This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Gainers and Losers

July 31, 2023

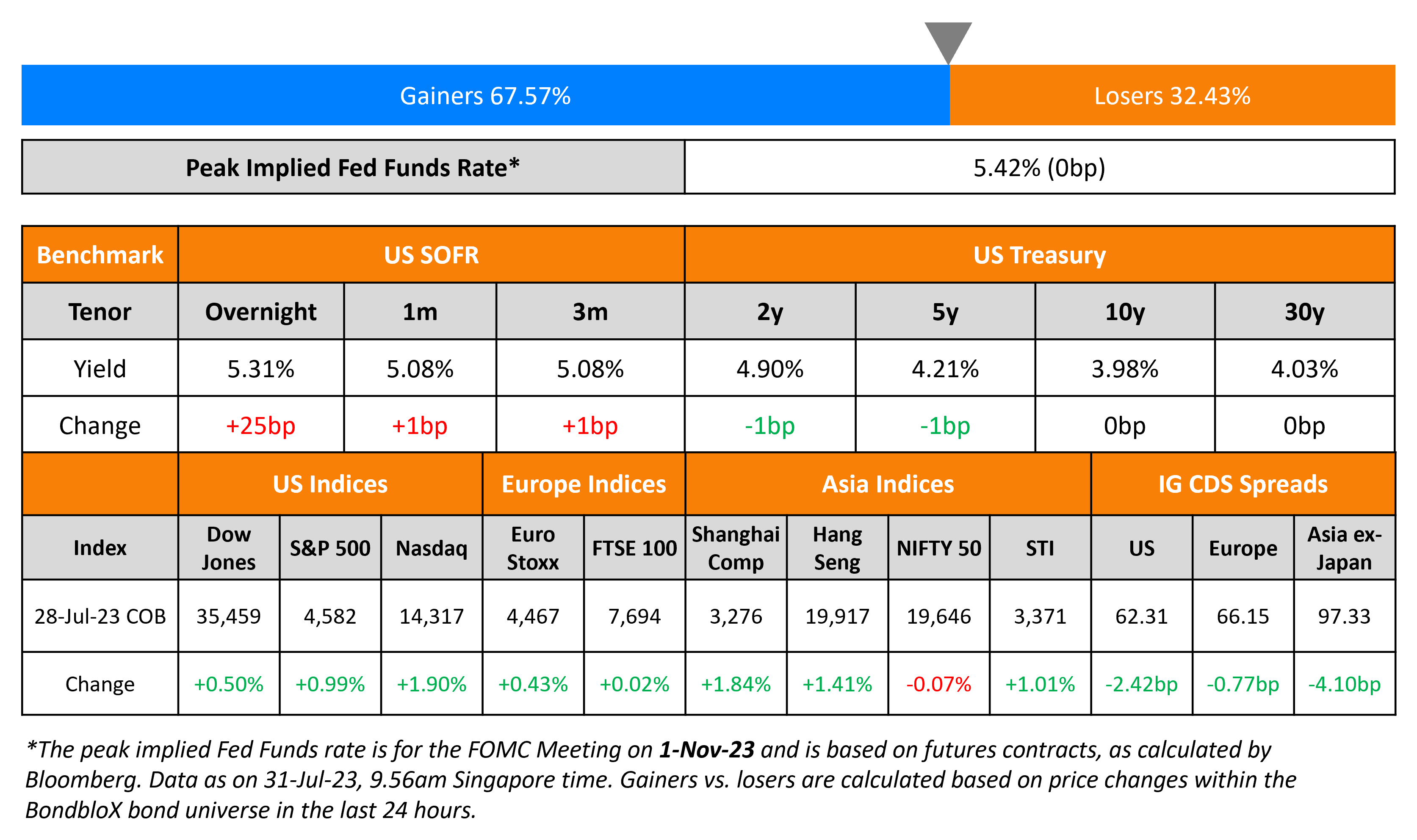

Treasury yields were flat after inflation indicators showed a softening in prices. US Core PCE for June saw a 4.1% rise, lower than expectations of 4.2% and also lower vs. May’s 4.8%. Headline PCE was up 3%, in-line with expectations and trended lower from 3.8% seen in May. US IG credit spreads tightened 2.4bp while HY CDS spreads were tighter by 12.8bp. The S&P and Nasdaq ended higher by 1% and 1.9% respectively.

European equity indices closed higher too. European main CDS spreads were 0.8bp tighter and Crossover CDS tightened 4.5bp. Asia ex-Japan CDS spreads continued to tighten by 4.1bp to 97.3bp, going below the 100bp mark for the first time since early February. Asian equity markets have opened in the green this morning.

.png)

New Bond Issues

- China Cinda $ 3.5Y at T+175bp area

- GS Caltex $ 5Y at T+165bp area

Rating Actions

- Moody’s confirms Kenya’s ratings at B3, changes outlook to negative

- Fitch Downgrades Estonia to ‘A+’; Outlook Stable

- Moody’s downgrades ratings of Greenland Holding and Greenland Hong Kong; outlook negative

- Moody’s downgrades Sino-Ocean’s ratings to Caa2/Caa3; outlook negative

Term of the Day

Structural Subordination

Structural subordination risk refers to the risk that most of the claims of the holding company are at its operating subsidiaries where these claims have a priority over the claims at the holding company in the event of a bankruptcy. Essentially, a lender to a parent is structurally subordinated to other lenders who have lent money to the subsidiary. Hence, lenders to the parent company will not have access to the subsidiary’s assets until the subsidiary’s creditors have been paid back first.

Talking Heads

On the Outlook for Inflation – Minneapolis Fed President Neel Kashkari

“(The inflation outlook in the US is) quite positive…The base case scenario seems to be that we’ll have a slowing economy, but that we would avoid a recession…(Given that the increase in core prices are still above the 2% target,) if we need to hike, raise rates further from here, we will do so.”

On the Likelihood of a US Soft Landing – global chief economist at Vanguard Group Joseph Davis

“To get inflation down that last yard to 2%, you have to see a modest weakening in the labor market, which means the unemployment rate’s going to rise—although hopefully not drastically, let’s say four-and-a-half percent over the next year…Well, that’s a hundred basis-point rise. So by definition, that is a recession. Now, anyone who thinks that that’s a soft landing is spitting in the face of 150 years of history.”

On the Obstacles to a Bond Market Rally

Ken Shinoda, portfolio manager at DoubleLine Capital

“Jerome Powell, he was a little late to start the hiking cycle and he may stay stubbornly high…The market is expecting cuts as soon as next year and he may stay higher for longer.”

Jason Pride, director of investment strategy and research at Glenmede

“(Treasuries will be more) properly priced when the market fully reflects the possibility of the Fed holding rates above 5% through the middle of next year and only gradually bringing them down from that.”

Mark Cabana, head of US interest-rate strategy at BofA

“(A rise in US Treasuries supply to finance a growing budget deficit) does further some concerns we have about the supply-demand backdrop in the US rates space…We see risks that Treasuries will have to continue to cheapen in order to incentivize demand.”

Jim Caron, co-CIO for global balanced risk at Morgan Stanley

“(The BoJ’s loosening grip on long-term yields is) significant because it means global bond yields have lost their anchor to some degree.”

On Brazil’s Expected Rate Cut This Week

Leonardo Costa, economist at ASA Investments

“We believe the initial step will be more cautious, given the ongoing persistence of longer-term inflation dislocation from official targets, elevated core inflation, and the still robust labor market.”

Julio Hegedus Netto, chief economist at Mirae Asset

“There would be conditions for a more aggressive rate cut in August, but the central bank, somewhat divided within its board, is likely to opt for a 25-basis-point reduction.”

On Easing Bearishness Over Chinese Bonds – portfolio manager at Pimco Stephen Chang

“We have turned neutral on China bonds for a number of weeks now, compared with an underweight bias at the beginning of the year…Data continue to show the Chinese economy losing momentum and the current monetary policy justifies a more neutral stance for us on duration.”

Top Gainers & Losers – 31-July-23*

Go back to Latest bond Market News

Related Posts: