This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

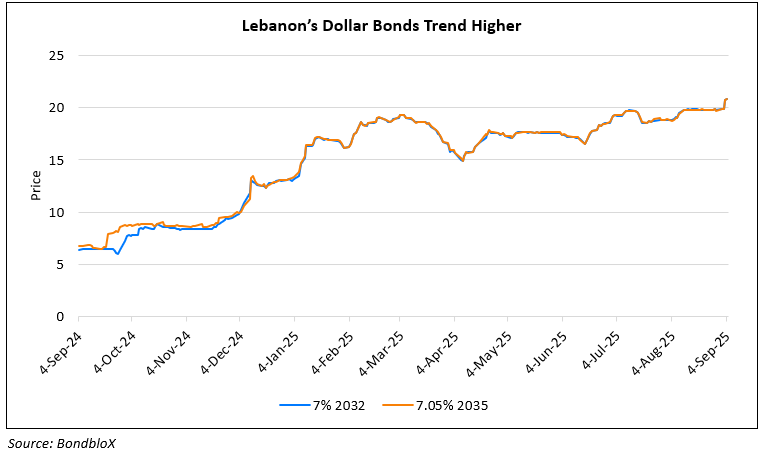

Lebanon’s Dollar Bonds Rise Above 20 cents on the Dollar After Five Years

September 4, 2025

Lebanon’s defaulted dollar bonds have climbed above 20 cents on the dollar for the first time in five years. Analysts have highlighted that investor optimism regarding political and economic reforms are gaining traction. The rally follows the formation of a functional government and pledges by new leadership, to tackle an $80bn banking hole and pursue restructuring. Creditors, including BlackRock, Amundi, and Aberdeen, are pushing for a deal, but progress hinges on IMF support, regional funding, and resolving Lebanon’s banking and political crises. Gulf states have tied financial aid to reforms, anti-corruption efforts, and demilitarization. While these conditions remain unresolved, early signs of economic recovery, such as an uptick in PMI and central bank efforts to stabilize banks, have buoyed sentiment, reports suggest. Lebanon was upgraded to CCC last month by S&P. According to Bloomberg, Lebanon’s 2035 bonds have given a 250% total return since September 2023, outperforming all other emerging-market debt, despite no payments since 2020.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Credit rating boost for Ireland & Portugal: EU inches towards recovery

September 20, 2017

China Refutes S&P Downgrade Action

September 26, 2017

Mongolia’s Credit Ratings Upgraded to B3 by Moody’s

January 19, 2018