This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

June 12, 2023

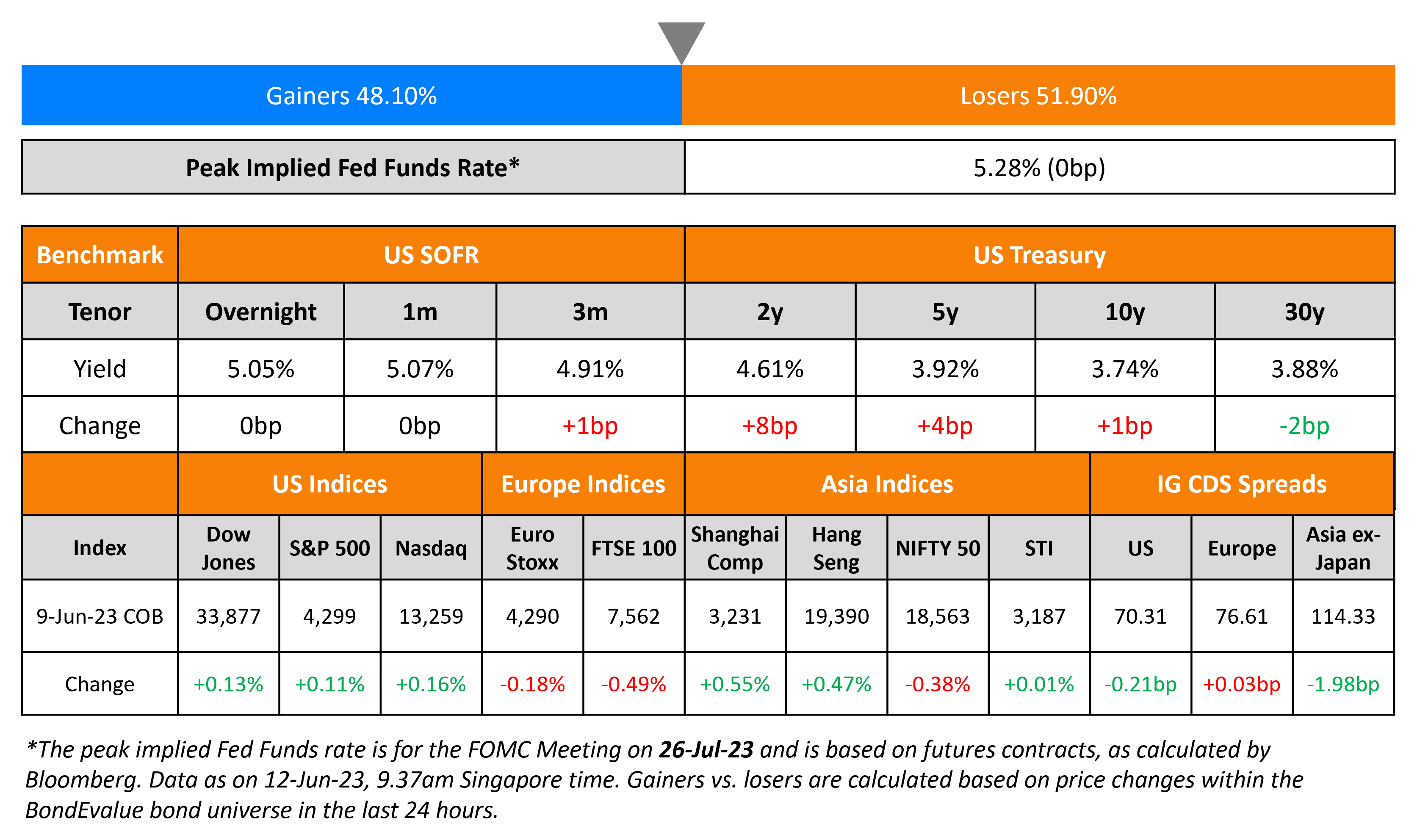

US Treasury yields moved higher on Friday led by the 2Y that rose 8bp. Expectations continue for a status quo at the 13-14 June FOMC meeting while markets are pricing-in a 53% probability of a 25-50bp rate hike in the July meeting. The peak Fed Funds Rate was unchanged at 5.28% for July. All eyes focus on the US CPI data due this week – expectations are for a 4.1% print in the headline CPI and 5.2% in the Core CPI for May. This compares to 4.9% and 5.5% in the April data. Equity indices ended higher on Friday with the S&P and Nasdaq up by 0.1-0.2%. US IG and HY CDS spreads tightened 0.2bp and 0.7bp respectively.

European equity indices closed slightly lower. European main CDS spreads were flat while Crossover spreads were 1.64bp tighter. Asia ex-Japan CDS spreads saw a 2bp tightening and Asian equity markets have opened broadly mixed this morning.

Exclusive Event for BondEvalue Subscribers in Dubai | 19 June

New Bond Issues

- HSBC $ 11NC10 Tier 2 at T+310bp area

New Bonds Pipeline

- United Airlines hires for bond

- SK Broadband hires for $ 3Y or 5Y bond

- Pertamina Geothermal hires for bond

- H&H International hires for $ 3Y bond

Rating Changes

- Moody’s upgrades Ghana’s local currency ratings to Caa3 from Ca, maintains stable outlook

- Fitch Downgrades Tunisia to ‘CCC-‘

- Fitch Downgrades Unigel’s IDRs to ‘CCC’

Term of the Day

Initial Price Guidance (IPG)

Initial price guidance (IPG) refers to the proposed yield on a new bond issue. Based on the IPG, investors will place orders with the lead managers of the new bond issue. Once the lead managers have received orders for the proposed bond, they will decide the final pricing on the bond, which in most cases will be tighter (lesser) than the IPG.

HSBC has launched a 1NC10 Tier 2 bond at an IPG of the US 10Y Treasury yield + 310bp area.

Talking Heads

Steve Ellis, global fixed-income CIO at Fidelity

“Something akin to a credit crunch is what I’m most concerned about.”

Mike Riddell, portfolio manager at Allianz

“Our base case is for a moderate-to-deep recession — and potentially crises — as the unprecedented pace of global policy tightening seen over the last year starts to really bite.”

Patrick McDonough, portfolio manager at PGIM

“Consumers are stretched, so I’m not 100% sure that a soft landing is really realistic at this point…The downside is becoming more and more likely, just because we’ve been propped up by consumers for so long.”

“This does remind me an awful lot of that March-to-June period in 2008…it would be a miracle if this ended without recession…I’m highly confident that we’re going to be in recession a year from now…There are a lot of things that resonate with 2008…Yet until it happened, it was largely dismissed…There are a lot of companies sitting on very low-cost funding; when they go to refinance, it will double, triple or they won’t be able to and they’ll have to go through some sort of restructuring or default.”

On the Potential of Future Fed Rate Hikes – CIO Franklin Templeton Fixed Income, Sonal Desai

“There are people who still believe that’s the end of the cycle…I don’t think we can say that yet because we really have sticky inflation.”

On the Fed Interest Rate Decision in June and July

Meghan Swiber, rates strategist at Bank of America

“The market is positioned for a rally in long duration…and the ultimate thing that underpins that view is that the Fed is done with the hiking cycle.”

Arvind Narayanan, senior portfolio manager at Vanguard Group Inc.

“The Fed is pretty much done even if they go one or two more times…Either the economy slows materially into a recession that forces the Fed to cut rates, or the economy slows down enough to keep rates at 5% for the rest of year and then the Fed slowly eases next year.”

Thomas McLoughlin, head of fixed income for the Americas at UBS Group’s wealth-management arm

“We think it’s more likely the Fed will skip into July.”

On Emerging Markets Potentially Regaining Traction

Xavier Baraton, global chief investment officer at HSBC Asset Management

“India, Brazil, China, they don’t have an inflation problem any longer, so they may cut rates faster than the Federal Reserve.”

Greg Lesko, managing director at Deltec Asset Management

“The pessimism, particularly in China and Hong Kong, has been extreme and is not accurately reflecting the economic fundamentals.”

Edwin Gutierrez, head of EM sovereign debt at abrdn

“Assuming that we are one or two hikes away from the peak, then that headwind to EM currency performance should dissipate…It also psychologically will pave the way for more EM central banks to consider rate cuts in the coming months.”

Alvin T. Tan, head of EM currency strategy at RBC Capital Markets

“A more concerted return of the carry trade would benefit the higher carry Latam and EMEA currencies even more, excepting the ones under the spell of unorthodox policies, such as the Turkish lira.”

Phoenix Kalen, head of EM research at SocGen

“We are anticipating the start of the easing cycle out a number of emerging markets in the second half of this year, starting with the Latin American economies, and also then some of the Central and Eastern Europe economies.”

Top Gainers & Losers – 12-June-23*

Other News

Go back to Latest bond Market News

Related Posts:-1.png)