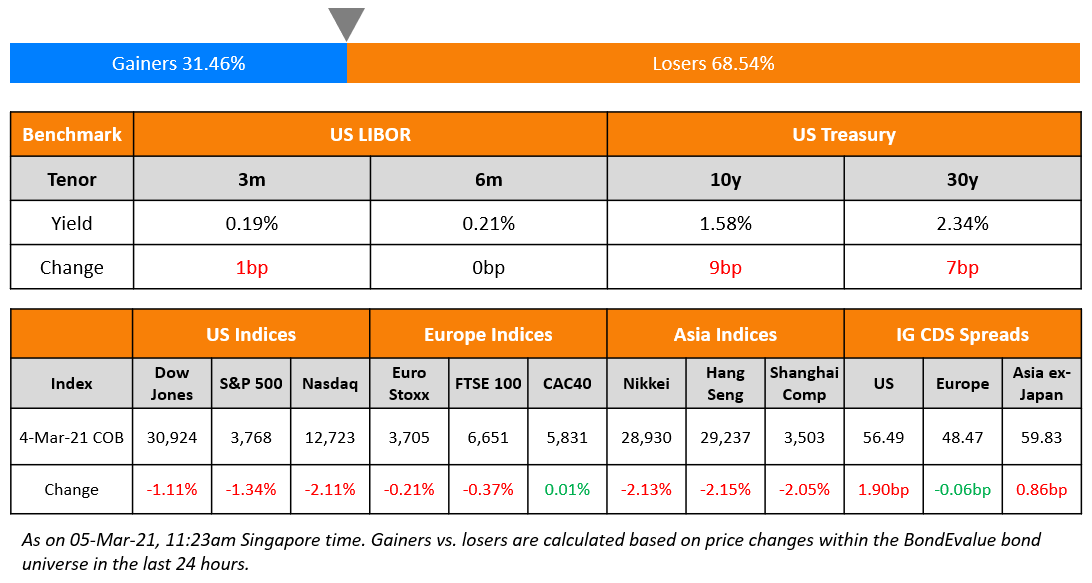

Equities continued to sell-off with S&P down 1.3% and Nasdaq down 2.1%, bringing the tech heavy index to negative territory YTD. US 10Y Treasury yields jumped another 9bp to 1.58%. While Fed Chair Powell maintained his stance on bond buying, he mentioned that ‘disorderly’ market conditions would concern him and added that he did not consider the recent spike in yields as disorderly. Newswires report that market participants were disappointed that he did not mention specifics on what the Fed would do to slow down long-term rates if desired. European equities held up better, flat to slightly lower. US IG CDS spreads were 1.9bp wider and HY was 9.5bp wider. EU main CDS spreads were flat and crossover spreads widened 0.1bp. Asian equity markets are down over 0.5% and Asia ex-Japan CDS spreads are wider by 0.8bp.

Bond Traders’ Masterclass | 25% Discount on a Bundle of Five Sessions

Keen to learn bond market fundamentals from industry professionals? Sign up for our Bond Traders’ Masterclass that consists of five modules starting on March 24.

The modules are specially curated for private bond investors and wealth managers to develop a strong fundamental and practical understanding of bonds. Given the ultra-low interest rate environment, flurry of new bond deals particularly from junk-rated issuers and tightening credit spreads, it is now more important than ever for investors to understand bond valuation, portfolio construction and new bond issues to help them get better return for risk. The sessions will be conducted by debt capital market bankers who have previously worked at premier global banks such as Credit Suisse, Citi and Standard Chartered.

New Bond Issues

- Ji’An Chengtou Holding $ 3Y at 4.8% area

China Everbright Bank Hong Kong branch raised $550mn via a 3Y bond at a yield of 0.929%, or T+65bp, a strong 45bp inside initial price guidance T+110bp area. The bonds have expected ratings of BBB+/BBB and received orders over $4bn, 7.3x issue size. Proceeds will be used for general funding purposes.

Lloyds Bank raised $2bn via a two-part offering. It raised:

- $1bn via a 3Y non-call 2Y (3NC2) bond at a yield of 0.695%, or T+55bp, 15/20bp inside initial guidance of T+70/75bp area

- $1bn via a 6Y non-call 5Y (6NC5) bond at a yield of 1.627%, or T+85bp, 20bp inside initial guidance of T+105bp area

The new 3NC2s and 6NC5s were priced at 19.5bp and 13.3bp inside its older 3.9% bonds due March 2024 and 3.75% bonds due in January 2027 respectively. The SEC registered bonds have expected ratings of A3/BBB/A+.

Daimler raised €1bn ($1.2bn) via a 12Y Green bond at a yield of 0.815%, or Mid-Swaps + 70bp, 25bp inside initial guidance of T+95bp area. The bonds received orders over $2.6bn ($3.1bn), 2.6x issue size. Proceeds will be used for a green bond loan and allocated as set out in Daimler’s Green Finance Framework.

New Bond Pipeline

- Meinian Onehealth Healthcare $ bond

- JSW Steel $ bond

Rating Changes

- French Container Liner CMA CGM Upgraded To ‘BB-‘ By S&P On Stronger Credit Metrics; Outlook Stable

- Sunshine 100 Upgraded To ‘CCC-‘ From ‘SD’ By S&P ; Outlook Negative

- Moody’s downgrades Mauritius’s ratings to Baa2, maintains negative outlook

- Fitch Downgrades Provident to ‘BB’; Outlook Negative

- Kommunalkredit Austria AG Public Sector Covered Bonds Ratings Raised To ‘A+’ By S&P; Outlook Stable

- Fitch Revises Outlook on Turkey Wealth Fund to Stable on Sovereign Action

- Fitch Revises Entel’s Outlook to Stable; Affirms Ratings at ‘BBB-‘

- Fitch Affirms EnLink Midstream LLC’s IDR at ‘BB+’; Outlook Revised to Stable

- Fitch Affirms Terna S.p.A. at ‘BBB+’; Withdraws Rating

- MGM Resorts International Issuer Credit Rating Lowered To ‘B+’ By S&P; Outlook Negative

- Avient Corp. Outlook Revised To Stable By S&P On Improving Macroeconomic Conditions And Credit Measures; Ratings Affirmed

- Whirlpool Corp. Outlook Revised To Stable From Negative By S&P On Healthy Appliance Demand; ‘BBB’ Rating Affirmed

- AT&T Inc. Outlook Revised To Negative From Stable By S&P Following Increase In Leverage From Auction; Ratings Affirmed

- Verizon Communications Inc. Outlook Revised To Stable From Positive By S&P On Increased Leverage From Auction; Ratings Affirmed

- Food Retailer Distribuidora Internacional de Alimentacion Ratings Withdrawn By S&P At The Issuer’s Request By S&P

Indian Issuers Start 2021 With a Bang In The Dollar Bond Markets

Indian corporates have taken the international bond markets by storm this year thus far, with total dollar bond issuance volume at $9.3bn, up almost 50% from the same period last year of $6.3bn. This increased supply of Indian dollar credit is on the back of favorable market conditions globally in the form of ultra-low yields, continued monetary and fiscal stimulus and tightening credit spreads. This has played out well particularly for emerging markets, India included, where funds from developed markets are finding their way to the greener pastures of Asia in pursuit of yield.

In this piece, we start by taking a look at the macro environment in the bond markets and then dive into dollar bond issuance from Indian corporates, highlighting some of the noteworthy deals.

Term of the Day

Convexity Hedging

Convexity hedging refers to a phenomenon of hedging portfolio interest rate exposure through bonds that stand to get impacted due to duration and convexity changes. This is most commonly used in mortgage-backed securities (MBS), given the prepayment profiles. For example, when interest rates rise, MBS investors would see their portfolio duration rise (as prepayments slowdown) and therefore they would have to reduce duration to their holdings. This reduction could be through selling longer duration treasuries or swaps. Thus for example, if rates rise, principally MBS duration rises and Treasury duration falls thus changing the hedge ratio of MBS vs. Treasuries – effectively having to sell more Treasuries than otherwise to hedge their MBS portfolios. These Treasuries would generally be higher duration/convexity bonds since they correspond to mortgage-related securities which have high durations. This is considered among the factors that can exacerbate sell-offs in Treasuries. In the recent sell-off in US Treasuries, besides inflation expectations, one of the factors attributed has been this phenomenon of convexity hedging.

Talking Heads

On Powell’s dovish message leaving bond market disappointed

Jerome Powell, Federal Reserve Chairman

The recent run-up in bond yields “was something that was notable and caught my attention,” he said. “I would be concerned by disorderly conditions in

markets or persistent tightening in financial conditions that threatens the achievement of our goals.” “We will be patient,” he said. “We’re still a long way from our goals.”

“Financial conditions are highly accommodative and that’s appropriate given the ground the economy has to cover,” he said. “If conditions do change materially, the committee is prepared to use the tools that it has to foster the achievement of its goals.” “Our current policy stance is appropriate,” he said. “It is a picture of an economy that is all but fully recovered,” he said. “Realistically, that is going to take some time.” “While there are still risks, there’s good reason to expect job creation to pick up in coming months,” he said.

Krishna Guha, vice chairman at Evercore ISI

“Powell stays dovish but not dovish enough to prevent further increases in yields.”

“The risk of a fiscal crisis appears to be low in the short run despite the higher deficits and debt stemming from the pandemic,” the CBO said in the report. “Nonetheless, the much higher debt over time would raise the risk of a fiscal crisis in the years ahead.”

“In sum, the evidence so far indicates negative interest rate policies have succeeded in easing financial conditions without raising significant financial stability concerns,” the IMF economists said. “Central banks that adopted negative rates may be able to cut them further … Ultimately, given the low level of the neutral real interest rate, many central banks may be forced to consider negative interest rate policies sooner or later.”

“Macro situations at both home and abroad have been generally improving, and (we should) pay close attention to price trends.” “Meanwhile, government bond issuance may accelerate in the second quarter, causing increasing supply pressure, so the upward trend of market interest rates has not yet ended.”

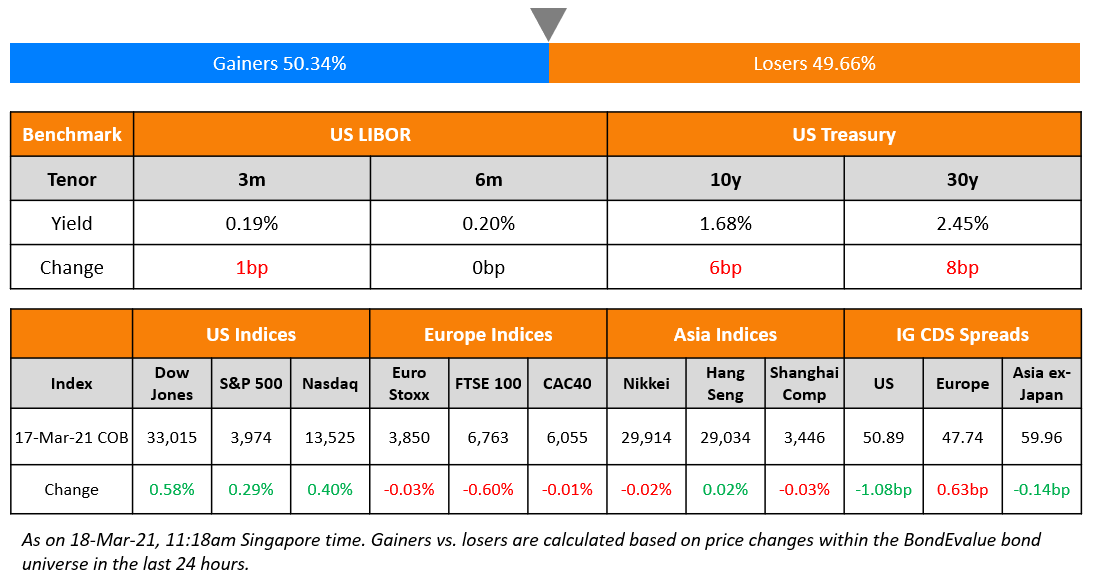

Top Gainers & Losers – 05-Mar-21*

Go back to Latest bond Market News

Related Posts: