This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

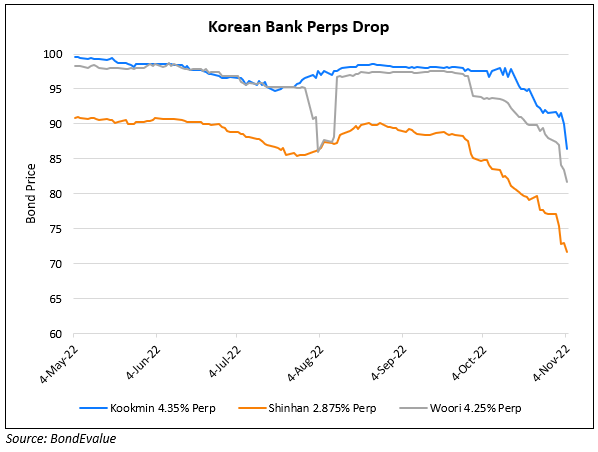

Korean Bank Perps Drop after Insurer Skips Call

November 4, 2022

Korean bank dollar perps including the likes of Kookmin Bank, Shinhan Group, Woori Bank etc. have dropped sharply this week (see chart above). This comes after Korean insurer Heungkuk Life Insurance Co. announced skipping the call option on November 9 on its USD 4.475% Perp – the bonds are down 27 points in the last 3 days, trading currently at 72 cents on the dollar. As per Bloomberg, this is the first time a Korean issuer has taken a step to skip the call on their perps since Woori Bank skipped a call date in 2009. DB Life, another Korean insurer, is also said to be planning to skip the first call date for its hybrid debt. “Investors are reassessing the risks of non-call for financial subordinated debt in Asia following Heungkuk Life’s decision not to call their subordinated bonds,” said Nicholas Yap, head of Asia credit desk at Nomura.

In the midst of the insurance sector led credit market fears, Korea’s Financial Services Commission said, “To ensure stability in money market, authorities asked insurers to refrain from selling bonds”. This comes after the insurance sector expressed the need for measures to help them accumulate more liquid assets or reduce their burden of having to maintain certain levels of liquid assets.

For the full story, click here

Go back to Latest bond Market News

Related Posts: