This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

January 2023: Easing Inflation Triggers Rally in Bonds with 92% of Dollar Bonds in the Green

February 1, 2023

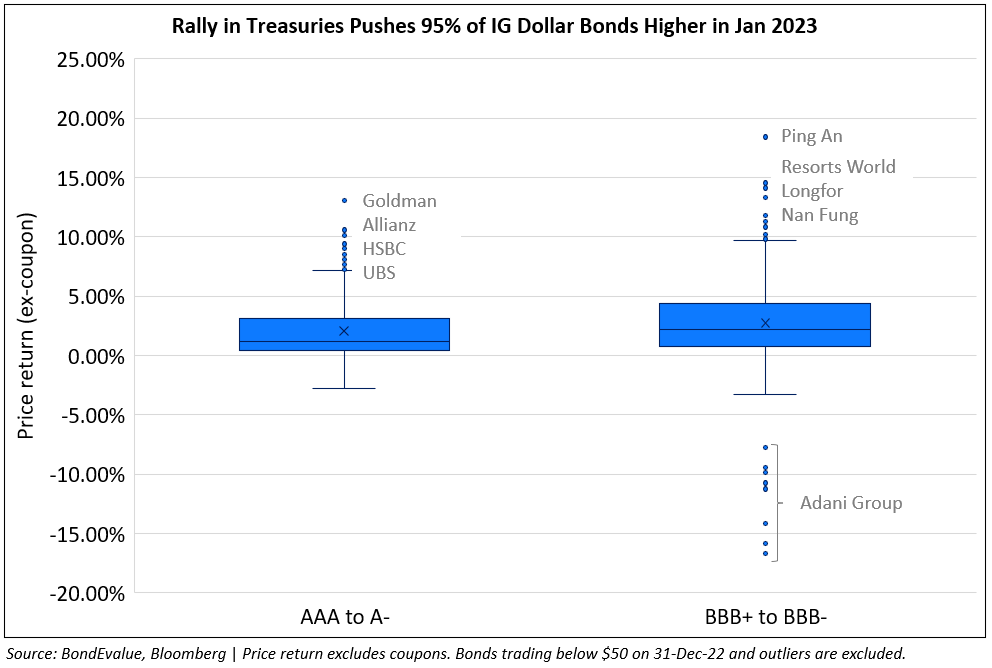

The month of January saw a massive turnaround in fortunes for bond investors as 92% of dollar bonds in our universe delivered a positive price return (ex-coupon), owing largely to the fall in benchmark yields. This comes after a 10-month-long losing streak until November last year. In January, 95% of all Investment Grade (IG) dollar bonds in our universe ended the month in the green, outperforming the High Yield (HY) segment that saw 87% of dollar bonds in the green. Looking at returns of indices, the LatAm IG bond index delivered a 5.4% total return, followed by the US IG bond index that gave a 4% return in January. These were followed by the EM dollar bond index that saw a 3.2% return and the US HY index that saw 2.2% return.

Benchmark yields shifted lower across the board as inflation slowed, coupled with a softening in wage inflation. While US Non-Farm Payrolls came at 223k for December, higher than the surveyed 202k, the Average Hourly Earnings YoY fell to 4.6%, lower than the surveyed 5% and last month’s revised 4.8% print. Later in the month, CPI inflation came at 6.5% for December, in-line with expectations of 6.5% and lower than last month’s 7.1% print. Core CPI also came in-line with estimates at 5.7% and lower than last month’s 6% print. On the back of the softening in price pressures, some Fed speakers indicated that the extent to which policy rates may have to be hiked would be lesser than earlier thought – essentially pointing towards a slower rate hiking path. This saw a rally in US Treasuries, pushing yields lower by over 30bp from the 5Y segment with a risk-on rally across equity and credit markets.

The move lower across benchmark yields especially saw IG bonds outperform due to its greater duration sensitivity. Among the largest gainers in the IG space were bonds of insurance company Ping An and casino operator Resorts World, besides real estate companies like Longfor and Nan Fung. The most notable losses across the IG space were dollar bonds of Adani Group that made headlines after falling by over 15-20% on the back of short-seller Hindenburg Research's report asserting that the group was involved in fraud and stock manipulation.

Asia ex-Japan IG dollar bonds saw their second best monthly returns since 2009, going up 2.55%, with their best returns seen in November 2022 at 3.85%. Given the higher duration sensitivity of IG bonds, the strong performance comes on the back of a move lower across the US Treasury curve with yields cooling-off by over 30bp during the month.

Issuance Volumes

Primary bond markets saw a surge in issuance volumes during the beginning of the year where deals surged. During the first week of January, global dollar deals totaled $103.8bn, over 5% of the total deals in 2022. During the entire month, global corporate dollar bond issuances stood at $269.9bn, up 5.8x from December's $39.6bn in issuances, and lower by 10% YoY. January saw the highest monthly issuance since March 2022 that witnessed $300mn in deals. 90% of the issuance volumes came from IG issuers with HY issuers taking the remainder.

Asia ex-Japan & Middle East G3 issuances stood at just $44.4bn, up 9.5x MoM and down 3% YoY. HY issuances were at the highest since December 2021, standing at $4.6bn while IG issuances stood at $39.4bn, the highest since January 2022 which stood at $3.1bn. The issuance volume from the region was the highest since January last year which saw only $45.7bn in deals.

Largest Deals

The largest deals in January 2023 were led by banks with Morgan Stanley’s $6bn three-trancher, Banco Santander raising €5bn via a three-trancher, US Bancorp’s $3.65bn two-trancher and Deutsche Bank’s ~$3.1bn equivalent multi-currency three-trancher. Besides, other large deals included Regal Rexnord’s $4.75bn four-trancher and Mexico's $4bn dual-trancher amongst others.

In the APAC & Middle East region, the largest deals were led by several large deals by sovereigns - Philippines raised $3bn via a three-trancher, Hong Kong SAR raised $4.3bn via a multi-currency issuance, followed by Indonesia’s $3bn deal. Other large deals included KEXIM and NAB raising $3.5bn via a three-tranche issuance, AAHK and SK Hynix’s $2.5bn three-part deals.

Top Gainers & Losers

The biggest gainer during the month was Jababeka's 6.5% 2023s that rallied 63% towards par after the Indonesian company decided to exercise an optional redemption of the bonds. Majority bondholders consented to swap the bonds for new 2027s whilst also loosening certain covenants in the old bonds, and they were upgraded to CCC+ by Fitch. Besides, several higher-rated Chinese property developers' bonds like Sino-Ocean, GLP China, Jinmao, China SCE, COGARD and other saw their bonds lead the gainers list. First, Beijing's efforts to draft a detailed 21-point plan to help “high quality developers” helped bonds move higher. This was followed by sources saying that Chinese regulators and its biggest bad-debt asset management companies were planning to offer ~RMB 160bn ($24bn) of refinancing support to high-quality developers in 1Q 2023. Also, Vedanta Resources' dollar bonds were also higher during the month after news that it would sell its assets from THL Zinc Ltd. Mauritius to its majority 65% owned unit Hindustan Zinc for $2.98bn in cash. The transaction, coupled with Vedanta Ltd's announcement of an interim dividend of $570mn to its parent was said to help cut its debt.

On the losers list, the most notable were dollar bonds of Adani Group that fell over 15-20% on the back of Hindenburg Research's report asserting that the group was involved in fraud and stock manipulation. The company also took a short position in Adani's dollar bonds. Besides, B2W bonds of Americanas dropped by a massive 74% after accounting “inconsistencies” saw the resignation of its newly appointed CEO. Other losers included Ghana's dollar bonds that fell up to 10% after it suspended interest payments on its on offshore bonds, commercial loans and most bilateral obligations pending an agreement with creditors. Also, Ghana’s terms of restructuring for its local bonds was said to be favoring domestic creditors over its offshore creditors.

Go back to Latest bond Market News

Related Posts: