This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

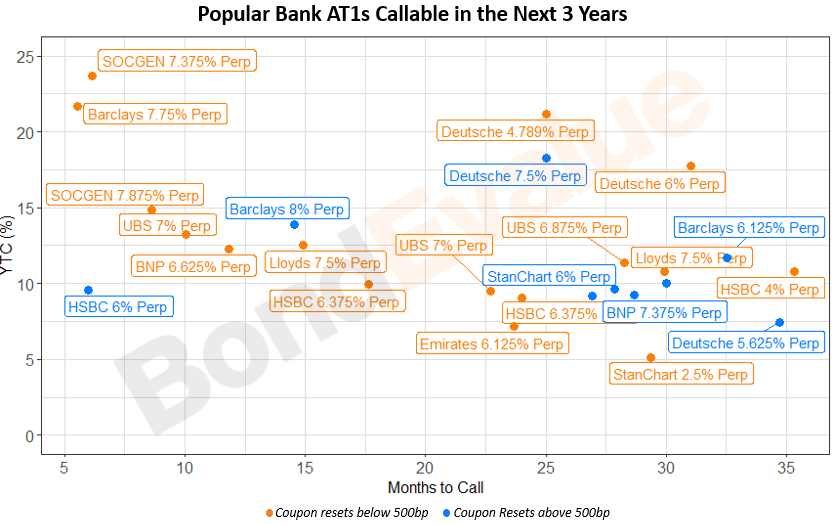

IG Rated Bank Bonds Turn Attractive Amid the Move Higher in Interest Rates

With the ‘higher for longer’ theme that has taken over in the markets, interest rates across the yield curve have risen significantly. For instance, since the beginning of the month, the US 5Y and 10Y treasury yields have jumped 25bp and 38bp. Given the push higher in treasury yields, yields on investment grade (IG) dollar bonds have also moved higher with the average US IG yield touching 6.43%, its highest since 2009. This is over 100bp higher than 5.42%, levels seen at the start of the year. Analysts have noted that investors have developed a preference for IG bonds with a view to lock-in yields for longer whilst minimizing default risk, as rates rise and affect refinancing costs. Besides, higher interest rates could be a tailwind for the banking sector in particular. Given that banks typically borrow for the short-term and lend for the long-term, the recent steepening of the yield curve could also see banks improve net interest margins.

We have thus put together a series of interactive charts that plot IG-rated dollar bonds from popular banks – AT1s, Tier 2s and senior notes. For each chart, we have plotted the bonds’ yield vs. its maturity / next call date. In the charts below, you can hover over each bond for more details like the price, yield, duration, rating, coupon reset and more.

To trade some of these bonds on the BondbloX Bond Exchange, click here

Disclaimer:

The information in this article are solely for general information reference purposes only. They are not intended to, nor shall they constitute an offer or inducement or a recommendation to sell, a solicitation of an offer to buy or an offer to purchase any securities, nor should it be deemed to be an offer, or a solicitation of an offer, or an inducement, or a recommendation, to purchase or sell any investment product or service or engage in any investment strategy. The business of investing is a complicated matter that requires serious financial due diligence for each investment. No representation whatsoever on the suitability or otherwise of any securities, products, or services for any particular investor is made or implied. Each investor is solely responsible for its own independent investment decision based on its personal investment objectives, financial circumstances and risk tolerance, and should seek its own independent legal, tax and other professional advice prior to any investment decision.

Go back to Latest bond Market News

Related Posts:

Finding Value in Popular Bank AT1 & Tier 2 Bonds

April 5, 2023

Non-Call Risk in Focus as Bank AT1s Approach Call Date

April 19, 2023