This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Global Markets Sell-off on Tariff Imposition

February 3, 2025

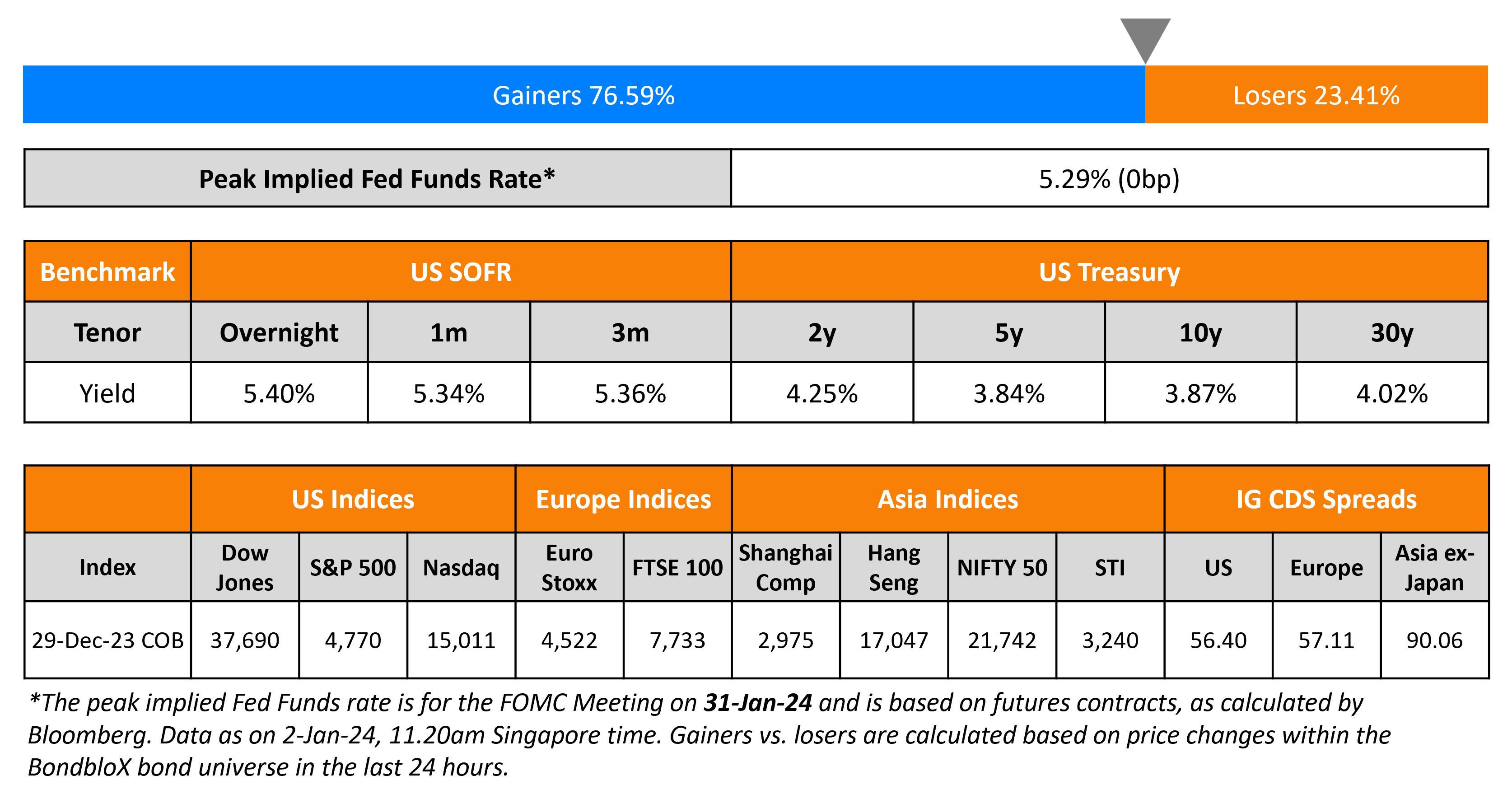

The US Treasury curve bear flattened, with the 2Y yield higher by 3bp, while the 10Y eased marginally by 1bp. US Core PCE YoY in December rose by 2.8%, in-line with expectations. US President Donald Trump imposed a 25% tariff on imports from Canada and Mexico, with an exception of a 10% tariff on Canadian energy. Besides, a 10% additional duty on Chinese products was also imposed, effective February 4.

US equity markets dropped, with the S&P and Nasdaq lower by 0.5% and 0.3% respectively. US IG and HY CDS spreads widened 0.3bp and 3.2bp respectively. However, European equities ended higher. In terms of Europe’s CDS spreads, the iTraxx Main tightened by 0.1bp, while Crossover spreads widened by 1.1bp. Asian equity markets have opened with a sea of red this morning. Asia ex-Japan CDS spreads were 0.8bp wider.

New Bond Issues

Rating Changes

- Various Positive Rating Actions Taken On Greek Banks On Stronger Institutional Framework And Improving Capital Quality

- Brazilian Airline Azul S.A. Upgraded To ‘CCC+’ From ‘SD’ Following Debt Restructuring; Outlook Positive

- Moody’s Ratings takes actions on six Argentinean regional and local governments following sovereign upgrade

- SGL Group Outlook Revised To Stable From Positive On Slower Deleveraging, ‘B’ Rating Affirmed

- Moody’s Ratings changes Albertsons’ outlook to stable from positive; affirms Ba1 CFR

- Moody’s Ratings affirms Mediobanca S.p.A.’s ratings, outlook on issuer and senior unsecured debt ratings changed to negative

Term of the Day: Personal Consumption Expenditures (PCE)

Personal Consumption Expenditures (PCE) is an inflation metric measuring consumer spending on goods and services, released by the US Department of Commerce. The Fed’s preferred measure of inflation is the Core PCE – this refers to the Headline PCE after stripping out two volatile components, namely, food and energy.

The US also publishes another inflation metric, the CPI (Consumer Price Inflation), a key inflation indicator. CPI and PCE differ on four fronts: formula, weight, scope and other factors. As per the BLS, “CPI sources data from consumers, while PCE sources from businesses. The scope effect is a result of the different types of expenditures CPI and PCE track…CPI only tracks out-of-pocket consumer medical expenditures, but PCE also tracks expenditures made for consumers, thus including employer contributions. The implications of these differences are considerable.”

Talking Heads

On Bonds Gaining in January as Trump’s Return Drives Topsy-Turvy Month

Michael de Pass, Citadel Securities

“The near-term and medium-term macro outlook is exceptionally murky given the lack of clarity around policy… e are in a time of great uncertainty and likely high volatility”

George Catrambone, DWS Group

“The bond market is shrugging it off until implementation”

On Dangerous Week on Wall Street Fires Up ‘Diversify Or Else’ Bets

Ayako Yoshioka, Wealth Enhancement Group

“Having the diversification across markets matters”

Michael Sapir, Proshares

“The market always has cycles. Issuers want to be prepared when the market cycle shifts”

Corey Hoffstein, chief investment officer of Newfound

“Continued macro volatility will have investors continuing to evaluate how they want to build resilient portfolios. Diversification isn’t meant to be a crisis or tail hedge: its benefits take time to compound”

On Trump stretching trade law boundaries with Canada, Mexico, China tariffs

Tim Brightbill, Wiley Rein

“The courts have historically upheld the president’s power to take emergency actions, especially when they are related to national security… question is, does that include tariffs, since IEEPA has only been used for sanctions”

Jennifer Hillman, Georgetown University

“At least for me, I don’t think there is such a connection in this case… he tariffs would not be applied only to fentanyl, so there is not a clear reason why tariffs on all goods are ‘necessary'”

Top Gainers and Losers- 3-February-25*

Go back to Latest bond Market News

Related Posts:

ADP Payrolls Softer Than Expected

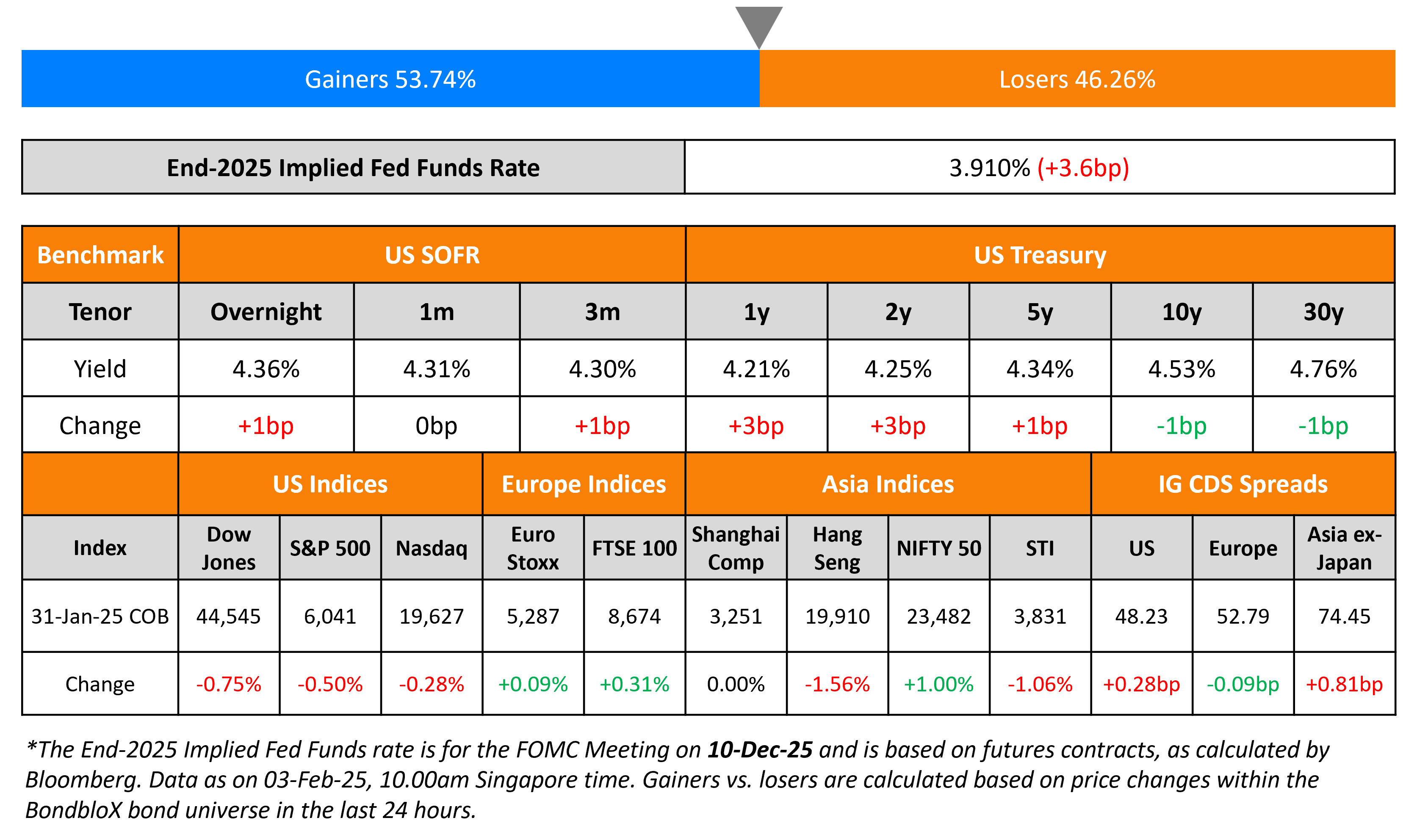

December 7, 2023