This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Gainers and Losers

February 13, 2023

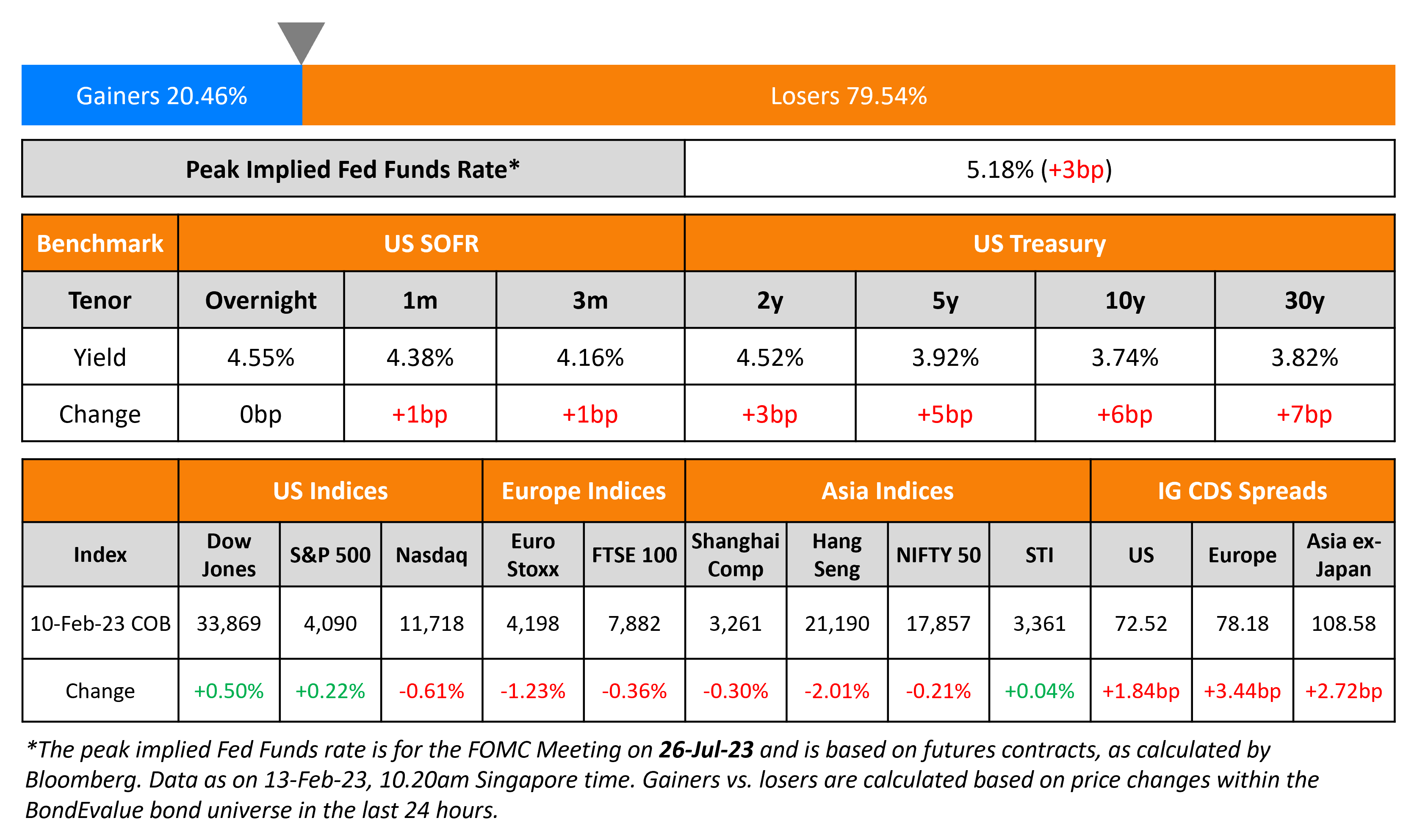

US Treasury yields were broadly higher by 3-7bp across the curve. The peak Fed funds rate widened 3bp to 5.18% for the July 2023 meeting. While a 25bp hike at next month’s FOMC meeting is all but certain (91% probability), the likelihood of another 25bp hike at the May meeting stands at 71%, up from 60% a week ago. Markets now turn their attention toward the CPI inflation report this week on February 14 with estimates of a 6.2% print. US IG CDS spreads widened by 1.8bp while HY spreads were 11.1bp wider. Equity indices were mixed with the S&P up and 0.2% and Nasdaq down 0.6%.

European equity markets ended higher. The European main CDS spread tightened widened 3.4bp while crossover CDS spreads widened 16.9bp. Asian equity markets have opened with a negative bias today. Asia ex-Japan CDS spreads were 2.7bp wider. Singapore’s Q4 GDP grew at 2.1% YoY vs. expectations of a 2.2% growth. However, it kept its 2023 growth forecast at 0.5-2.5% this year.

.png)

New Bond Issues

Nokia raised €500mn via a 8.5Y sustainability-linked bond at a yield of 4.444%, 45bp inside initial guidance of MS+200bp area. The senior unsecured bonds have expected ratings of Ba1/BBB-/BBB-, and received orders over €2bn, 4x issue size. Proceeds will be used to fund tender offers and for general corporate purposes. The issuer may be required to pay a redemption premium of 75bp when the notes are redeemed if it fails to satisfy the following conditions: (i) the GHGe Scope 1+2+3 KPI Amount is equal to or lower than 50% of the GHGe Scope 1+2+3 KPI for the Baseline Year (ii) the relevant determination report and the assurance report are published no later than 180 days after 31 December 2030.

New Bonds Pipeline

- Khazanah Nasional Bhd hires for $ bond

- SMBC hires for € 3Y Covered bond

Rating Changes

- Fitch Upgrades Andrade Gutierrez Engenharia to ‘CCC-‘

- Correction: Fitch Downgrades Azul’s IDRs to ‘CCC-‘

- Moody’s downgrades Ukraine’s ratings to Ca with a stable outlook

- Moody’s downgrades Lippo Malls to Caa1; outlook remains negative

Term of the Day

Rolling Recession

A rolling recession is a recent term that talks of a recession only affecting certain sectors of the economy at a time. Unlike a typical recession that affects most industries/sectors at the same time, a rolling recession is one where industries/sectors take turns going down, as per Loyola Marymount University economics professor Sung Won Sohn.

Some economists say that the current US economy is witnessing a ‘rolling recession’ where select sectors like housing, manufacturing and tech sectors are taking a hit while many other sectors are not contracting.

Talking Heads

On Credit Markets Poised for a Gut Check After 10% Rally

Maria Staeheli, a senior PM at Fisch Asset Management

“The low hanging fruit has been collected. It has been evident for the past couple of weeks”… opportunities in new issues in particular “are getting very close to fair value.”

Barclays strategists led by Brad Rogoff

“While it is difficult to identify a specific catalyst that will drive material near-term widening, we think that the risk-reward for credit has worsened following the recent rally”

JPMorgan Chase strategists

“After four months of calling for tighter spreads, we are starting to feel a bit nervous”

On ECB must avoid unnecessary rise in real interest rates – ECB’s Visco

“Today, disinflation is obviously needed, but given the levels of private and public debts that prevail in the euro area, we must be careful to avoid engineering an unnecessary and excessive rise in real interest rates… Indeed, I am convinced that the credibility of our actions is preserved not by flexing our muscles in the face of inflation, but by continually showing wisdom and balance.”

On Global Bond Bulls’ Biggest BOJ Fear Already Well Under Way – JPMorgan Chase

“Our forecast anticipates a sustained shift in Japanese portfolio flows this year from overseas to domestic debt. This shift, we believe, is being prompted in part by a view that sustained price and wage rises will inform further relaxation of yield-curve control policy and greater BOJ tolerance for domestic yield rises”

Top Gainers & Losers – 13-February-23*

Go back to Latest bond Market News

Related Posts: