This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

November 21, 2022

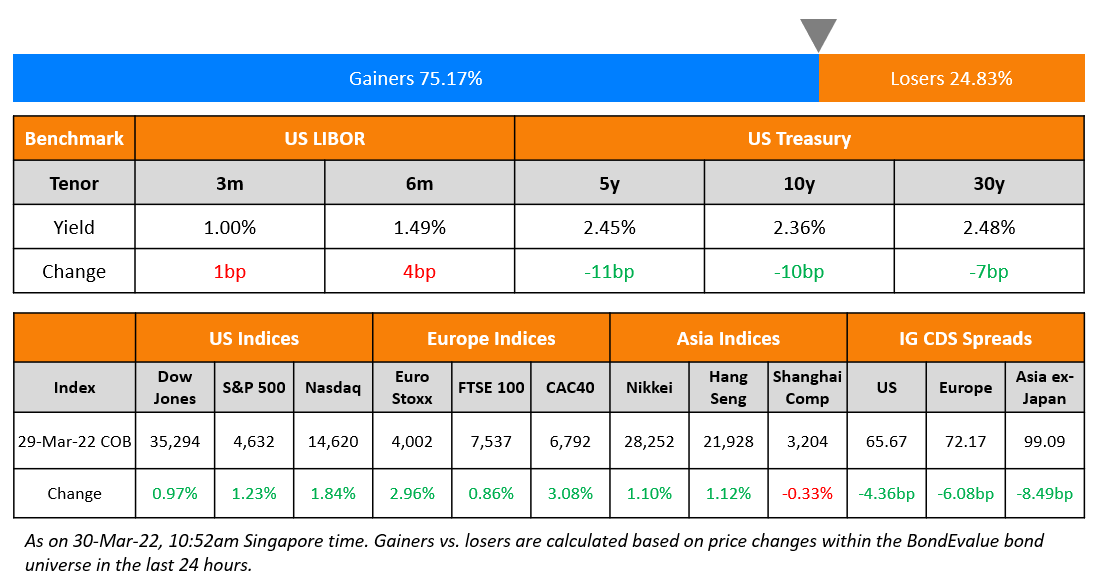

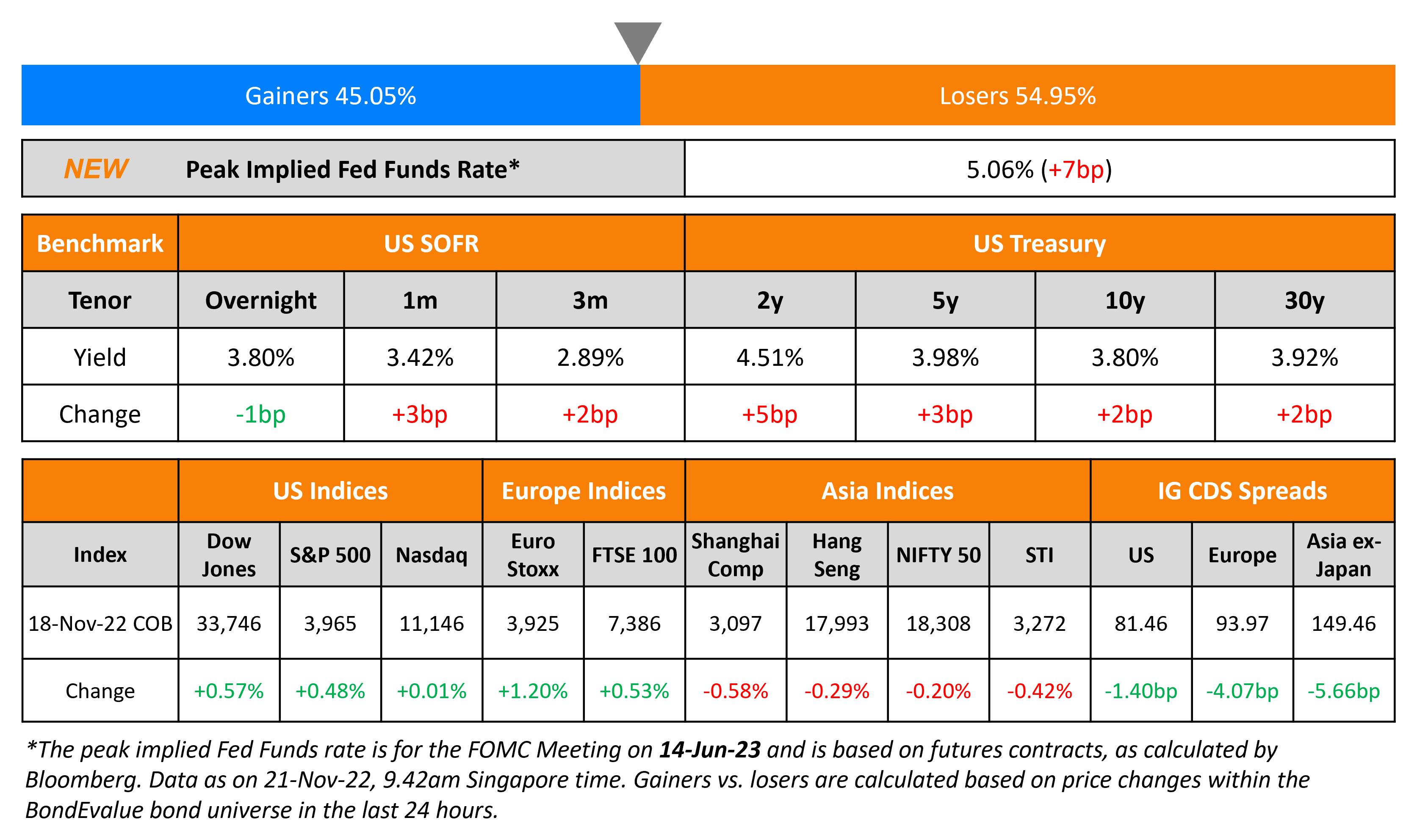

US Treasury yields moved 2-5bp higher on Friday, with the 2Y leading the move and the 2s10s yield curve flattening further to -71bp from -62bp last week. The peak Fed Funds rate subsequently rose by 7bp to 5.06% for the June 2023 meeting. Probabilities of a 50bp hike at the FOMC’s December meeting continue to stay above 80%. US IG CDS spreads tightened 1.4bp and HY spreads saw a 9.1bp tightening. US equity markets were higher with the S&P up 0.5% and Nasdaq marginally higher.

European equity markets were also higher. EU Main CDS spreads tightened 4.1bp and Crossover spreads tightened 14.6bp. Asian equity markets have opened lower today. Asia ex-Japan CDS spreads tightened by 5.7bp.

New Bond Issues

- ASB Bank $ 5Y at T+160bp area

- Jinan Rail Transit Group $ 364-day at 7.2% area

Chengfa Industrial raised $105mn via a 364-day bond at a yield of 6.5%, unchanged from initial guidance. The senior unsecured bonds are unrated. Proceeds will be used to repay offshore debt.

Shaanxi Yushen raised $85mn via a 3Y bond at a yield of 7%. Proceeds will be used for infrastructure construction.

New Bonds Pipeline

- Rakuten Group hires for $500mn 2Y bond

- Korea Investment & Securities hires for $ Green bond

- Zhongrong International Trust hires for $ 367 mn Short 1Y bond

- Shangrao Investment hires for $ Sustainable bond

Rating Changes

- Fitch Downgrades Unifin to ‘D’ on Announced Restructuring Proceeding

- Fitch Downgrades Tenneco’s IDR to ‘B’ and Assigns Final Ratings to New Debt; Outlook Stable

- Rolls-Royce PLC Outlook Revised To Positive From Stable On Improving Operating Performance; ‘BB-‘ Ratings Affirmed

Term of the Day

Yield Per Duration

Yield per duration is a ratio that indicates how much yield an investor would receive on a bond for every unit of the bond’s duration (click here to learn more about bond duration) that they take while buying a bond. It is thus a useful measure to see the incremental return per unit of interest rate risk. Naturally, a high yield for a shorter duration would indicate the best reward-to-risk for an investor purely in terms of interest rate risk (and not necessarily credit risk).

From the above chart, the EM HY dollar bond index offer the maximum yield per duration. Fran Rodilosso, Head of Fixed Income ETF Portfolio Management at Nasdaq notes that this additional carry over comparable the US HY bond index would enable EM HY companies absorb a larger degree of rise in base interest rates or wider credit spreads. However, it should also be noted that the EM USD HY index might be offering the highest yield per duration due to the higher weightage of Chinese corporates and the increased defaults in the sector.

Talking Heads

On Bond Market Heading Into Treacherous Waters as Activity Subsides

Beth Hammack, co-head of Goldman Sachs

“The Treasury market is still particularly volatile right now and liquidity feels thin”

Matt Smith, investment director at London-based Ruffer

The rally that Bullard’s comments halted is “a counter trend move in rates and I don’t expect that will last too long”

George Goncalves, head of US macro strategy at MUFG

“This is a market that wants to trade the future outcome today”

On NY Fed saying that bank liquidity may be tighter than thought, with policy implications

“There is still a potential for strategic cash hoarding when reserve balances get sufficiently low… As central banks around the world respond to inflation by tightening their monetary stance and shrinking their balance sheets, the potential consequences for the wholesale payment system of the ongoing draining by central banks of reserves will likely be an important input into policy making”.

On Fund Managers Are Turning Ever More Pessimistic on the US Dollar

John Bromhead, strategist at ANZ Group

“The dollar’s exceptionalism premium is receding as the Fed approaches maximum hawkishness. The safe haven premium is also falling as the backdrop improves”

Morgan Stanley strategists including Matthew Hornbach

“Weak global growth and less CPI inflation allow the Fed to pause, driving US rates and the US dollar lower”

Top Gainers & Losers – 21-November-22*

Go back to Latest bond Market News

Related Posts:%20x%20311px%20(h).jpg?upscale=true&width=1400&upscale=true&name=Tablet%20banner%20661px%20(w)%20x%20311px%20(h).jpg)