This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

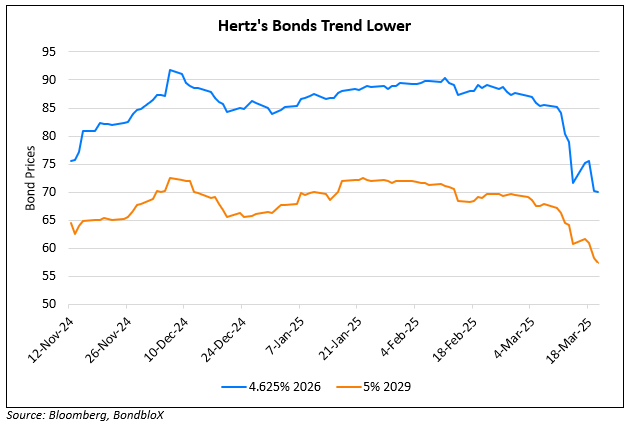

Hertz’s Bonds Rise after Reporting First Quarterly Profit in Nearly 2 Years

November 5, 2025

Hertz swung to a quarterly profit after nearly two years, a significant turnaround that saw its bonds rally by 2-4 points and its shares skyrocket by 42%. The profitability was largely driven by strong performance in used vehicle sales and the strategic advantage of maintaining a newer rental car fleet, which helped boost demand. Hertz reported adjusted earnings of $0.12/share, significantly exceeding the average estimate of just $0.02/share. While overall quarterly revenue saw a 4% YoY drop, the $2.5bn total still managed to surpass estimates of $2.4bn. The shift in profitability is closely linked to the company’s efforts to diversify and revamp its operations. The positive result follows a period of substantial operational restructuring where Hertz has been actively reshaping its fleet composition by shedding much of its electric vehicle inventory. This move was made in favor of gas-powered cars, citing a slump in EV rental demand and higher associated repair costs. This strategic fleet change, combined with the launch of a fully online car-buying marketplace, has helped Hertz stabilize its business and capitalize on used car market trends.

Hertz’s 5% 2029s jumped higher by 4.3 points to trade at 71.5, yielding 14.5%.

For more details, click here

Go back to Latest bond Market News

Related Posts: