This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

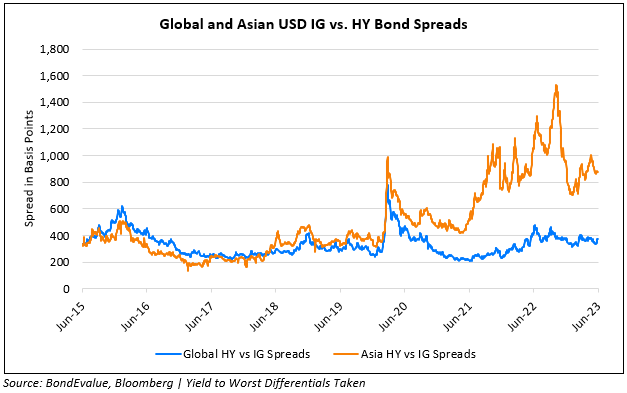

Global HY and IG Bonds’ Spreads Now at Its Tightest since June 2022

June 26, 2023

US Treasury yields are lower by 5-6bp following the uncertainty out of Russia over the weekend. Wagner Group, a Russian private army of soldiers saw its leader Yevgeny Prigozhin stage a mutiny in Russia over the weekend. However, this was later withdrawn after agreeing to a deal with Russian President Vladimir Putin. Markets continue to price in a 25bp hike in July and expect them to stay at that level till the end of the year, as per CME probabilities. The peak Fed Funds rate fell 2bp to 5.32%. US equity indices ended in the red with the S&P and Nasdaq down 0.8% and 1% lower respectively. US IG and HY CDS spreads widened 1.2bp and 11bp respectively.

The spread between Global High Yield and Investment Grade bonds are now at its tightest since June 2022 and also around its 10Y average levels of over 300bp. On the other hand, looking at Asian USD HY vs. IG spreads, the current spread is at 878bp, about 300bp higher than its historical average of 500bp.

European equity indices closed lower with European main and Crossover CDS spreads wider by 1.2bp and 9.5bp. Asia ex-Japan CDS spreads widened by 2bp. Asian equity markets have opened broadly lower this morning to begin the week.

New Bond Issues

- Nonghyup Bank $ 5Y Social at T+135bp area

New Bonds Pipeline

- Petrobras planning $1.5bn 10Y bond

- Mitsubishi hires for $ 5Y bond

- ANZ hires for $ 2Y bond

- KoGas hires for $ bond

Rating Changes

- Fitch Downgrades U.S. Bancorp to ‘A+’; Outlook Stable

- URS Holdco Inc. Downgraded To ‘SD’ On Distressed Exchange; Ratings Subsequently Withdrawn

- Moody’s revises PacifiCorp’s outlook to negative, affirms ratings

Term of the Day

Central Bank Put

Central bank put is a term used by market analysts to denote an insurance measure taken by the central bank to mitigate market and economic volatility. It essentially denotes a central bank policy that is akin to having a put option on the equity market where the buyer is insured against the underlying falling in price. A put option gives the buyer of the option the right but not the obligation to sell the underlying instrument at a particular price known as the strike price at expiration. The term central bank put is thus a play on the term “put option”. A central bank put thereby would prevent the equity market from seeing a sharp drop, providing a backstop to the markets and sustaining prices.

JPMorgan’s head of institutional portfolio strategy Jared Gross says that the fiscal policies taken by governments following the pandemic have acted as a fiscal put, that has replaced the central bank put. For more details, click here

Talking Heads

On the Need for Further Rate Hikes in the US – San Francisco Fed President Mary Daly

“It is, in my judgment, prudent policy… to slow the pace of policy as you near the destination…Right now we are really missing on our price stability goal, and that miss is not trivial…Taking a slower pace as we approach our destination …means we save many Americans from us either stopping short and wishing we had done more, or going too far and wishing we had done less…More tightening may be required to get the economy sustainably back into balance…we are going to have to find the terminal rate by looking at the data…(two further quarter-point rate hikes this year is) a very reasonable projection at this point.”

On Interest Rates and Inflation in the US

Greg Peters, co-CIO at PGIM Fixed Income

“A realization is setting in that the Fed isn’t going to be cutting interest rates this year…It’s a kind of an ‘ah-ha’ moment being priced in by the market that central bankers mean what they say.”

Thierry Wizman, global interest rates and currency strategist at Macquarie

“If you look at some of the indicators of inflation in the US, they are clearly coming down…In the back half of the year you are going to finally see that so-called stickiness we are seeing in (several inflation indices) start to recede and come down. I think the market understands that.”

Jared Gross, head of institutional portfolio strategy at JPMorgan

“Given how far we’ve come, it may make sense to move rates higher but do so at a more moderate pace.”

On ECB’s Interest Rate Decisions in July and Beyond – ECB governing council member Gabriel Makhlouf

“On the evidence that we have at the moment, it does look like, in July, there will be another 25 basis point increase. Some colleagues do feel that we’re likely to need further rises in the autumn. I’m just prepared to look at the evidence…I do feel that we’re near the top of the ladder. Some others may feel we’re further down, but we’ll see.”

On Turkey’s Disappointing Rate Hike

Viktor Szabo, emerging markets investment director at abrdn

“They lost one perfect chance to demonstrate that they mean business…Whether it’s because they have political constraints, or they’re afraid for the banking system, it’s not great. It’s not a great message.”

Eric Fine, portfolio manager of emerging market debt at VanEck

“They look less credible now…They need to hike rates to whatever level prevents the need for currency interventions using reserves. They haven’t.”

Marek Drimal, lead strategist at SocGen

“For now, it’s not enough, probably, for long-term investors. Because of the magnitude of some of the problems in the economy.”

Dan Wood, portfolio manager at William Blair

“I think investor disappointment should be tempered…It is clearly positive that a return to a more orthodox economic policy has been signalled.”

Kaan Nazli, portfolio manager at Neuberger Berman

“I don’t think investors will throw in the towel just yet because I think there is still expectation there is more to come in the coming months…The market is very cautious – so to regain confidence, that will take a long time. I would think that you would need to maintain tight policy for a considerable amount of time for significant, more long-term inflows to come in.”

On a Potential Recession in Europe

Gordon Shannon, portfolio manager at Twentyfour Asset Management

“Data this week has given the recession argument a serious foothold and I’d expect that to continue… Gilt yields are already elevated, and have more potential to rally on recession fear relative to Bunds or to US Treasuries.”

Guillermo Felices, investment strategist at PGIM Limited

“I would expect risky asset markets to start putting more weight on the negative growth implications of tighter monetary policy…That means downward pressure on GBP, despite higher interest rates.”

Van Luu, global head of currencies at Russell Investments

“The global growth cycle is not picking up, but worsening.”

Top Gainers & Losers – 26-June-23*

Other News

CK Asset gets shareholder approval for US$619 million takeover of UK’s Civitas Social Housing

Go back to Latest bond Market News

Related Posts: