This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

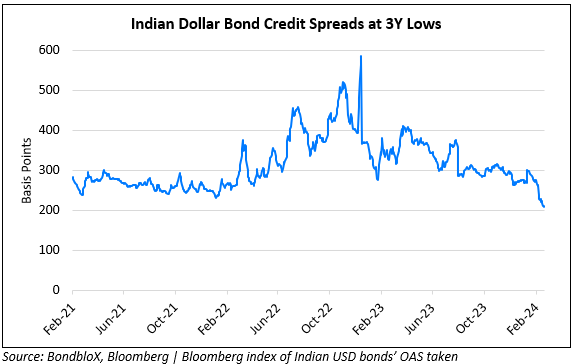

Indian Dollar Bond Spreads Tighten to 3Y Lows Led by HY

February 21, 2024

Credit spreads of Indian corporate dollar bonds have compressed over the past year and currently stands at 3Y lows of ~209bp as seen in the chart above. The tightening in spreads comes after the broad easing in pressures in Adani Group companies’ dollar bonds over the past year after the spike up post Hindenburg’s allegations.

Whilst Adani bonds have tightened, credit spreads on Indian High Yield (HY) corporate dollar bonds have also driven the broad tightening seen in this space. This is led by the tightening in the dollar bonds of Vedanta, Azure Power, India Clean Energy, Greenko and others as seen in the table below. Click on the table below to view the interactive table with entire list of bonds along with the change in Z-Spreads.

As seen in the animated chart below, Z-Spreads of Indian dollar bonds have compressed from its levels seen in January 2023. To view the individual bonds, pause the chart (top left) and hover over the dots.

Go back to Latest bond Market News

Related Posts: