This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

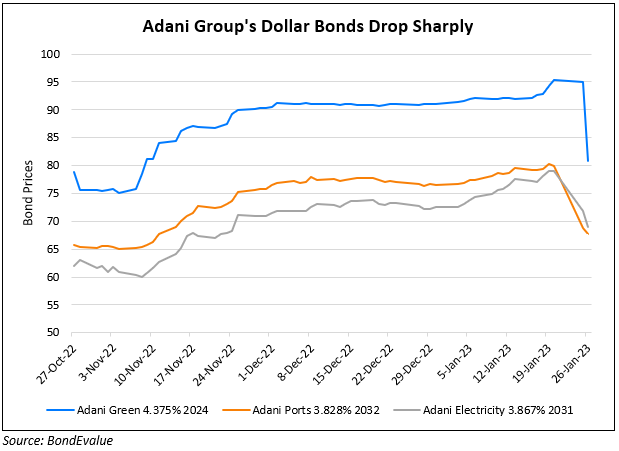

Adani Dollar Bonds Show Recovery after Response to Hindenburg Report

January 27, 2023

Adani Group responded to Hindenburg Research’s note with its dollar bonds recovering by ~5%. Adani Group dismissed the claims as baseless, saying that it was timed to damage its reputation ahead of the planned $2.5bn share issuance of Adani Enterprises. Besides, it added, “We are evaluating the relevant provisions under U.S. and Indian laws for remedial and punitive action against Hindenburg Research”… The report has “adversely affected the Adani Group, our shareholders and investors. The volatility in Indian stock markets created by the report is of great concern”

Retorting to Adani Group’s response, Hindenburg Research said, that they would “welcome” threats of legal action, adding that they fully stood by their report and believed that any legal action taken would be “meritless”. Further, Hindenburg added, “If Adani is serious, it should also file suit in the U.S. where we operate. We have a long list of documents we would demand in a legal discovery process”

Adani Ports’ USD 3.1% 2031s were up 5.9% to trade at 69.79, yielding 8.35%.

Adani Green’s USD 4.375% 2024s were up 5.6% to trade at 85.44, yielding 5.63%.

Go back to Latest bond Market News

Related Posts: