This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Kaisa Creditors Offer Forbearance to Avoid Default; Evergrande’s Coupon Awaited

December 7, 2021

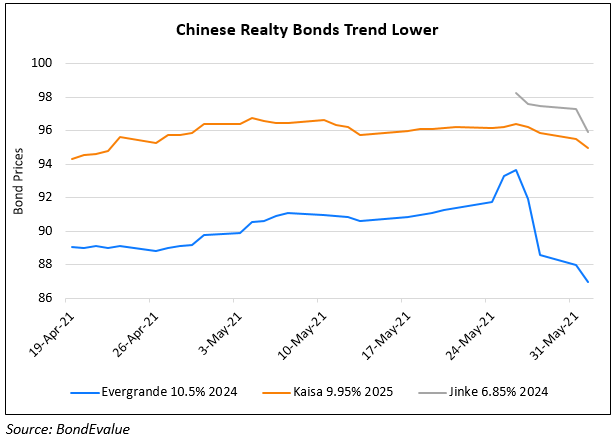

Kaisa Group’s creditors sent the company a formal forbearance proposal as per sources to avoid a formal default on its $400mn 6.5% bonds due December 7, 2021. The news comes after Kaisa failed to win approval from its bondholders for a debt swap last week. State media CCTV reported that Kaisa was unable to deliver some residential projects to buyers and failed to pay salaries to some workers in Guangzhou. Kaisa’s dollar bonds continue to trade at distressed levels of 34-36 cents on the dollar,

For the full story, click here

Separately, no news as yet has been released on Evergrande’s coupons payments that were due after its 30-day grace period. The bonds in question are its 13% 2022s and 13.75% 2023s issued by Scenery Journey, with coupon payments of $41.9mn and $40.6mn respectively. Evergrande’s dollar bonds are down 2 points at distressed levels of 18-22 cents on the dollar.

Go back to Latest bond Market News

Related Posts: