This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Initial Jobless Claims Rise to 233k; New Issues; Rating Changes

May 10, 2024

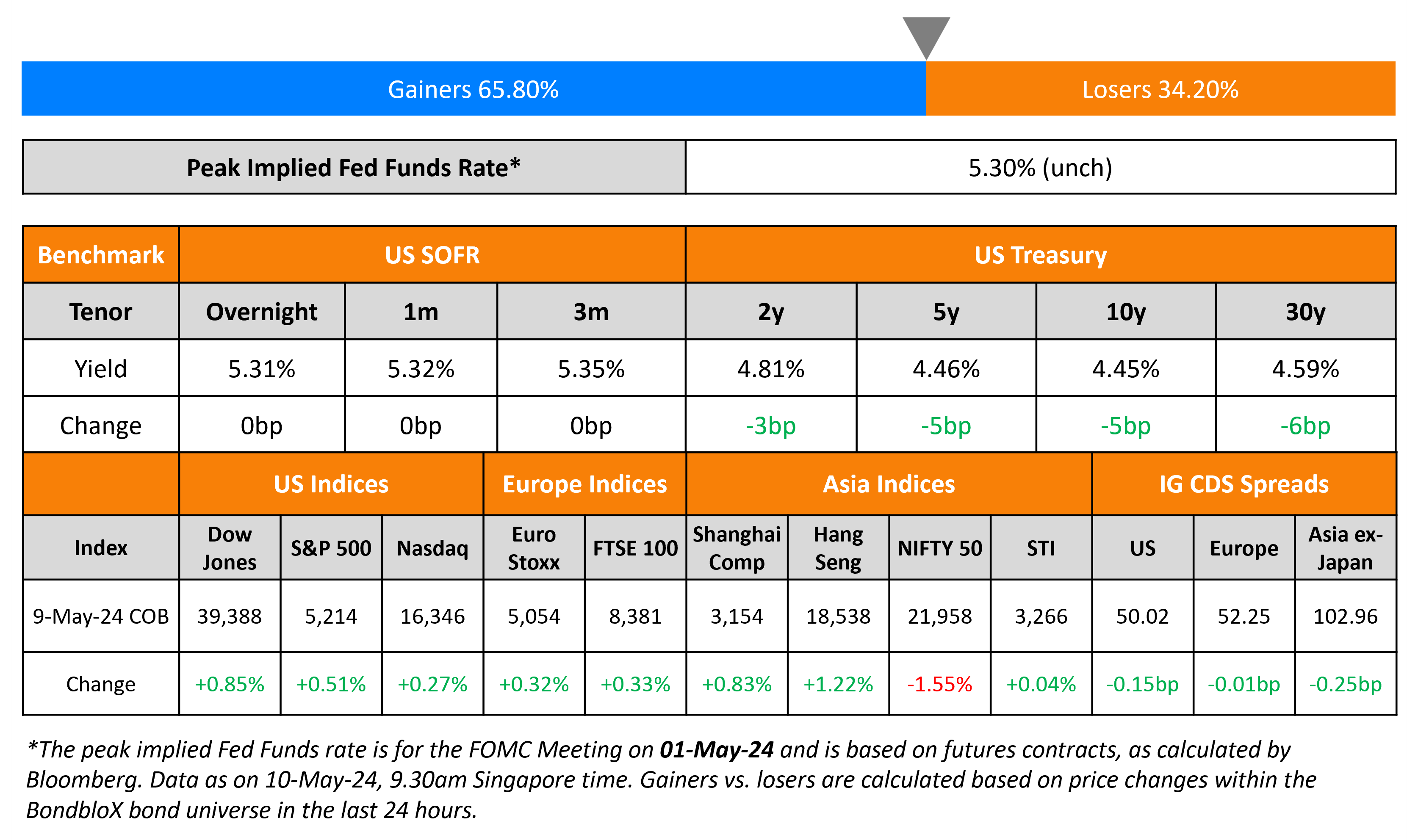

US Treasury yields were 3-5bp lower on Thursday. Initial jobless claims for the previous week rose to its highest in eight months to 233k vs. expectations of 212k with analysts noting that it might indicate some signs of a cooling down in the labor market. San Francisco Fed President Mary Daly said that it might “take more time” for the current rates to bring inflation down. She added that there was “considerable uncertainty” about what the next few inflation readings would be and what the Fed “should do in response”. Regarding the labor market, she said that it was “far too early” to say that it was “fragile or faltering”. S&P and Nasdaq were higher, up by 0.3-0.5%. US IG CDS spreads tightened 0.2bp and HY spreads were 2bp wider.

European equity markets were higher. Europe’s iTraxx main CDS spreads were flat and crossover spreads tightened 0.2bp. Asian equity indices have opened higher this morning. Asia ex-Japan CDS spreads were 0.3bp tighter.

New Bond Issues

- Al Rajhi $ PerpNC5.5 Sust. at 6.875% area

New Bond Pipeline

- SMIC SG Holdings hires for $ bond

- Turk Telekom hires for $ bond

Rating Changes

- Moody’s Ratings upgrades Jordan to Ba3; changes the outlook to stable from positive

- Fitch Downgrades Ardagh Group’s IDR to ‘CCC’

- Moody’s Ratings Affirms Renault’s Ba1 rating, changes outlook to positive

Term of the Day

Hostile Takeover

A hostile takeover is an M&A strategy used by the potential buyer to directly go to the target company’s shareholders by making a tender offer or through a proxy vote. This is in contrast to a friendly takeover wherein, the target company’s board approves of the takeover and recommend shareholders vote in favor of it. Target companies can use anti-takeover strategies like poison pills, golden parachutes etc.

Talking Heads

On Vanguard Joins Pimco in Seeing More BOJ Hikes Than Market

Vanguard Group, Ales Koutny

“We think markets are underpricing the BOJ. For all the noise last week about intervention, we are already above that again… the only way to really get out of that is for Japan to send a fairly hawkish message… once that proper reassessment happens, we would be quite keen to buy JGBs for our portfolios”

On India Index Inclusion on Track, Clients Ready – JPMorgan

“As always, there are still teething issues when entering a new market, however we have found these to be related mostly to the operational readiness and flexibility of counterparties and custodians”… estimates foreign inflows will be between $20-25bn, assuming an index-neutral position

On Top Bond Forecasters Diverge as Fed Keeps the Market in Limbo

Anshul Pradhan, the head of US rates strategy at Barclays

“The US economy is going to be far more resilient than what the consensus is expecting. The progress on inflation is going to be slower”… 10-year yields, currently around 4.5%, will likely push higher — possibly re-testing the 16-year peak of 5%

Stephen Stanley, chief economist at Santander US

“Unless you come to the view that the Fed might actually hike rates, there’s probably not much more of an adjustment that needs to be made”

Top Gainers & Losers- 10-May-24*

Go back to Latest bond Market News

Related Posts:

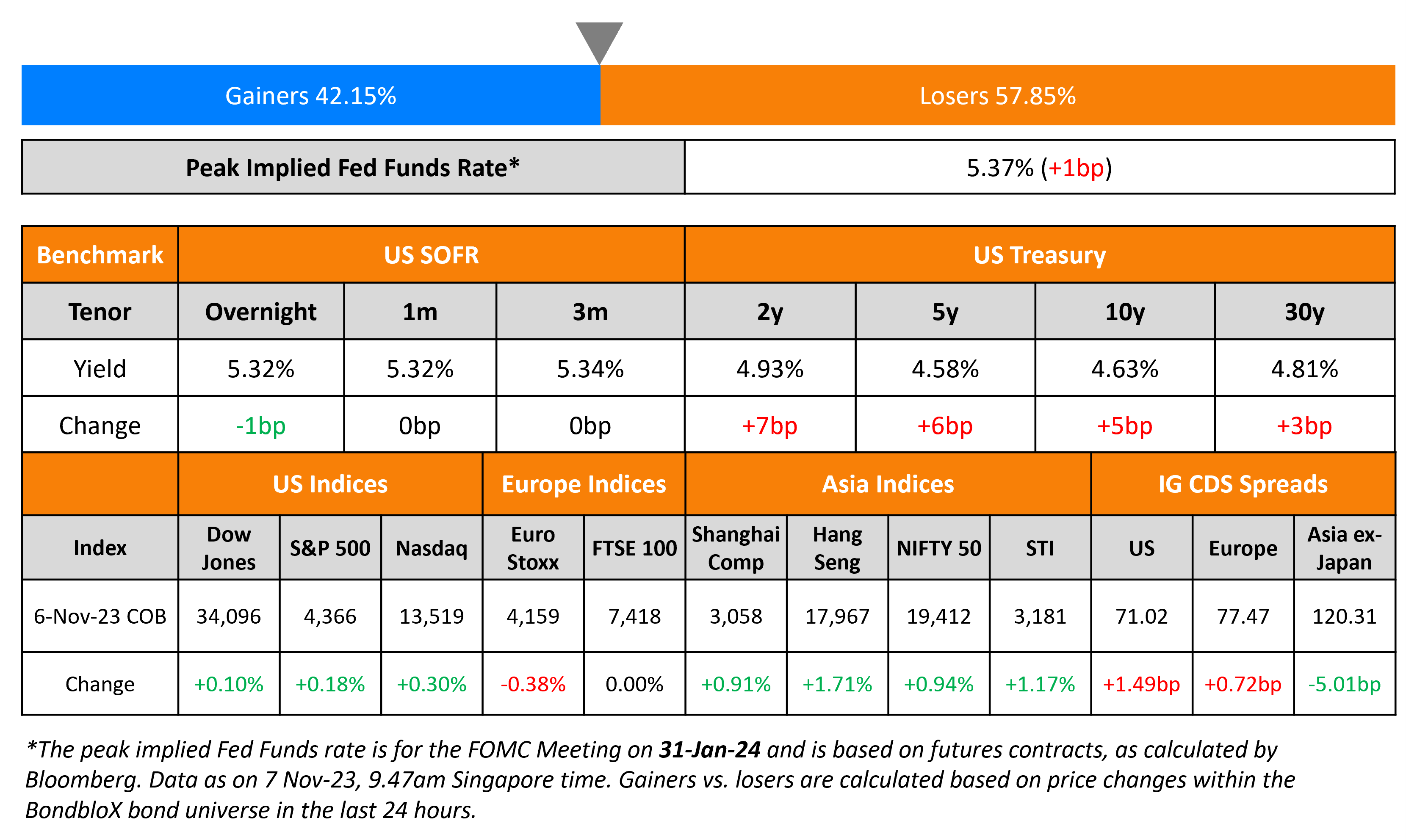

US Treasuries Take a Breather; New Bond Issues; Rating Changes

November 7, 2023