This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

October 11, 2021

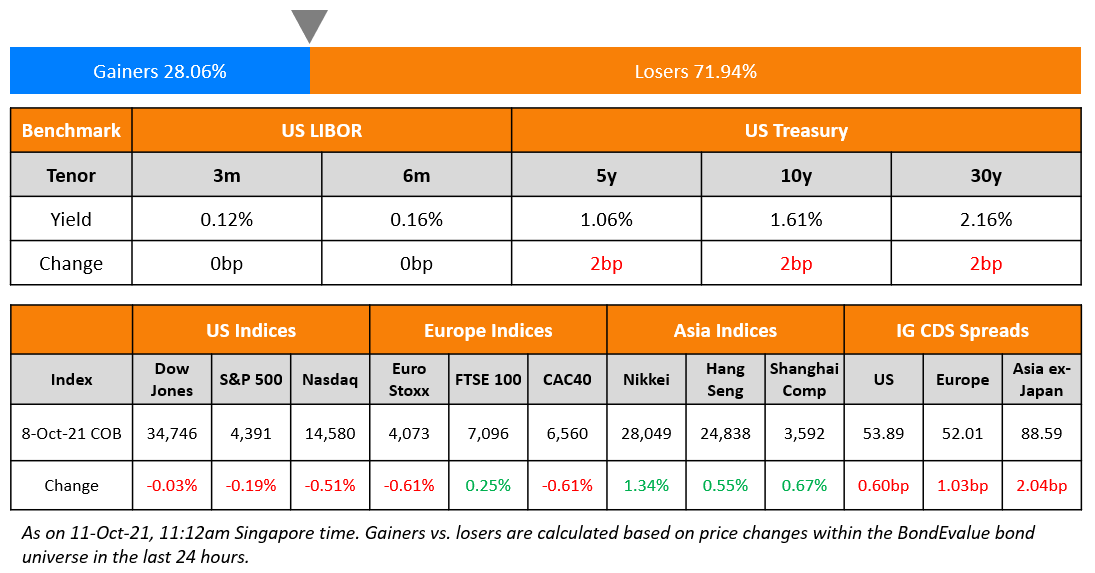

US equities ended lower on Friday with the S&P and Nasdaq down 0.2% and 0.5%. While Energy and Financials were up 3.1% and 0.5%, all other sectors were in the red with Real Estate falling 1.1%. US 10Y Treasury yields were up 2bp to 1.61%. European stocks were mixed with the DAX and CAC falling 0.3% and 0.6% while the FTSE was up 0.3%. Brazil’s Bovespa ended 2% higher. In the Middle East, UAE’s ADX was up 0.3% and Saudi TASI was down 0.2%. Asian markets have opened slightly higher with Shanghai up 0.4%, HSI up 2.2%, STI up 0.1% and the Nikkei up 1.3%. US IG CDS spreads and HY CDX spreads widened 0.6bp and 4.2bp respectively. EU Main CDS spreads were 1bp wider and Crossover CDS spreads widened 5.5bp. Asia ex-Japan CDS spreads widened 2bp.

US NFP saw 194k jobs added in September, the smallest gain since December 2020, disappointing forecasts of a 500k increase. On the positive side, the unemployment rate fell to 4.8% from 5.2% in August and average hourly earnings YoY rose from 4.3% in August to 4.6%.

New Bond Issues

- Tuan Sing S$ 3NC2 at 6.9% final

Guangdong Hong Kong Greater Bay Area Holdings (GD-HKGBA) raised $41.5mn via a 2Y bond at a yield of 15.012%. The bonds have expected ratings of B– (Fitch). It also raised $235.72mn under an exchange offer for its 14% 2021 notes which were trading at 100.03 and yielding 25.94%, bringing the total size of the new bonds to $277.22mn.

Taizhou Hailing City Development Group raised $33mn via a 364-day bond at a yield of 2%, unchanged from initial guidance. The bonds are unrated. The bonds are issued by Taizhou Haiminghui Trading, guaranteed by Taizhou Hailing City Development Group and supported by a letter of credit from Bank of Shanghai Nanjing branch.

Yibin Emerging Industry Investment raised $97mn via a 35-month bond at a yield of 2.6%, 20bp inside initial guidance of 2.8% area. The bonds are unrated. The bonds are supported by a letter of credit from Chengdu Rural Commercial Bank. The issuer provides investment management services. Its parent company is Yibin State-owned Assets Management, which is wholly owned by the Yibin SASAC and is the main asset management and investment entity for the Yibin municipal government in China’s Sichuan province.

New Bonds Pipeline

- Kookmin Bank hires for € 5Y green bond

- Zhuji State-owned Assets Management hires for $ bond

- Dongfeng Motor Group hires for € 3/5Y bond

- Nanjing Jiangning Economic and Technological Development hires for $ bond

- KEB Hana Bank hires for $ PerpNC5 sustainability AT1 bond

- China plans for $4bn 3/5/10/30Y bond

- Saigon-Hanoi Bank hires for $ bond

- Burgan Bank hires for $500mn 6NC5 bond

- Kexim hires for $/€ bond

Rating Changes

- Moody’s upgrades Kutxabank’s deposit ratings to Baa1; outlook changed to positive

- Fitch Downgrades Xinyuan to ‘C’ on Distressed Debt Exchange

- Moody’s downgrades Solomon Islands’ rating to Caa1, maintains stable outlook

Term of the Day

Red-Chip Companies

Red-Chip companies are Chinese companies that are incorporated outside mainland China and listed on the Hong Kong Stock Exchange. These companies are substantially owned, directly or indirectly, by mainland China state entities with over 55% of its revenue or assets derived from China.

Talking Heads

On the view that Congress will raise debt ceiling – Janet Yellen, US Treasury Secretary

“Once Congress and the administration have decided on spending plans and tax plans, it’s simply their responsibility to pay the bills that result from that.” “It’s a housekeeping chore. Because really, we should be debating the government’s fiscal policy.” “I don’t believe any president has ever had to make a decision about what they would do if Congress failed to raise the debt ceiling. I can’t imagine our being there on December 3rd.” “There is a trade-off there. We know that programs that are universal have tended to be long-lasting and very popular,” Yellen said. “But there is also an argument for, you know, making sure that the highest income Americans perhaps don’t get the benefit of a program that is most needed by those with lower income.”

On the view that markets are right to price in quicker tightening

Andrew Bailey, Bank of England Governor

“We have got to, in a sense, prevent the thing becoming permanently embedded because that would obviously be very damaging,” he said. “This has been an almost unprecedented set of events,” Bailey said. “They are not over yet, that we are learning. We have to manage our way through them, and we will do that.”

Michael Saunders, a member of the Bank of England’s Monetary Policy Committee

“I think it is appropriate that the markets have moved to pricing a significantly earlier path of tightening than they did previously,” said Saunders.

On Evergrande contagion likely to trigger wave of defaults for developers

Michel Lowy, chief executive officer of SC Lowy

“Ultimately it’s a liquidity game,” said Lowy. “How many months can you survive until at some point the central government will relent and start releasing liquidity pressures on developers?”

Hao Hong, head of research and chief strategist at BoCom International

“It’s very difficult to see a solution right now,” China’s Evergrande strategy would be to “let as many people bear the cost as possible,” Hong said.

“There’s no interest to bail him out.” “In the situation he’s in now, I don’t think any political connections will come to his rescue.”

On BlackRock US bond ETFs hit by large outflows as sector booms

Todd Rosenbluth, head of ETF and mutual fund research at CFRA Research

“We are on track for potentially another record breaking year, breaking 2020’s net inflows record, but the heavyweight products from BlackRock have not been the driver.” “The BlackRock products tend to be used more by institutional investors. Retail and wealth management are often using the Vanguard products. Maybe institutional investors are investing less whereas retail investors are holding steady,” Rosenbluth said.

“We are on track for potentially another record breaking year, breaking 2020’s net inflows record, but the heavyweight products from BlackRock have not been the driver.” “The BlackRock products tend to be used more by institutional investors. Retail and wealth management are often using the Vanguard products. Maybe institutional investors are investing less whereas retail investors are holding steady,” Rosenbluth said.

Elisabeth Kashner, director of global fund analytics at FactSet

“Even though, in some instances, their products can be quite similar, BlackRock really emphasises trading and liquidity whereas Vanguard lives and breathes for long-term buy and hold investors”. “BlackRock has designed all of these products to be trader friendly, that is more friendly to tactical usage, and by golly they are being traded”, she added.

Ben Johnson, director of global ETF research at Morningstar

“These funds’ flows are notoriously fickle.” “They’re likely to be used by traders looking for liquidity or short-term exposure to a particular corner of the bond market, and less likely to be used by long-term allocators.”

“These funds’ flows are notoriously fickle.” “They’re likely to be used by traders looking for liquidity or short-term exposure to a particular corner of the bond market, and less likely to be used by long-term allocators.”

Deborah Fuhr, founder of consultancy firm ETFGI

“Vanguard has an ethos of being the low-cost provider. For many, as they move to ETFs, even from within Vanguard’s mutual fund products, that has been a driver of net inflows for them and they get significant income from financial advisers,” said Fuhr.

“Vanguard has an ethos of being the low-cost provider. For many, as they move to ETFs, even from within Vanguard’s mutual fund products, that has been a driver of net inflows for them and they get significant income from financial advisers,” said Fuhr.

In a statement by BlackRock

“Our clients, from retirement savers to institutional investors, turn to iShares for a combination of value and liquidity that helps them to quickly and efficiently transfer risk, reposition portfolios or implement hedges.” “iShares ETFs are a diverse offering of trading and allocation tools to enable critical versatility when navigating a wide range of market environments.”

“Our clients, from retirement savers to institutional investors, turn to iShares for a combination of value and liquidity that helps them to quickly and efficiently transfer risk, reposition portfolios or implement hedges.” “iShares ETFs are a diverse offering of trading and allocation tools to enable critical versatility when navigating a wide range of market environments.”

Top Gainers & Losers – 11-Oct-21*

Other Stories

Go back to Latest bond Market News

Related Posts:

1, 2, 3, 4th Fed Hike!

June 14, 2017

Fed Survey Results Supportive of Funds Flow into Bonds

September 10, 2017