This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Huarong Wires Funds to Repay $300mn Bond

May 19, 2021

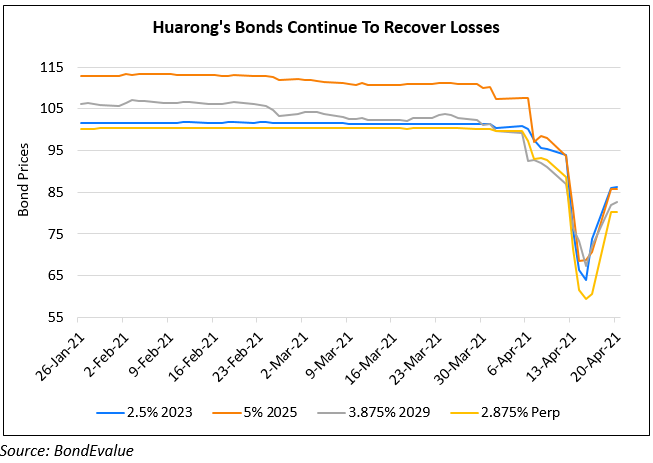

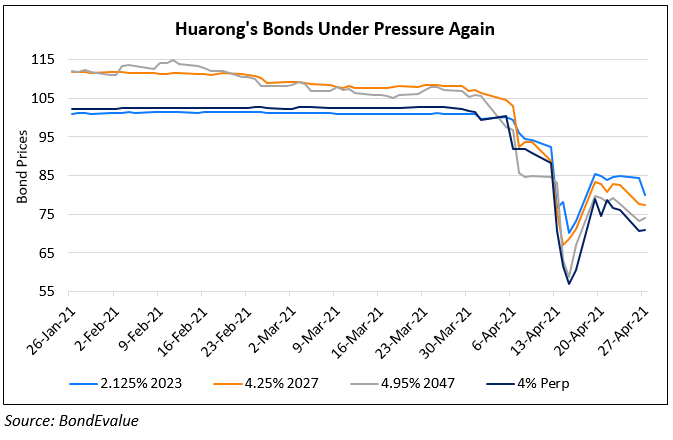

Embattled bad debt manager, China Huarong Asset Management has provided some relief to its creditors after it wired $300mn to pay its 3.3% 2021’s due on Thursday. The company, one of the four biggest distressed asset management firms in China, was reported to have secured adequate funding to last it till August which would allow it to bridge the gap caused due to the delayed FY2020 results. The interim relief is important for the company as it has notes worth $6.5bn due this year. The company has successfully managed to pay its bondholders till now. Before the current transfer, it had repaid its S$600mn bonds due April 27 with funds provided by ICBC. Despite the bond payments, the investors continue to watch the company closely as its financial statements for 2020 are yet to be released and the level of support it receives from the Chinese government is still not clear. The longer dated bonds continued the slide after the New York Times reported that Huarong’s bondholders could face significant losses on their investments as the Chinese government is in the early stage of planning a reorganisation.

China Huarong’s 3.25% 2021s and 1.375% 2021s were up 0.34 and 0.53 to trade at 99 and 97.25 as these pull to par. However, the other bonds continued to trade at distressed levels and were down ~5%. Its 4.25% 2027s and 5.5% 2047s were down 4.75 and 4.38 to trade at 66.25 and 62.25 cents on the dollar.

Go back to Latest bond Market News

Related Posts: