This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

March 6, 2023

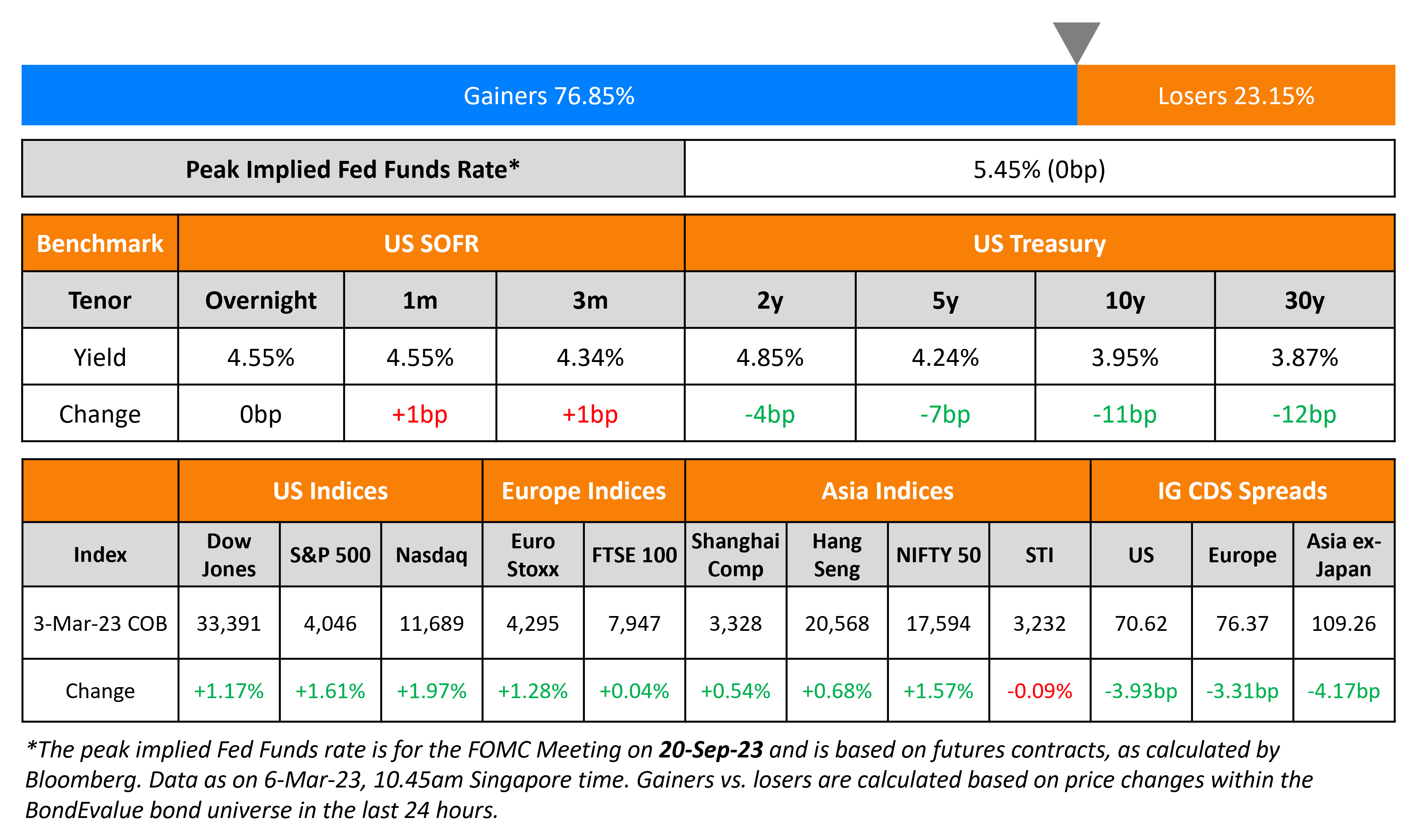

US Treasury yields dropped by 11-12bp on the long-end while the 2Y and 5Y yields fell 4-7bp on Friday. The peak Fed Funds rate was unchanged at 5.45% for the September 2023 meeting. US ISM Non-Manufacturing data for February continued to show an expansion, coming in at 55.1 vs. estimates of 54.5. This was helped by a build up in New Orders at 62.6 (vs. 60.4 in January) while the Prices Paid component was only slightly lower at 65.6 (vs. 67.8 in January). Markets are pricing in three hikes of 25bp each at the next three FOMC meetings in March, May, June, based on the CME’s maximum probability calculations. US IG and HY CDS spreads tightened by 3.9bp and 22.98bp respectively. The HY CDS spread tightened by the most since early Jan, post the jobs report that saw AHE fall to 4.6%, lower than the surveyed 5%. The S&P and Nasdaq ended higher on Wednesday, up by 1.2% and 1.6%.

European equity markets also ended higher. European main CDS spreads tightened 3.5bp while crossover CDS spread tightened 19.3bp. Asian equity markets have opened well in the green. Asia ex-Japan CDS spreads tightened by 4.2bp.

New Bond Issues

- CBA $ 3Y/3Y FRN at T+95bp area/SOFR equivalent

DBS raised $900mn via a 3Y mortgage-backed FRN bond at a yield of 4.729%. The secured notes will settle on 10 March 2023, and are unrated. Merrill Lynch was the sole bookrunner for the deal. Proceeds will be used for general corporate purposes. The new bonds are priced 22.1bp tighter to its existing 1.194% 2027s that yield 4.95%. The deal was only reported after final pricing.

New Bonds Pipeline

- REC hires for $ Long 5Y Green bond

- Qatar plans for $ bond

Rating Changes

- Fitch Upgrades Costa Rica to ‘BB-‘; Outlook Stable

- Community Health System, CA Bond Rating Lowered To ‘BBB+’ On Operating Losses, Weaker Metrics

Term of the Day

Interest Rate Swaps

Interest rate swaps (IRS) are derivative contracts used to hedge against the risks of interest rates rising/falling for a period of time. They typically entail paying/receiving a fixed interest rate whilst simultaneously receiving/paying a floating interest rate (like LIBOR or SOFR) plus a spread in return. IRS are of two types, a payer swap and a receiver swap. In the former, the party entering the swap pays a fixed interest rate in return for a floating rate; in the latter, the party entering the swap receives a fixed interest rate and pays a floating rate in return.

If an issuer issues a fixed-rate bond, they are exposed to the risk of interest rates falling and thereby having to pay a higher current coupon rate. Thus, they can enter into a receiver swap where they essentially nullify the fixed rate component (pay a fixed coupon whilst receiving a fixed rate on the swap) and thereby end up having to pay only a floating rate. Thus the swap converts a fixed rate bond into a floating rate instrument.

BT reports that in 2023, IG-rated firms have issued $8.6bn in 3NC1 bonds, about 50% more than similar notes sold in the whole of 2022. CreditSights notes that issuers are taking advantage of the current pricing of bond vs swap markets where issuers can cut down their cost of raising debt. Taking an example of an issuer’s 3NZ1 at 4.9%, they note that about 0.6% of coupons could be saved after entering into a receiver swap. They say that it this is due to the current differences in how bond markets value a company’s right to call its debt, compared with how derivatives markets value the right for the bank to cancel the swap.

Talking Heads

On Harris Associates Sells Entire Credit Suisse Stake – FT

David Herro, CIO International Equities at Harris Associates

“There is a question about the future of the franchise. There have been large outflows from wealth management… Rising interest rates mean lots of European financials are headed in the other direction. Why go for something that is burning capital when the rest of the sector is now generating it?”

On Nigeria Bonds Rebounding on Yield Appeal as Vote Dispute Deepens

Samir Gadio, head of Africa strategy at StanChart

“If you look at Nigeria dollar-bond spreads versus comparable peers, there is still significant relative value… Global market conditions turned less supportive by mid week, though there may have been some marginal profit-taking in Nigeria.”

Kaan Nazli, senior economist and PM at Neuberger Berman

“We think the opposition challenges play a role as they introduce some uncertainty alongside the recognition of the new administration “

On ECB facing high core inflation in the near term, Lagarde says

“In the short term, core inflation is going to be high… We must continue to take whatever measures are necessary to bring inflation back to 2%. And we will do so”

On seeing rates at 5.5%-5.75% – Richmond Fed’s Thomas Barkin

“That would suggest inflation was in fact more persistent than a lot of people are forecasting. It’s not what I’m hoping for but I could certainly imagine it…I think when you are on a more deliberate rate increase path it does give you a lot more flexibility in terms of the ability to move for longer, or to higher, if you need to”

Top Gainers & Losers – 06-March-23*

Go back to Latest bond Market News

Related Posts:.png)