This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

China tells Banks that Evergrande Will Not Pay Interest Next Week; Downgraded to CC by S&P

September 16, 2021

The Ministry of Housing and Urban-Rural Development convened a meeting with banks this week and informed them that China Evergrande will not be able to meet its debt obligations due on September 20 as per sources. They added that Evergrande is still discussing on the possibility of extending payments and rolling over some loans to banks. This is the firmest sign yet that the debt-laden developer is facing a major liquidity-stress on its $300bn liabilities.

Rating agency S&P downgraded Evergrande to CC with a negative outlook due to its “depleted liquidity” with an extremely high nonpayment risk ultimately leading to debt restructuring, implying that a default scenario is a virtual certainty. Its two subsidiaries’ failure to discharge their guarantee obligations of RMB 934mn ($145mn) on WMPs, along with hiring advisers to evaluate liquidity, increases the probability of debt restructuring. S&P added, “Presales slowing will reduce main source of cash inflow. Waning buyers’ confidence and construction suspension of Evergrande’s projects could lead to decreases in contracted sales and saleable resources on a prolonged basis. This would limit the company’s main source of cash inflow at this point.” Its inability to service even interest on debt with coupon payments due on dollar bonds beginning September 23 only adds additional challenges and repayment lapses.

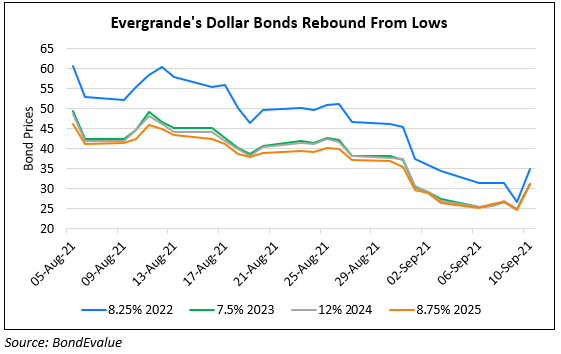

As per market rumors, Evergrande’s dollar bonds were said to be trading ‘flat’ at all-time lows of 17-18 cents on the dollar. Trading in Evergrande’s onshore bonds have been halted for a day following a downgrade by local rating agency China Chengxin, as per IFR, citing exchange filings. The onshore bonds will resume trading tomorrow but will only be traded through negotiated transactions, according to the filings.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

Evergrande’s Property Sales Fall 26% YoY

September 7, 2021

Evergrande’s Bonds Rebound as Loan Extensions Agreed Upon

September 10, 2021