This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

JP Morgan Sees No Major Impact on Adani Group Entities

December 10, 2024

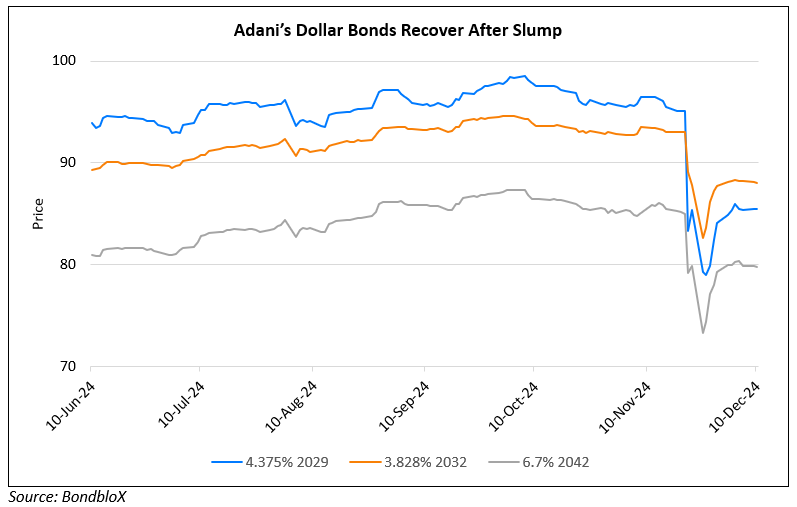

JPMorgan has assigned an ‘overweight’ rating to four Adani Group bonds, citing no signs of stress in the conglomerate’s key listed entities, most of which have leverage below five times. Three of the rated bonds were issued by Adani Ports, and one by Adani Electricity Mumbai. It remained ‘neutral’ on five other bonds and ‘underweight’ on a bond from Adani Green Energy. The key concern remains with Adani Green Energy, which has a $1.1bn loan maturing in March 2025. This review follows recent allegations against the group in the US, which they have denied. JPMorgan also noted that uncertainty surrounding Adani’s international bonds appears to have settled. As per the report, most Adani entities issuing bonds have significant offshore debt. However, these entities’ secured bonds also have various covenants which offer protection from cash leakage out of project companies. Additionally, overall “cash flow available for distribution has been reasonably strong across the secured bond structures”, the report added. Adani bonds have partially recovered after the initial slump due to the allegations, as seen in chart above

Go back to Latest bond Market News

Related Posts: