This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

IMF Plans New Loan Program Discussion with Senegal

July 25, 2025

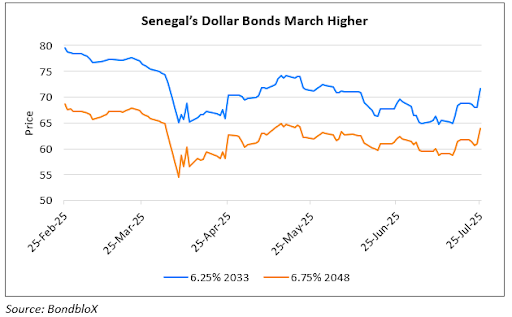

The IMF is planning to send a mission to Senegal in August to address billions in hidden debts uncovered under the previous administration and to begin discussions on a new loan program. Following the news, Senegal’s bonds rose sharply as seen in the chart above. Senegal’s hidden debt is estimated at $11.3bn by end-2023 as per the IMF, with other estimates at around $13bn. As Reuters notes, the scale of Senegal’s hidden debts makes it significantly larger than Mozambique’s $3bn “tuna bond” scandal. The IMF, which froze its previous loan program, needs more data and agreement on corrective measures before its board can decide whether to grant a misreporting waiver or require Senegal to repay previous disbursements. An agreement could be reached in the coming weeks, potentially enabling Senegal to negotiate a new IMF program. The IMF is also conducting an internal review to understand how the hidden debts went undetected. Senegal was downgraded by S&P last week to B- due to mounting financing needs.

For more details, click here.

Go back to Latest bond Market News

Related Posts: