This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Indian State-Owned Issuers Set to Tap Dollar Bond Markets Led by SBI

April 26, 2023

Indian state-owned issuers led by State Bank of India (SBI) are planning to tap dollar bond markets over the upcoming weeks. SBI has already appointed six banks to arrange investor calls for a likely 5Y issuance, via its London branch. Besides SBI, Indian Railway Finance Corp (IRFC), Indian Oil Corp (IOC) and Bank of Baroda (BoB) are also exploring potential dollar bond issuances. IRFC is likely to launch its deal in the upcoming weeks followed by BoB and then IOC in June, as per IFR. BoB has recently received board approval to raise up to $1bn from foreign currency bonds.

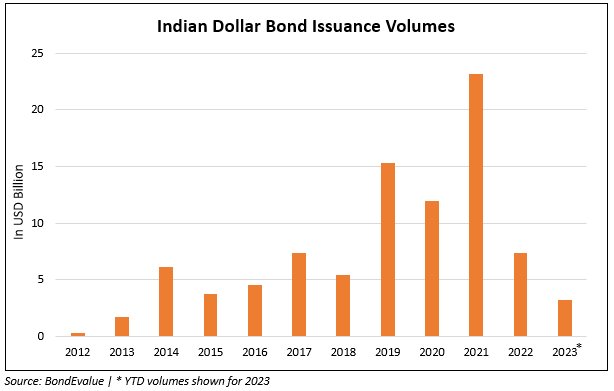

This comes after REC’s dollar bond issuance earlier this month where it raised $750m via 5Y green bond at a yield of 5.625%. Bankers noted there is decent demand for Indian bonds in the offshore market given a lack of supply in the past year. Indian issuers issued only $7.4bn in dollar deals last year as compared to $23.2bn a year prior to that. Issuers from India have already raised $3.2bn via new dollar deals this year.

Go back to Latest bond Market News

Related Posts: