This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; New Bond Issues; Rating Actions; Talking Heads; Gainers and Losers

September 13, 2023

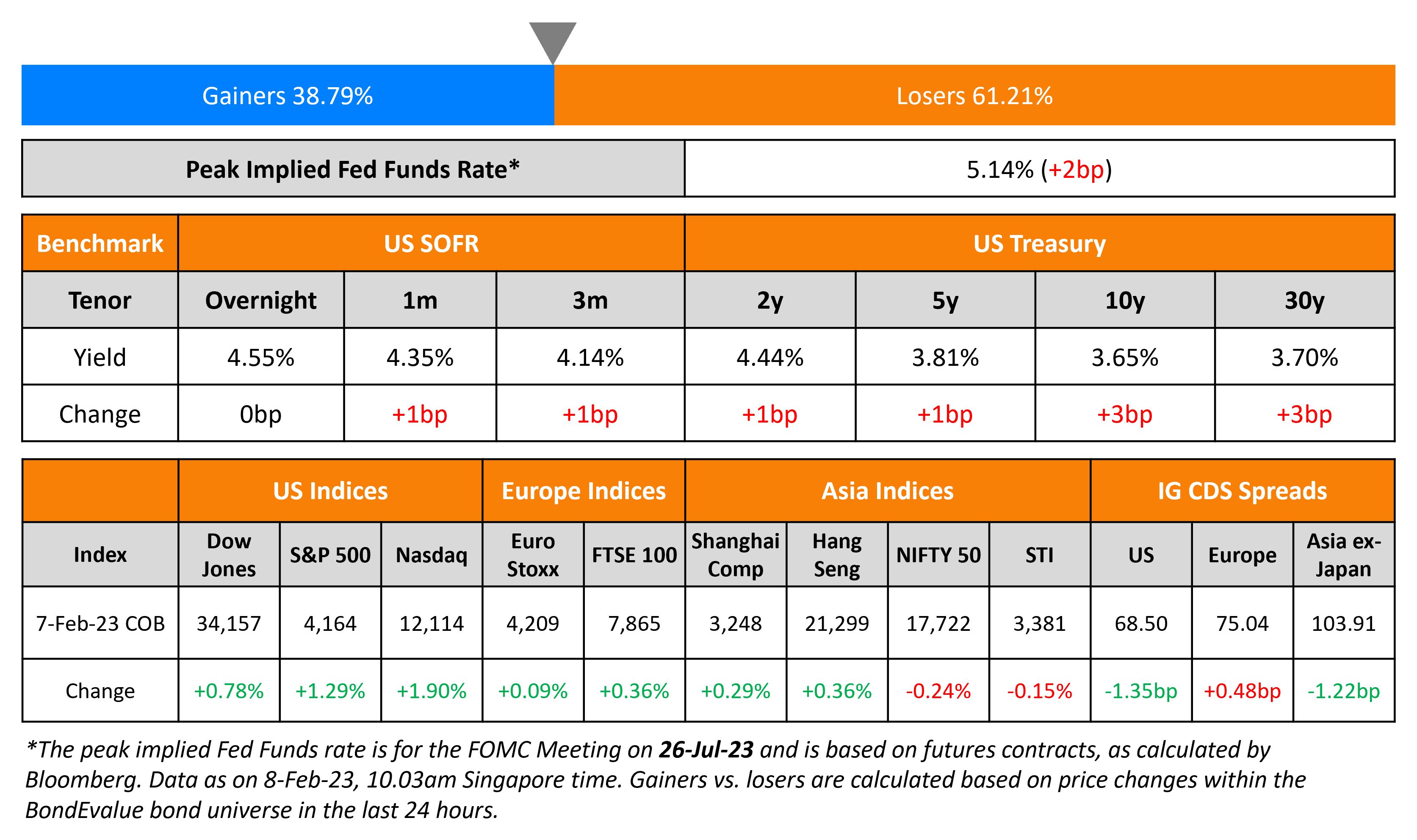

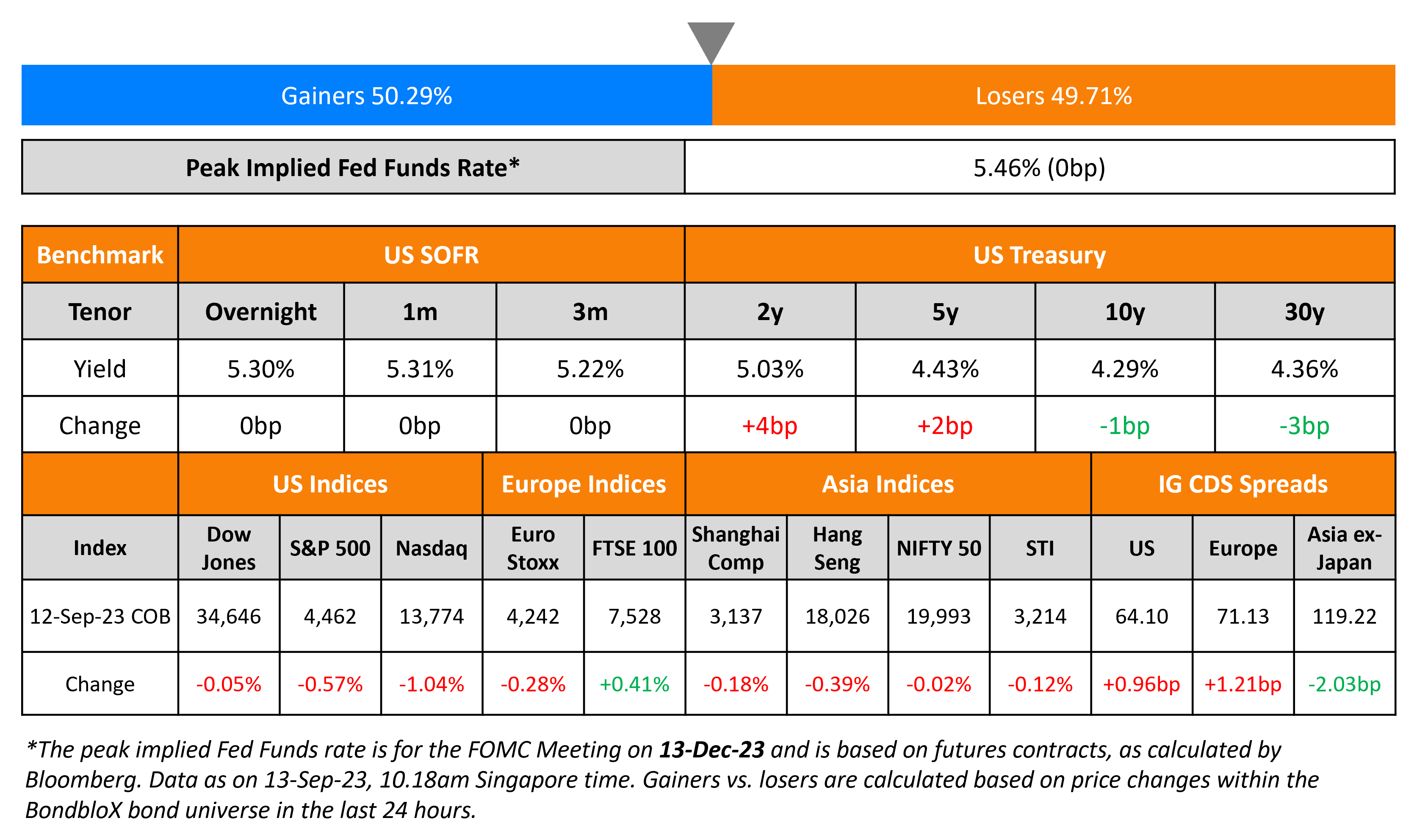

US Treasury yields flattened with the shorter-end of the curve (2Y and 5Y) widening by 2-4bp, while the longer-end tightened by 1-3bp. Markets continue to await the US inflation report later today, where headline CPI is expected at 3.6% vs. July’s 3.2%. The probability of a 25bp rate hike at the November meeting remained steady at 38%. IG CDS spreads were 1bp wider while HY spreads widened by 4.1bp. The S&P and Nasdaq moved lower by 0.6% and 1% respectively.

European equity markets ended mixed. In credit markets, European main CDS spreads were wider by 1.2bp with crossover spreads tightening 4.2bp. Asian equity markets have opened broadly weaker this morning while Asia ex-Japan CDS spreads tightened 2bp yesterday.

New Bond Issues

- Sharjah $ 10.5Y sukuk at T+220bp area

Bank of America raised $8.5bn via a four-part deal. The details of the issuance can be found in the table below.

.png)

If uncalled after 3, 5 and 10 years, the coupons on the 4NC3s, 6NC5s and 11NC10s will reset at the overnight SOFR plus a spread of 134bp, 157bp and 184bp respectively. Thereafter, the coupon will be paid quarterly. For the 4NC3 FRN, the floating coupon will also reset at the overnight SOFR plus a spread of 135bp and be paid quarterly. The senior unsecured bonds are expected to be rated A1/A-/AA-. Proceeds will be used for general corporate purposes. The new 6NC5s are priced 2.1bp tighter than its existing 4.271% 2029s (callable in 2028) yielding 5.84%, while the new 11NC10s are priced 4.2bp tighter than its existing 5.288% 2034s (callable in 2033) yielding 5.83%.

HSBC raised S$675mn via a 10.5NC5.5 Tier 2 bond at a yield of 5.3%, 30bp inside initial guidance of 5.6% area. If uncalled on its first call date in 2029, its coupon will reset at the SGD overnight indexed swap (OIS) rate plus a spread of 200bp. The bonds also have a statutory write down/conversion clause in the event that the UK regulatory authority decides to exercise its bail-in power. The bonds have expected ratings of Baa1/BBB/A-, and received orders over S$1.2bn, 1.8x issue size. Private banks snapped up majority of the deal at 59% while fund managers, insurance companies, pension funds and banks took the remainder. Singapore accounted for 93% while Europe and the rest of Asia took 7%. Proceeds will be used for general corporate purposes, and to maintain or further strengthen the issuer’s capital base. The table below compares HSBC’s new Tier 2s with other similarly rated SGD-denominated Tier 2s.

.png)

New Bond Pipeline

- Korea Southern Power hires for $ 3Y bond

- Energy Development Oman hires for $ 10Y sukuk

- Emirates NBD hires for Sustainable bond

- FWD hires for $ 10Y bond

- Bangkok Bank hires for $ senior bond

Rating Changes

- Moody’s upgrades Royal Caribbean’s CFR to B1, outlook positive

- Fitch Upgrades SSE Plc to ‘BBB+’; Outlook Stable

- Accor S.A. Upgraded To ‘BBB-/A-3’ On Operating Performance And Credit Metrics Recovery; Outlook Stable

- Fitch Downgrades Canary Wharf’s IDR to ‘BB’/Negative Outlook, Secured Bonds to ‘BB+’

- Chemical Producer Equate Petrochemical Outlook Revised To Stable From Positive On Slow Price Recovery; ‘BBB’ Affirmed

Term of the Day

Put Option

A put option gives the buyer of the option the right but not the obligation to sell the underlying instrument at a particular price known as the strike price at expiration. Put options in bonds are in the hands of the bondholders unlike call options, which lie with the issuer. Exercising a put would require the issuer to redeem the bonds, leading to a cash outflow.

Talking Heads

On Italy’s Bond Rally Coming to An End

Eric Oynoyan and Chiara Zangarelli, strategists at Morgan Stanley

“The supportive factors that allowed the 10-year BTP-bund spread to reach our 160 basis points bull case scenario have vanished. We now expect higher fiscal deficits and weaker growth. In a context of a fast-weakening euro zone economy, that repricing should accelerate over the coming months.”

On US Companies Opting For Short-Term Debt

Matt Brill, Head of Invesco

“For the most part, companies are preferring to borrow for three, five, seven or 10 years much more than borrowing for 30 years. I think that’s just a function of how expensive it’s gotten for companies to borrow versus where it was just a year-and-a-half or so ago. You don’t want to be paying this high coupon for any longer than you have to.”

On High Demand For Treasury Bills Among Retail Investors

Thomas Simons, senior economist at Jefferies LLC

“These are attractive yields so it never made much sense for bills to be stuffed with the dealers for long. It has taken a long time for retail investors to pay attention to bills, and the same motivation is there for institutional investors too.”

John McClain, a portfolio manager for Brandywine Global

“You’re being paid to be patient and there’s a very compelling opportunity to allocate excess cash into T-bills. The earnings yield on the S&P 500 is below T-bills and that doesn’t happen very frequently. There’s a lot of compelling reasons why you’re supposed to invest in T-bills at the moment.”

On Fed Not Hiking in upcoming September Meeting

Brett Ryan, senior U.S. economist at Deutsche Bank

“Though we continue to expect the Fed to remain on hold at the Sept. 20 FOMC meeting, we would not be surprised to see most officials continue to project one more rate hike by year-end in their updated ‘dot plot.”

Top Gainers & Losers- 13-September-23*

Other News

Go back to Latest bond Market News

Related Posts: