This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Gainers and Losers

October 12, 2023

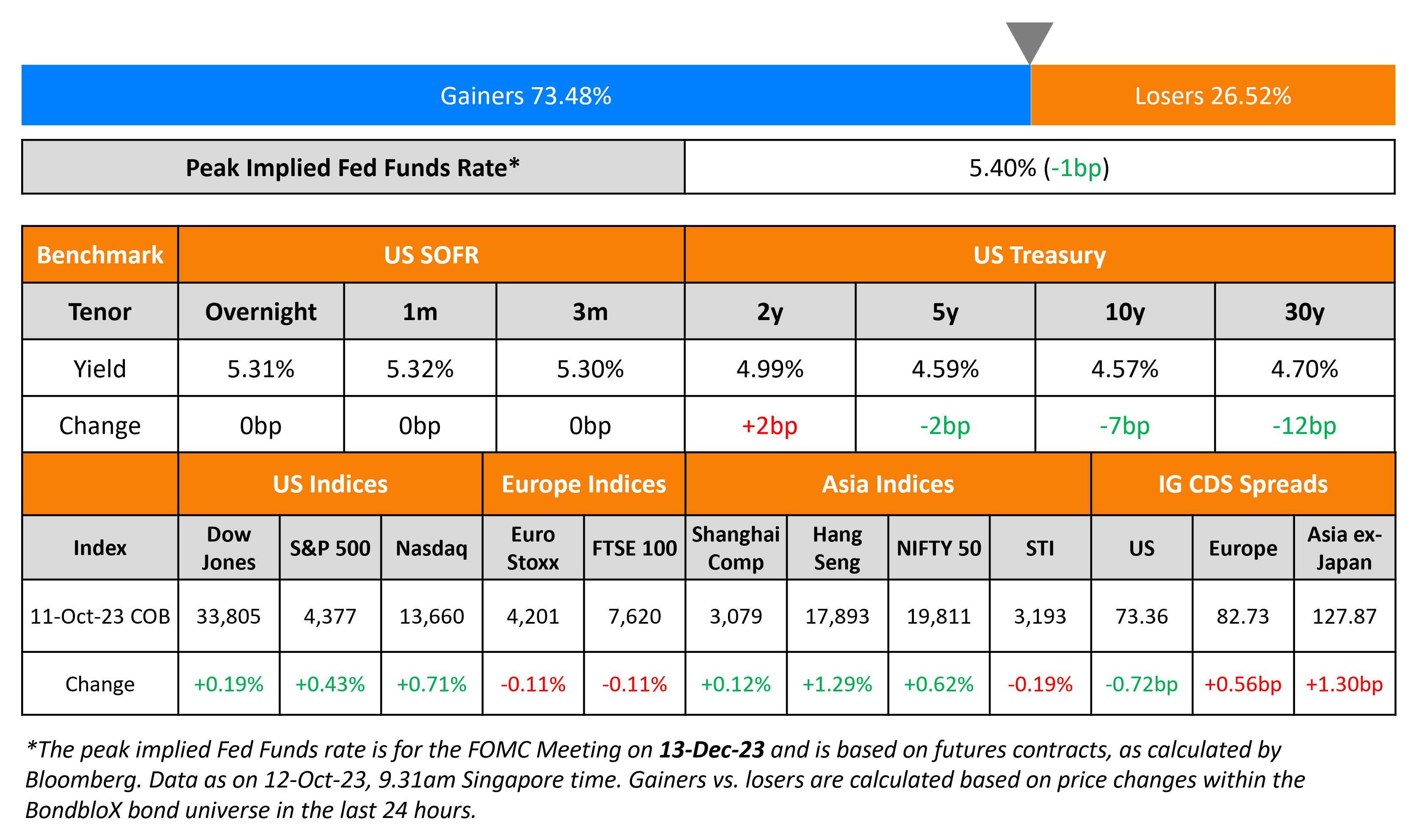

US long-end Treasury yields dropped with the 10Y yield down 7bp and 30Y down 12bp. The minutes of the Fed’s September meeting were released yesterday where members agreed that policy should remain restrictive for some time, while noting that the risks of overtightening now had to be balanced. The minutes noted that “a majority” of Fed officials saw one more rate increase “would likely be appropriate” while “some” said “no further increases would be warranted”. On the data front, US headline and core PPI came in stronger than expected for September with a 2.2% and 2.7% YoY growth vs. forecasts of 1.6% and 2.3% owing to higher energy costs. US credit markets saw IG CDS spreads tightening 0.7bp and HY spreads tighter by 3.7bp. US equities moved higher with the S&P and Nasdaq up by 0.5-0.6%.

European equity markets jumped higher too. In credit markets, European main CDS spreads were wider by 0.6bp and crossover spreads widened 1bp. Asian equity markets have broadly opened in the green today morning. Asia ex-Japan IG CDS spreads widened 1.3bp.

New Bond Issues

- BOC Luxembourg €300mn 3Y Green Transition at MS+80bp area

Santander raised €2.25bn via senior-non preferred two-part deal. It raised €1.25bn via a 4NC3 bond at a yield of 4.737%, 30bp inside initial guidance of MS+155bp area. If uncalled after 3 years, the coupon will reset at the EUR 1Y Swap rate plus a spread of 125bps. It also raised €2bn via a 8Y bond at a yield of 4.971%, 30bp inside initial guidance of MS+200bp area. The bonds have expected ratings of Baa1/A-/A-. The 4NC3s received orders over €2bn, 1.6x issue size and the 8Ys received orders over €3.6bn, 1.8x issue size.

New Bond Pipeline

- BOC Luxembourg hires for € 3Y Green Transition bond

- Oman Telecom hires for $ 7Y sukuk bond

Rating Changes

- Fitch Upgrades Aircastle Limited to ‘BBB+’; Outlook Stable

- Moody’s upgrades Hilcorp Energy’s CFR to Ba1

- Fitch Downgrades Amgen to ‘BBB’; Outlook Stable

- Moody’s downgrades ratings of Ping An Real Estate and Pingan Real Estate Capital; changes outlooks to negative

Term of the Day

Transition Bonds

Transition bonds are bonds aimed at industries with high greenhouse gas (GHG) emissions a.k.a. “brown industries” to raise capital with the objective of becoming less brown and thereby shift to greener business activities. Industries issuing transition bonds could range from mining, utilities, transport, chemicals etc. These bonds are different from ‘Green Bonds’ in that the use of proceeds is less clear; also the latter are generally issued by industries/companies already on the path of reducing emissions.

Talking Heads

On PIMCO bullish longer term bonds with a 12-month horizon

US economic growth is expected to slow the remainder of 2023 and next year, “hovering between stagnation and mild recession… As fiscal support fades, the drag from tighter monetary policy will intensify”… continue to favour long-term bonds over the next year, as they provide high yields not seen for over a decade while offering a cushion against economic uncertainty

On Urging Significant Allocation to Credit Market – Oaktree’s Howard Marks

If higher rates are here to stay, “credit instruments should probably represent a substantial portion of portfolios … perhaps the majority… Thanks to the changes over the last year and a half, investors today can get equity-like returns from investments in credit… Sell it all and put the proceeds into high yield bonds at 9%”

On Rates, Yields to Stay Higher for a Long Time – Harvard’s Kenneth Rogoff

“I’m definitely in the school that rates will stay high for as far as the eye can see.. fundamentals point to having higher interest rates for a long time… Interest rates have gone up and maybe we will hit recession at some point… the economy has not fallen apart… (it) is adjusting”

On Bond Traders Starting to Bail on Winning Yield-Curve Bets

Kellie Wood, deputy head of fixed income at Schroders

“Our US steepener view has been our best performing trade this year. This position protected our modest long duration view that underperformed over the last quarter as we positioned for the end of the US policy cycle.”

Xie Patrick, head of income strategies at Pendal

“The momentum feels exhausted. Probably much like the bond bearish momentum overall.”

Top Gainers & Losers- 12-October-23*

Go back to Latest bond Market News

Related Posts: