This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

ING, SocGen, Sabadell, Eli Lilly Price Bonds

February 11, 2025

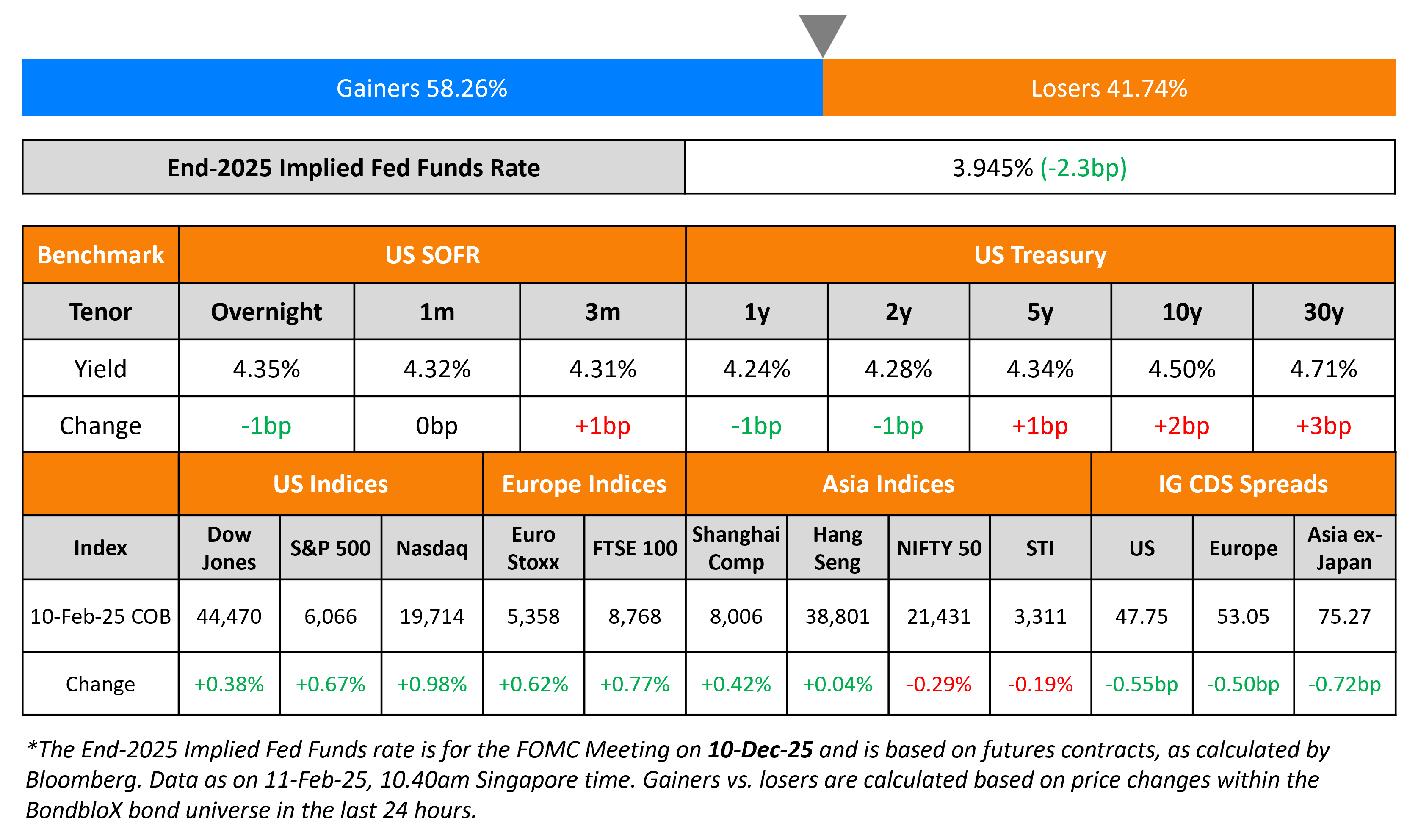

US Treasury yields held steady across the curve, with markets awaiting the inflation print on Wednesday. US President Donald Trump imposed a 25% tariff on steel and aluminum imports from the earlier 10%. He also said that there would be broader reciprocal tariffs. Fed Chairman Jerome Powell begins his two-day testimony to Congress today that will likely include comments about monetary policy and inflation.

US equity markets saw the S&P and Nasdaq rise by 0.7% and 1% respectively. Looking at credit markets, US IG and HY CDS spreads tightened by 0.6bp and 3.2bp respectively. European equity markets were higher too. The iTraxx Main and and Crossover CDS spreads tightened by 0.5bp and 0.8bp respectively. Asian equity markets have opened broadly mixed. Asia ex-Japan CDS spreads were tighter by 0.7bp.

New Bond Issues

- ADCB $ 5Y FRN Formosa at SOFR+105bp

ING Groep raised €2.75bn via a two-tranche deal. It raised €1.25bn via a 6.5NC5.5 bond at a yield of 3.124%, 33bp inside initial guidance of MS+125bp area. It also raised €1.5bn via a 11.5NC10.5 bond at a yield of 3.502%, 30bp inside initial guidance of MS+150bp area. The senior unsecured notes are rated Baa1/A-/A+.

SocGen raised €1bn via a 10.25NC5.25 Tier 2 bond at a yield of 3.84%, ~42.5bp inside initial guidance of MS+205/210bp. The subordinated bonds are rated Baa3/BB-/BBB.

Sabadell raised €500mn via a 8NC7 bond at a yield of 3.486%, 35bp inside initial guidance of MS+160bp area. The senior non-preferred bonds are rated BBB-/BBB+ (S&P/Fitch). Proceeds will be used for general corporate purposes.

Eli Lilly raised $6.5bn via a six-trancher. Details are given in the table below:

Term of the Day: Mid-Swaps

Mid-Swaps are essentially the mid-rate or the average of the bid-ask rates on a swap corresponding to the maturity of the bond. Whilst bonds are generally priced as a spread over Treasuries, some issuers price them over the Mid-Swaps rate. Many euro denominated bonds are priced as a spread over the Mid-Swaps rate. The ‘swap rate’ is essentially the fixed-rate that the receiver gets in exchange for paying the floating rate in a Swap contract with the Mid-Swaps being the average of the bid-ask swap rates.

Talking Heads

On EM Risk Spread Falling to Lowest Level Since Covid Surge

Anders Faergemann, Pinebridge Investments

“Sovereign high-yield has been a big factor in the spread compression… debt restructuring names have provided the bulk of returns… EM fundamentals have improved, the Fed has lowered interest rates, and most EM sovereign high-yield names have market access… platform for EM HY to perform well as long as US HY spreads remain tight”

On Bond Market Inflation Gauge Pressured Over Trump Tariff Turmoil

Steven Zeng, Deutsche Bank

Move in breakevens suggests that “tariffs would have a near-term price shock, but shouldn’t unanchor long-term inflation expectations”

On Disinflation on Track But Trade Poses Risks – ECB President, Christine Lagarde

“The disinflation process in the euro area is well on track. Greater friction in global trade would make the euro area inflation outlook more uncertain”

Top Gainers and Losers- 11-February-25*

Go back to Latest bond Market News

Related Posts: