This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Senegal Downgraded to B- on Worsening Debt and Financing Pressures; Outlook Negative

July 15, 2025

Senegal’s sovereign rating has been cut to B- from B by S&P with a negative outlook, reflecting a sharp deterioration in its fiscal position and mounting financing needs. The downgrade follows a government audit that revised Senegal’s 2024 debt-to-GDP ratio to 118% vs the previously reported 104%. This was the highest among African sovereigns in the B rating. The new data released in the 2025-27 budget program reveals nearly XOF 8.3tn ($13bn) in additional debt, mostly external, which equates to 41% of GDP. The 2025 budget also signals higher financing needs of about $10.2bn or 26% of GDP. S&P expects Senegal’s debt-to-GDP to remain high at about 110% by end-2028.

Negotiations with the IMF are expected to take longer as they review the newly audited figures, potentially delaying multilateral disbursements. While Senegal has secured some funding from the World Bank, BADEA and the Trade & Development Bank, access to broader financing hinges on an IMF agreement.

Senegal’s 5.25% 2033s are down by 0.2 points at 65, yielding 14.51%.

For more details, click here.

Go back to Latest bond Market News

Related Posts:

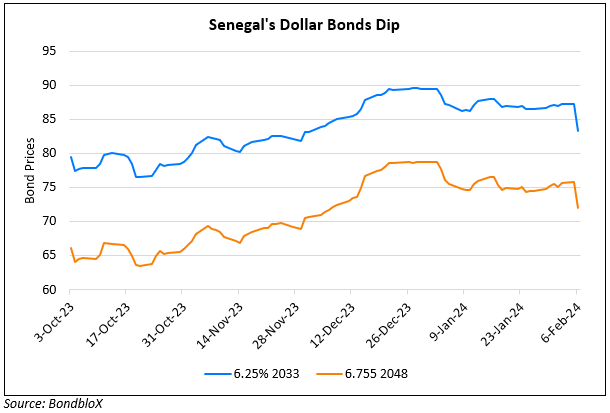

Senegal’s Dollar Bonds Drop 4 Points on Election Postponement

February 6, 2024

Senegal’s Dollar Bonds Trend Higher on Political Developments

September 11, 2024