This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Kenya Upgraded to B3 by Moody’s

January 28, 2026

Kenya was upgraded by one notch to B3 from Caa1 by Moody’s. The upgrade is driven by a marked strengthening in the nation’s external liquidity, supported by higher FX reserves, a narrower current account deficit, and a more stable exchange rate. Kenya’s return to international bond markets has reduced near-term refinancing risks, eased balance of payments pressures, and improved funding flexibility, according to Moody’s. Improved domestic financing conditions, including lower yields and strong demand for government securities, have further enhanced the government’s ability to meet large fiscal funding needs locally, reducing immediate reliance on external financing. Moody’s expects Kenya’s fiscal deficit to remain close to 6% of GDP, with debt broadly stable at around 67% of GDP and interest payments consuming over 30% of government revenue. The stable outlook assumes Kenya will sustain recent gains in external liquidity and market access.

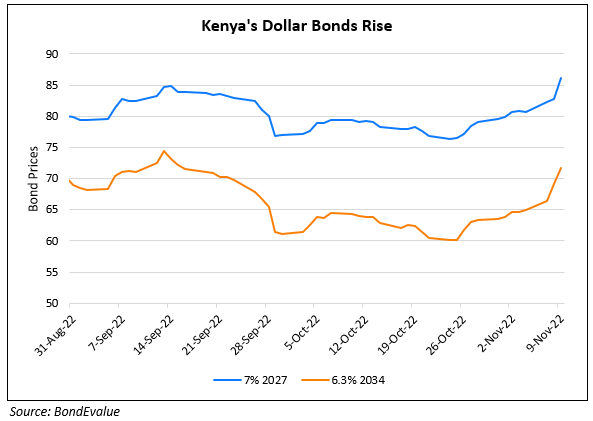

Kenya’s dollar bonds traded stable with its 6.3% 2034s at 91.9, yielding 7.75%.

Go back to Latest bond Market News

Related Posts:

IMF Delays $238mn Kenya Loan for Budget Purposes

June 28, 2022

Kenya Wanting to Renegotiate $5bn Loan with China

October 20, 2022

Kenya’s Dollar Bonds Jump Higher on IMF Agreement

November 10, 2022