This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

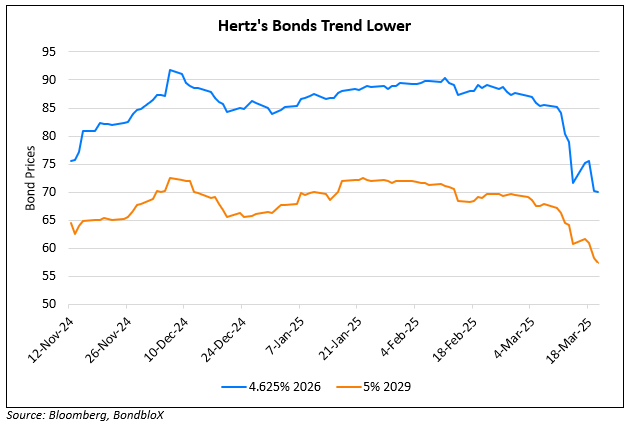

Hertz’s Bonds Tick Lower on Softer Quarterly Results

May 14, 2025

Rental car company Hertz’s bonds were lower by ~1 point after it missed the street’s expectations in its quarterly results. Hertz reported a near 13% drop in revenues to $1.81bn and an adjusted net loss of $1.12/share. Analysts had expected revenues of $2bn and adjusted net loss per share of $0.97/share. Hertz said that the drop in revenues was majorly due to reduced fleet capacity, down by 8% YoY. Besides, the company has also seen a slowing down in demand for bookings from corporate, government and US inbound customers. Late last month, Hertz’s bonds had fallen after news that US President Donald Trump was set to ease the 25% auto tariffs through a new executive order.

Hertz’s 5% 2029s were down 1 point to trade at 67.3 cents on the dollar, yielding 15.2%.

For more details, click here

Go back to Latest bond Market News

Related Posts: