This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

May 19, 2023

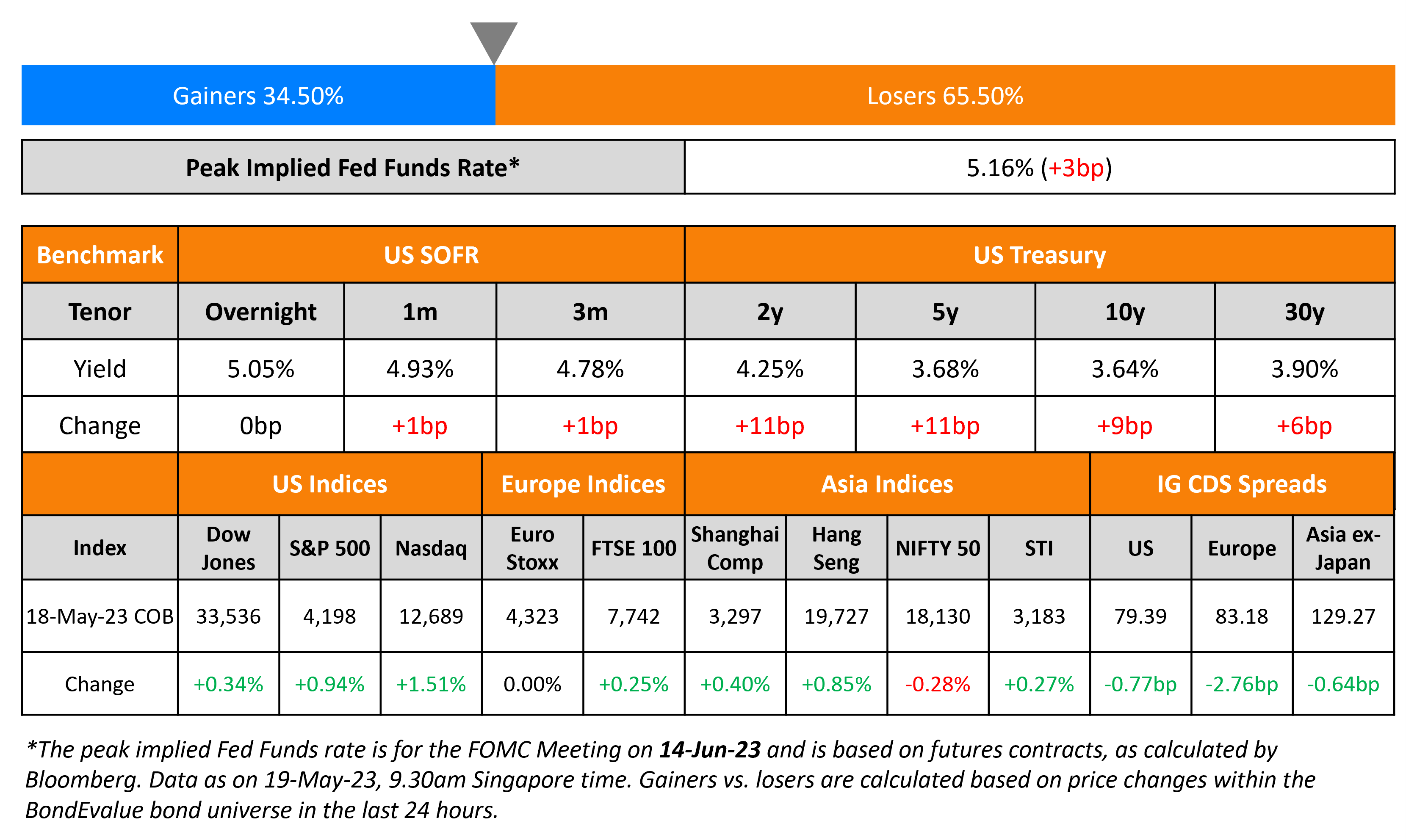

US Treasury yields continued to soar higher across the curve with by 9-11bp. Dallas Fed President Lorie Logan, an FOMC voting member came out stating that there is no clear case yet to be made for keeping Fed policy rates on hold. Also, positive economic data prints added to the rise in yields. Initial jobless claims for the prior week fell to 242k from the prior 264k print. Also, the Philly Fed Manufacturing Index came at -10, much better expectations of a -20 reading.

The peak Fed Funds Rate jumped 3bp to 5.16% with markets now expecting a 36% chance of a 25bp hike in the the Fed’s next policy meeting in June. This compares to just a 10% probability a week ago. Equity indices closed higher with the S&P and Nasdaq up 0.9% and 1.5% respectively. US IG CDS spreads tightened by 0.8bp and HY CDS spreads tightened by 4.3bp.

European equity markets ended higher too. European main CDS spreads were 2.8bp tighter and crossover CDS spreads were 13bp tighter. Asia ex-Japan CDS spreads tightened by 0.6bp. Asian equity markets have opened in mixed today.

New Bond Issues

New Bonds Pipeline

- BGK hires for $ 10Y bond

- GS Caltex hires for bond

Rating Changes

- Moody’s changes PECO’s outlook to negative; affirms ratings

Term of the Day

Viability Event

This is an event when the regulators/relevant authorities determine that the company under consideration may be non-viable or may not remain a going concern unless measures are taken to revive its operations given financial difficulties. Once the regulators determine that the company would be non-viable, it would trigger an action where for example, the company would have a right to irrevocably write-off (partly or fully) the outstanding principal of the bonds and make this portion non-payable henceforth. It could also include accrued and unpaid interest/dividends being unpayable. Thus, in this case, the regulator determines that without a write-off, the issuer would become non-viable and without a public sector injection of capital or other equivalent support, the issuer would become non-viable.

Talking Heads

On Fed’s hawks making a pitch against a rate-hike pause – Dallas Fed President, Lorie Logan

“The data in coming weeks could yet show that it is appropriate to skip a meeting. As of today, though, we aren’t there yet…. [on inflation] we haven’t yet made the progress we need to make… may warrant taking out some insurance by raising rates somewhat more to make sure that we really do get inflation under control”

On A Debt Deal ‘Not Close’ – Key McCarthy Ally

“We have a lot more work to do… the right things are being discussed”

On Inflation too high but impact of high rates not fully felt yet – Fed’ Governor Jefferson

Inflation “is still too high, and by some measures progress has been slowing… Outside of energy and food, the progress on inflation remains a challenge… [however the economy] has “slowed considerably”… History shows that monetary policy works with long and variable lags, and that a year is not a long enough period for demand to feel the full effect of higher interest rates.”

On ‘Soft landing’ narrative taking shape in the post-pandemic US economy

Chicago Fed President Austan Goolsbee

“There are a lot of things about this inflation that we’re still trying to understand… Mocking the ‘immaculate disinflation’ is a mistake because there was a large component that was ‘immaculate inflation'”

Jan Hatzius, chief economist at Goldman Sachs

Inflation is “starting to see clear signs of improvement”

Atlanta Fed President Raphael Bostic

“We have strength in parts of the economy that you don’t usually have when we’re in this part of a policy cycle… That’s why I have some confidence … we can see inflation get back to our target”

Top Gainers & Losers – 19-May-23*

Go back to Latest bond Market News

Related Posts: