This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

November 25, 2022

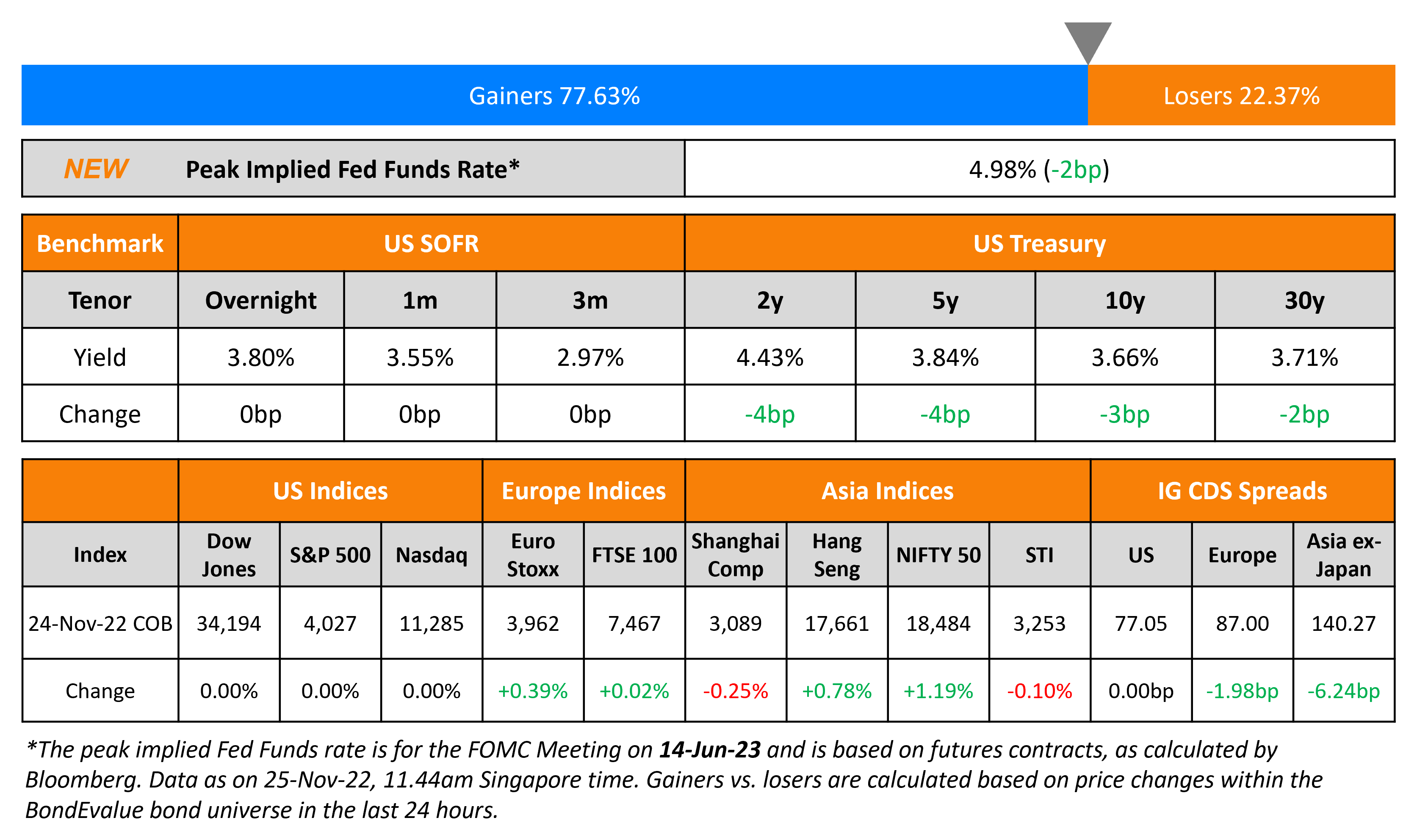

US Treasury yields moved lower by 2-4bp across the curve. The peak Fed Funds rate moved 2bp lower to 4.98% for the June 2023 meeting as the Fed’s dovish November meeting minutes continues to raise prospects of a slower than expected path of rate hikes. The probabilities of a 50bp hike at the FOMC’s December meeting currently stands at 76%. US CDS and equity markets were shut on account of Thanksgiving holidays.

European equity markets were also higher. EU Main CDS spreads tightened 2bp and Crossover spreads tightened 9.4bp. Asian equity markets have opened lower today. Asia ex-Japan CDS spreads tightened by 6.2bp.

New Bond Issues

- China Reform Holdings Corporation $ 3Y at 6.7% area

-

Guilin ETDZ Investment $ 3Y Sustainability at 6.8% area

New Bonds Pipeline

- Zhongrong International Trust hires for $ 367 mn Short 1Y bond

- Korea Investment & Securities hires for $ Green bond

Rating Changes

Term of the Day

Restricted Default

Fitch defines Restricted Default (RD) as the rating for an issuer that has defaulted on a bond, loan or other financial obligation but has not filed for bankruptcy or entered into liquidation or any other formal winding-up process, and which has not ceased operations. RD is different from Default (D) in that Fitch rates an issuer as default if, in its opinion, the issuer has entered into bankruptcy filings, liquidation or any other formal winding-up process.

Talking Heads

On Bond Buying Overdone During Pandemic – Gertjan Vlieghe, Former BOE Official

“It was very clear that they were buying just the lowest amount needed to achieve some stabilization. That was very different to the experience in the March 2020 episode when I was on the committee and we just bought gigantic amounts without feedback from the market. We just kept doing it, and doing it”

On Traders Taking Wall Street’s Advice to Come Back to European Bonds

Matthias Schell, a credit strategist at Landesbank Baden-Wuerttemberg

“The worst in terms of performance should be over and current yields in IG are very attractive. We expect that investors will put more money in credit.”

Peter Kaufmann at Erste Group Bank AG

“Much of the negative developments have already been priced in”

Credit Suisse

Investment grade is starting to “look interesting” as spreads are high given current fundamentals.

JPMorgan

Sees a continued rally in European high-quality debt as valuations are “extremely compelling.”

Top Gainers & Losers – 25-November-22*

Go back to Latest bond Market News

Related Posts:%20x%20311px%20(h).jpg?upscale=true&width=1400&upscale=true&name=Tablet%20banner%20661px%20(w)%20x%20311px%20(h).jpg)