This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Kenya, Romania Price Bonds, Launch Buybacks

October 3, 2025

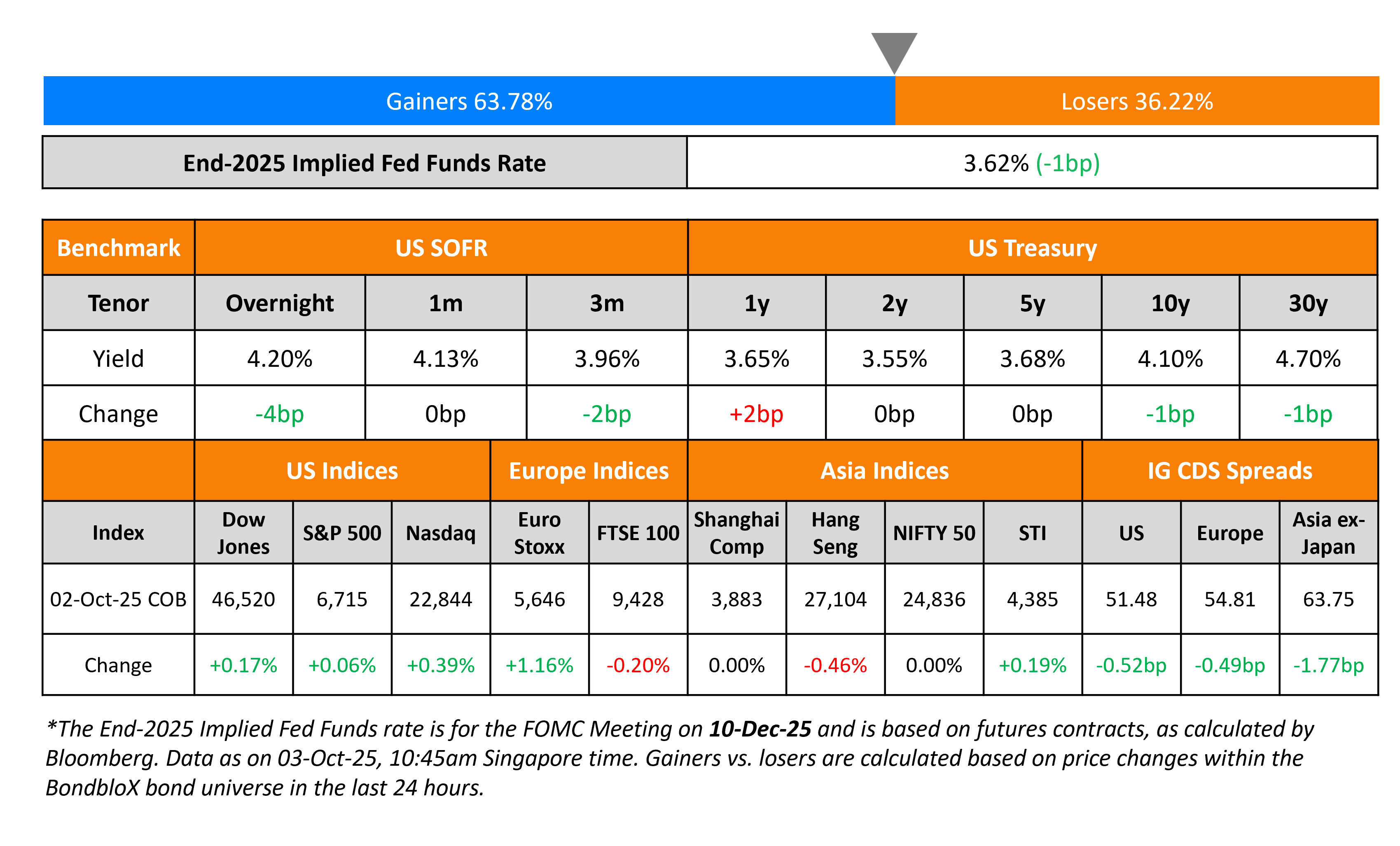

US Treasury yields were broadly unchanged across the curve with a lack of data or any catalysts in the markets. Due to the government shutdown, there will be no NFP release today. US Treasury Secretary Scott Bessent indicated that there could be a “pretty big breakthrough” in the next round of trade talks with China.

Looking at equity markets, both the S&P and Nasdaq ended 0.1% and 0.4% higher respectively. US IG CDS spreads were tighter by 0.5bp while HY CDS spreads were wider by 0.2bp. European equity markets ended mixed. The iTraxx Main CDS and Crossover CDS spreads tightened by 0.5bp and 2.7bp respectively. Asian equity markets have opened mixed today. Asia ex-Japan CDS spreads were tighter by 1.8bp.

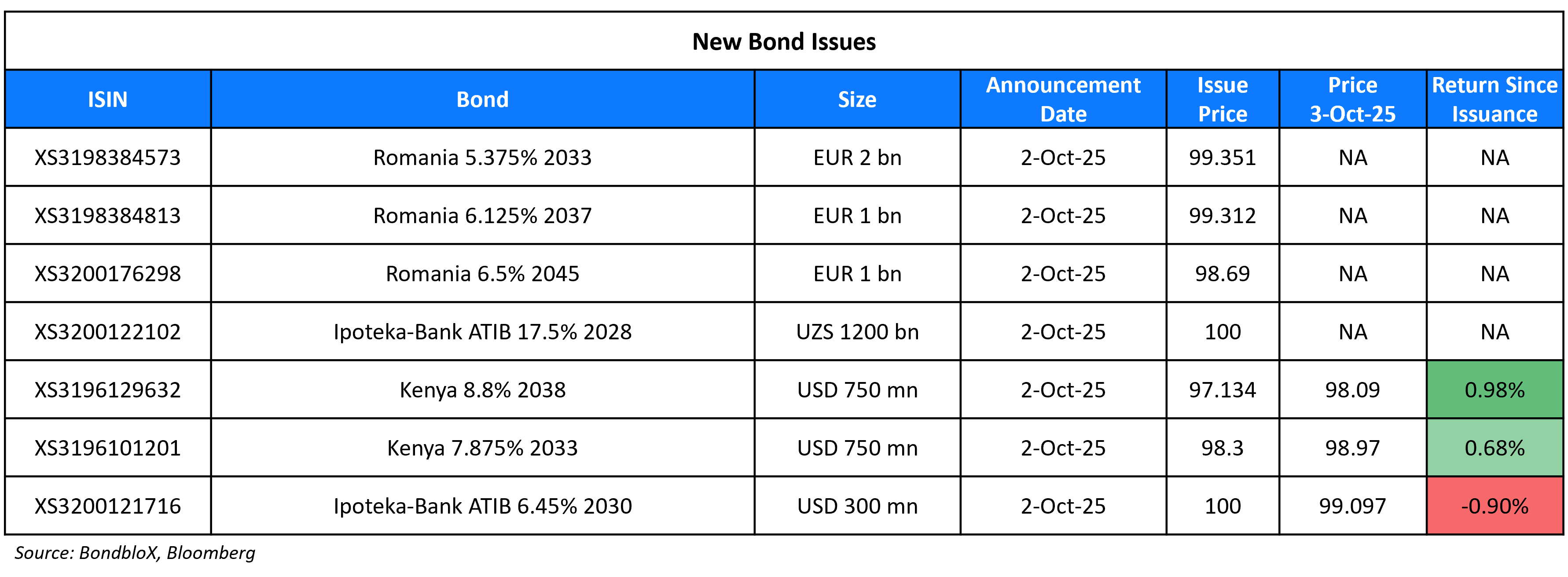

New Bond Issues

Kenya raised $1.5bn via a two-trancher. It raised $750mn via a 7Y bond at a yield of 8.20%, 55bp inside initial guidance of 8.75% area. It raised $750mn via a 12Y bond at a yield of 9.20%, 55bp inside initial guidance of 9.75% area. The senior unsecured notes are rated B/B-. The 7Y note is amortizable in three equal instalments on 9 October 2031, 9 October 2032 and 9 October 2033. Similarly, the 12Y note is amortizable in three equal instalments on 9 October 2036, 9 October 2037, 9 October 2038. The new 7Y note is priced at a new issue premium of 16bp over its existing 8% 2032s that currently yield 8.04%.

Proceeds will be used to finance the repayment of outstanding debt, including the buyback of its $1bn 7.25% 2028s via its tender offer announced on 2 October 2025. Any excess will be used for general budgetary purposes that may include the refinancing of other external debts. The nation has been working to cut its overall debt, which stands at nearly 70% of its GDP.

Romania raised €4bn via a three-trancher. It raised:

- €2bn via a long 7Y bond at a yield of 5.486%, 45bp inside initial guidance of MS+340bp area.

- €1bn via a 12Y bond at a yield of 6.208%, 40bp inside initial guidance of MS+385bp area.

- €1bn via a 20Y bond at a yield of 6.62%, 45bp inside initial guidance of MS+415bp area.

The senior unsecured notes are rated Baa3/BBB-/BBB-. Proceeds will be used for budget deficit financing, redemption of public debt and liability management operations including buybacks or exchanges. Romania launched a tender offer for three of its euro-denominated bonds due 2026 with a combined principal of €4.25bn.

Giti Tire Pte. Ltd. raised S$150mn via a 5Y sustainability bond at a yield of 5.75%, inline with final guidance. The senior unsecured notes are unrated. They have a change of control put at 101. Proceeds will be used to finance/refinance expenditure directly related to eligible projects under its sustainable finance framework.

Rating Changes

- Fitch Upgrades Pemex’s IDRs to ‘BB+’, Removes Watch Positive; Outlook Stable

- Fitch Upgrades Prudential plc to ‘A+’, Outlook Positive; Assigns IFS of ‘AA-‘ to Core Subsidiaries

- Moody’s Ratings upgrades Carvana’s CFR to B2, outlook remains positive

- Moody’s Ratings upgrades Aircastle’s senior unsecured rating to Baa2, outlook is stable

- Fitch Upgrades Hammerson’s IDR to ‘BBB+’/Stable; Senior Unsecured to ‘A-‘

- Office Properties Income Trust Downgraded To ‘SD’ From ‘CCC-‘ On Missed Interest Payments

- Tullow Oil PLC Rating Lowered To ‘CCC’ On Refinancing Risk; Outlook Negative

- Moody’s Ratings downgrades General Shopping’s CFR to Ca; Outlook remains stable

- Tupy S.A. Outlook Revised To Negative On Higher Leverage Due To Weaker Industry Conditions; ‘BB+’ Rating Affirmed

- Fitch Revises Outlook on Honda Finance to Negative; Affirms Rating at ‘A’

New Bonds Pipeline

- Vakif Katilim $ PerpNC5.5 AT1 Sukuk

Term of the Day: Change of Control Put

A change of control put is a common covenant in bond offerings, mentioned in the bond’s prospectus. Bonds that carry a change of control put offer bondholders the option to sell the bonds back to the issuer at a pre-defined price upon the occurrence of a change of control event, which is typically a change in ownership of the issuer. The option to redeem the bonds in this case lies with the bondholder, as against a call option, which lies with the issuer, not the bondholder.

Talking Heads

On Markets Should Be Nervous on Deficit – Jim Millstein, Guggenheim

Tariffs might “offset the incremental tax cuts that were incorporated… but it is not going to close the deficit in any meaningful way… That is why I think the bond market should be a little nervous about what the government is doing”

“We see global growth in the first half of the year having held steady, but we are starting to see signs of a slowdown globally now. With respect to inflation, what we see globally is a bit of a mixed picture… do see firms absorbing some of the tariff impact, so that seems to be part of the contributing factor to the fact that we’ve seen relatively limited impact so far on inflation in the US”

“If we aren’t going to have those, it’s problematic… going into a period where you’re trying to figure out: Is this a transition?… if you’re not going to get the data, it’s just that much harder”

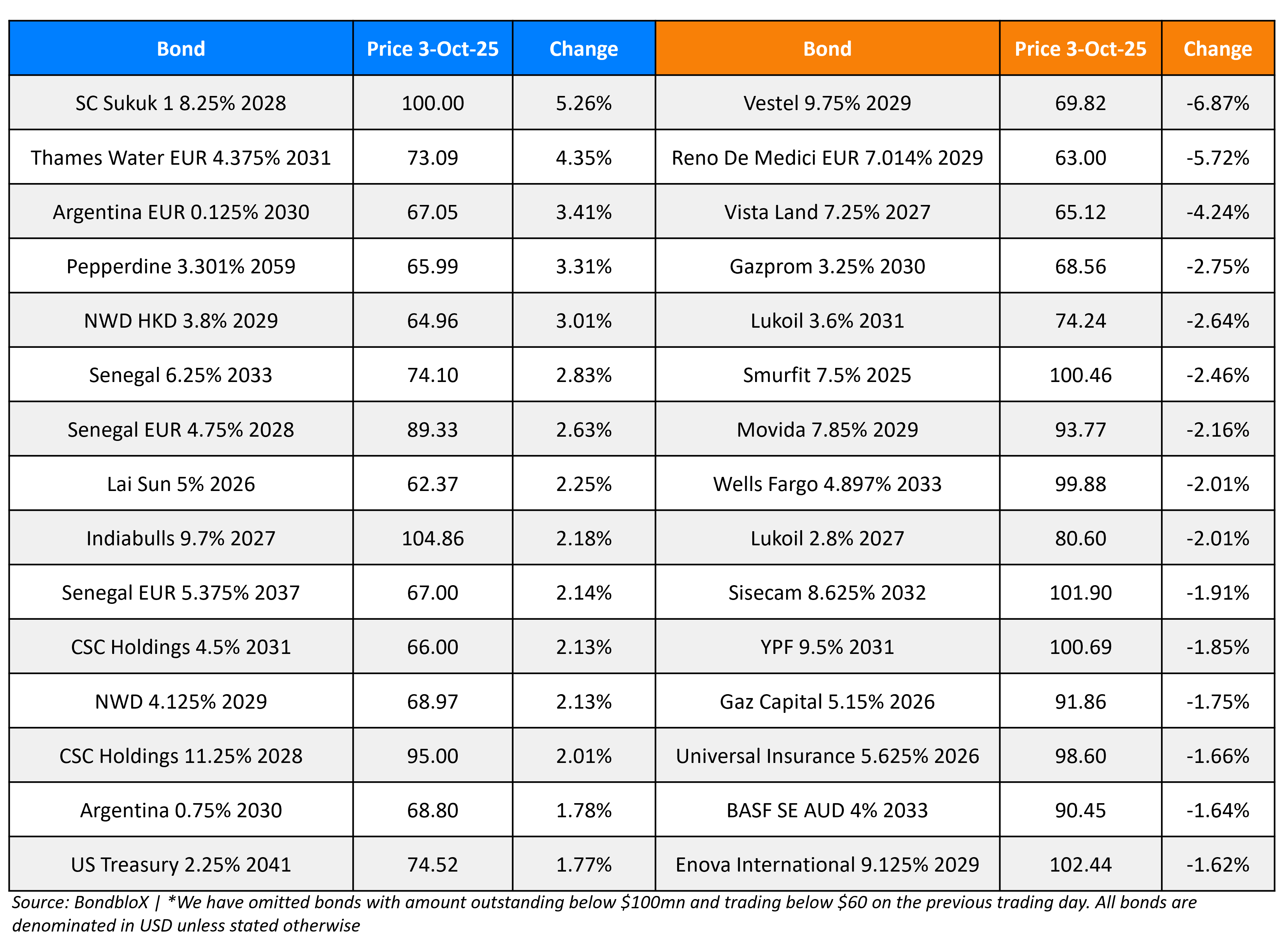

Top Gainers and Losers- 03-Oct-25*

Go back to Latest bond Market News

Related Posts: