This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Gainers and Losers

September 11, 2023

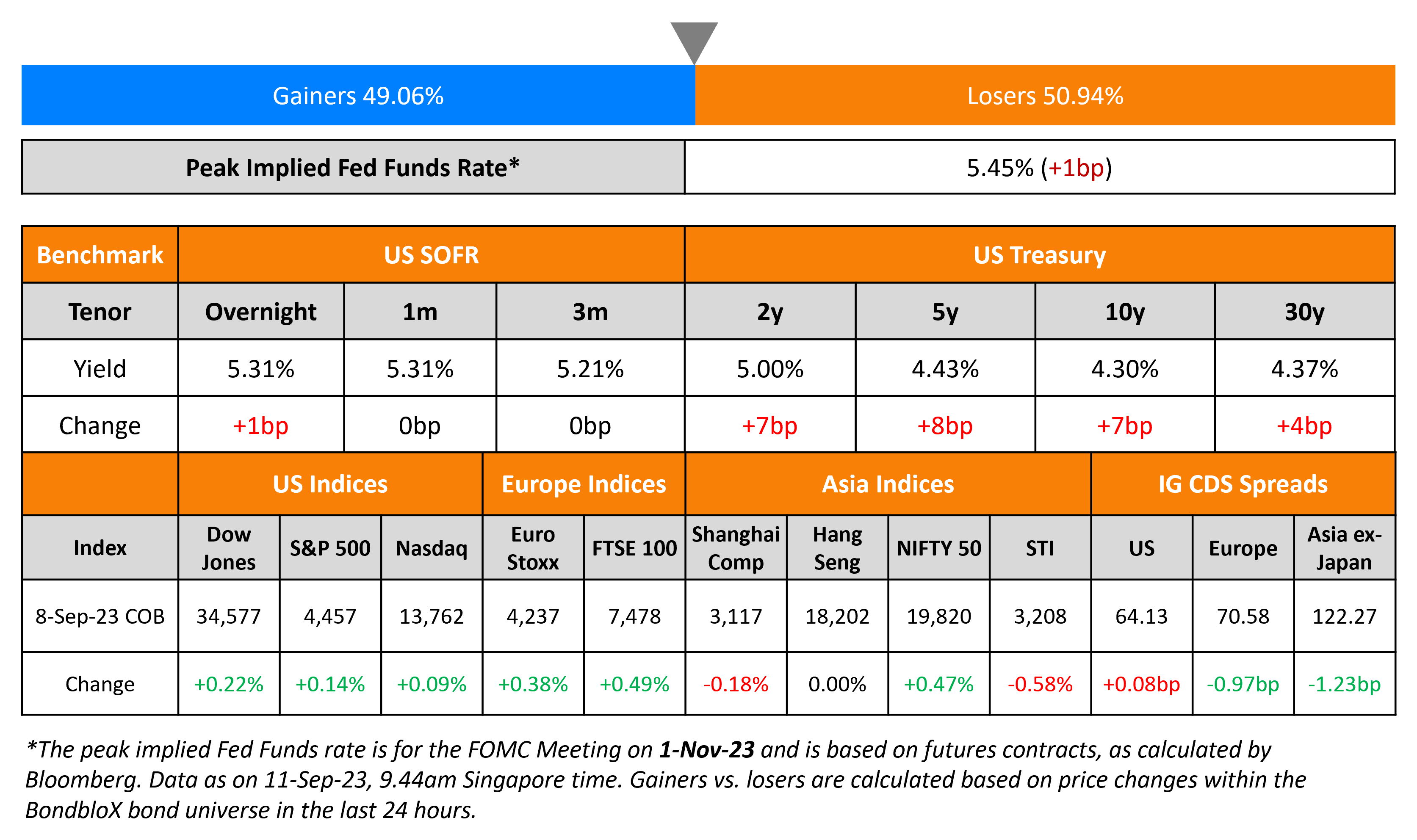

US Treasury yields moved higher by 7-8bp reversing the drop in yields seen on Thursday. NY Fed President John Williams said US monetary policy is “in a good place” but will need to parse through data to decide on how to proceed on interest rates. Separately, Dallas Fed President Lorie Logan said that skipping an interest-rate hike at the September meeting may be appropriate, while also signaling that rates may have to rise further to get inflation back to 2%. US IG CDS spreads were 0.1bp wider while HY spreads tightened 0.5bp. The S&P and Nasdaq moved slightly higher by ~0.1%.

European equity markets were also higher. In credit markets, European main CDS spreads were tighter by 0.3bp with crossover spreads tightening 3.9bp. Asian equity markets have opened mixed this morning while Asia ex-Japan CDS spreads tightened 1.2bp yesterday. Meanwhile in Japan, BOJ Governor Kazuo Ueda told the Yomiuri newspaper that it is possible that they would have enough information by year-end to judge if wages will continue to rise, a key factor to decide whether or not to end its loose monetary policy.

New Bond Issues

- BOC Dubai $ 3Y Green FRN at SOFR+105bp area

- Kexim $ 2Y/5Y/10Y at T+75/105/120bp area

- Tianjin Rail Transit $ 364-Day at 7.6% area

- Santos $ 10Y at T+300bp area

Rating Changes

- Fitch Revises Turkiye’s Outlook to Stable; Affirms at ‘B’

- Moody’s affirms Li & Fung’s ratings, changes outlook to negative

- Enbridge Gas Inc. Outlook Revised To Negative Following Outlook Revision On Parent; ‘A-‘ Rating Affirmed

New Bond Pipeline

- LG Energy hires for $ 3Y and/or 5Y Green bond

- Emirates NBD hires for Sustainable bond

- FWD hires for $ 10Y bond

Term of the Day

Peak Fed Funds Rate

Peak Fed Funds Rate refers to the highest Fed Funds rate as seen across all the upcoming Federal Reserve’s FOMC meeting dates. This rate is a calculation that is based on the Fed Funds futures contracts. The peak rate helps market participants calculate how many rate hikes are being priced-in by the markets as compared to the effective fed funds rate (EFFR). The EFFR is published daily by the NY Fed Reserve and gives an idea of the cost of borrowing federal funds by banks on an overnight basis. This rate is effectively within the Fed Funds target range, which the FOMC sets on every meeting date.

Talking Heads

On Bond Traders Bracing for Risk Inflation Will Fuel Rate-Hike Bets

Leslie Falconio, head of taxable fixed-income strategy at UBS Global Wealth Management

“CPI data could provide a little bit more color” on the likely path for the Fed. It’s not our expectation that the Fed moves in September. But while as of right now we say they don’t move in November either — you really have to give it a 50/50 chance.”

William Marshall, head of US rates strategy at BNP Paribas

Treasury market is “now in the realm of peak US yields”… any forthcoming rally in Treasuries will “not see a significant drop in longer-dated yields”

On Companies Betting Against High for Long in Bond Blitz

Dan Mead, head of the investment-grade syndicate at BofA

“Companies don’t really want to lock in these high yields for a very long time if they can avoid it… Many issuers are reluctant to lock in these higher absolute rates for longer term”

Steven Boothe, head of global IG fixed income at T. Rowe Price

“Investors were set up for this. Once we get through this wave, there’s not going to be much remaining supply for the rest of the year”

On Hedge Funds Ditching Bets on Euro Ahead of ECB

“The euro weakness is warranted — I think the ECB will pause… If it stops hiking then the euro may weaken a little further.”

Antony Foster, head of G10 currency spot trading at Nomura

“Most hedge funds are bearish euro, and generally bullish the dollar. Discussions with clients suggested they are worried about poor survey data not bouncing back, but inflation being sticky. They are worried about energy prices and China”

Athanasios Vamvakidis, head of G-10 currency strategy at BofA

“Euro-zone data has consistently surprised negatively in recent months, particularly compared with data in the US.”

On Mispriced Fed Bets Boosting ‘Higher for Longer’ Dollar – CIBC Capital Markets

“In the months ahead, we expect more in the way of easing to be priced in by end-2024 for those markets (Canada and Australia)… The drop in RRP of late suggests that the beta to UST issuance is still high — and that we could be in store for further declines with an abundance of Treasury supply still incoming”

Top Gainers & Losers- 11-September-23*

Go back to Latest bond Market News

Related Posts: