This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Gainers and Losers

October 11, 2023

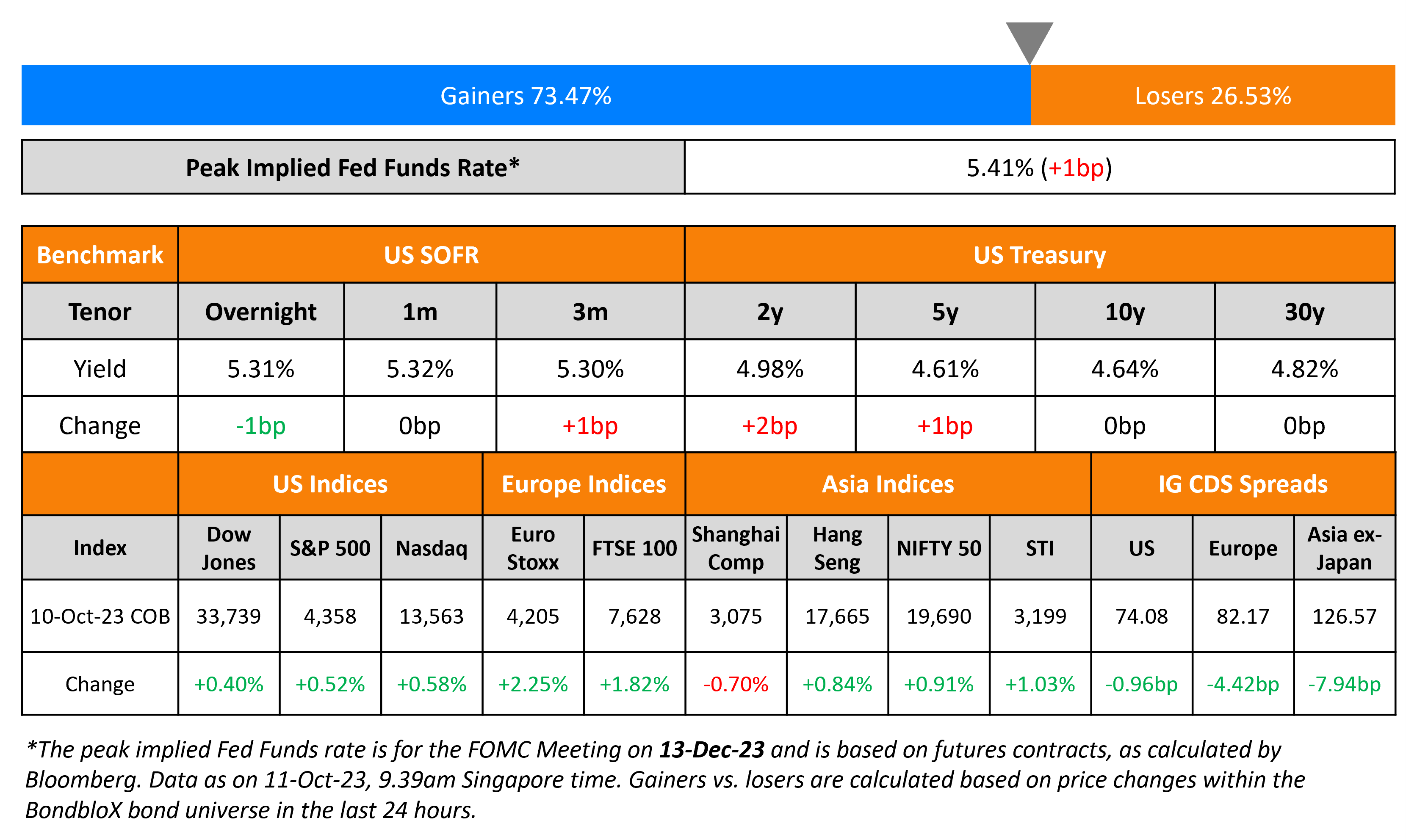

US Treasuries traded stable after an initial haven asset buying saw yields tumble by 12-15bp across the curve amid the Israel conflict and some dovish comments by Fed officials. San Francisco Fed President Mary Daly said yesterday that “financial conditions have tightened” and that “maybe the Fed doesn’t need to do as much” regarding hiking interest rates. US credit markets reopened with IG CDS spreads tightening 1bp and HY spreads tighter by 7.9bp. US equities moved higher with the S&P and Nasdaq up by 0.5-0.6%.

European equity markets jumped higher too. In credit markets, European main CDS spreads were tighter by 4.4bp and crossover spreads tightened 20.5bp. Asian equity markets have opened in the green today morning. Asia ex-Japan IG CDS spreads also tightened 7.9bp.

New Bond Issues

BPCE raised $4bn via a four-part senior deal:

For the 4NC3 FRN, the floating coupon will reset at the overnight SOFR plus a spread of 198bp and will be paid quarterly. For the fixed-rate 4NC3s, 6NC5s and 11NC10s, if uncalled by their respective call dates, the coupons will reset at the overnight SOFR plus spreads of 198bp, 227bp and 254bp respectively. Thereafter, the coupons will be paid quarterly. The senior notes will be rated Baa1/BBB+/A. Proceeds will be used for general corporate purposes. The new 4NC3s offer a new issue premium of 23.2bp over its existing 5.975% 2027s (callable in 2026) that yield 6.38%.

New Bond Pipeline

- BOC Luxembourg hires for € 3Y Green Transition bond

- Oman Telecom hires for $ 7Y sukuk bond

Rating Changes

- Moody’s downgrades five Egyptian banks; stable outlook on long-term deposit ratings

- Fitch Affirms Emirates NBD at ‘A+’/Stable; Upgrades VR to ‘bbb-‘

- Moody’s changes NOVA Chemicals’ outlook to negative; affirms Ba2 CFR

Term of the Day

Diaspora Bonds

Diaspora bonds are sovereign bonds that target investors that have emigrated to other countries. The reasons for emigration range from political unrest to better opportunities. For issuing countries, it is considered to be a possible stable source of finance particularly in bad times and can support the sovereign’s credit rating. For investors, it is believed to be a semblance of patriotism for the country of origin whilst also serving to manage risk since debt is serviced in local currency. Israel and India are two prominent nations that use this form of financing having collectively raised $35-$40bn via diaspora bonds. Some bonds even carry a “patriotic discount” that reduces the borrowing cost for the issuing sovereign.

Israel launched a diaspora bond campaign to raise money amid the war with Hamas.

Talking Heads

“Where we’ve been wrong is the fact that, normally, I don’t think deficits matter. But investors have been asked to take these bonds when there’s a big inversion and there’s loads of them… supply did matter… rise in bond yields we are seeing now makes the bullish views from earlier this year have more chance of being right. This comes through a fierce tightening of financial conditions.”

On Bonds to ‘Rally Big’ in 2024 Amid Recession – BofA’s Brett Hartnett

Pricing-in a recession “mutates into economic data, bonds rally big and bonds should be the best performing asset class in the first half of 2024… trigger a big rally in assets that have already discounted recession”

On Wall Street’s Paper Bond Losses Rear Head Again as Yields Rise

RBC Capital Markets Analysts

“Clearly the run-up in bond yields at the long end of the curve, which has led to the increases in unrealized bond losses, is weighing on the stocks. The scar tissue is so thick in the long-only investment community from what happened in March”

UBS Group Analysts

“The reason we think the stocks are rather oversold is that macro funds appear to be back and shorting banks for existential reasons”

“We’re not seeing a huge decline in risk appetite in equity markets and credit markets, so it’s a little bit odd… If you’re looking at the U.S. Treasury market, maybe there’s a question about who the buyers might be in the context where the government is also issuing quite a bit”

Top Gainers & Losers- 11-October-23*

Go back to Latest bond Market News

Related Posts: