This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

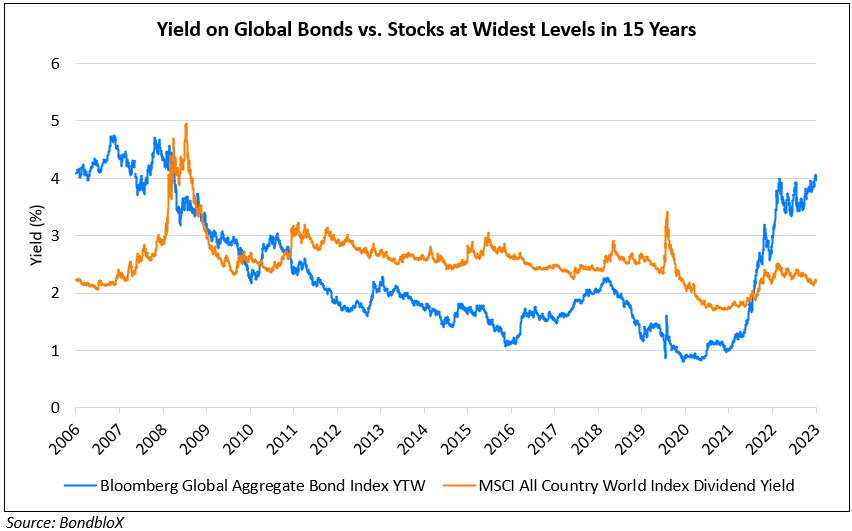

Global Bonds’ Yield Premium Over Stocks at Widest Levels in 15 Years

August 24, 2023

The Treasury curve flattened further on Wednesday with the 2Y down 6bp to hover near the 5% mark while the 10Y yield fell 10bp to 4.20%. US business activity expanded in early August at the weakest pace in six months. The S&P Global Flash Composite PMI fell 1.6 points to 50.4 in August as manufacturing continued to shrink and services activity cooled. US IG credit spreads were tighter by ~3.9bp while HY CDS spreads tightened by 19bp. The S&P jumped higher by 1.1%, its best day since June and the Nasdaq was up 1.6% following bullish earnings from Nvidia.

European equity markets moved higher too. In credit markets, European main CDS spreads were 2.3bp tighter and Crossover CDS tightened 10.6bp. In Europe, private-sector activity shrank at its fastest pace since November 2020, with questions lingering about a possible pause at the ECB’s September meeting. The Flash PMI for the Euro region further contracted to 47.0 from 48.6. Services activity shrank for the first time since end-2022 to 48.3, vs. an estimate of 50.5 (continued expansion). The services sector had until recently seen robust demand. Asia ex-Japan CDS spreads tightened by 5.5bp. Asian equity markets have opened higher this morning.

The yield gap between global bonds and stocks are now at its widest levels in over 15 years where on average, global bonds are offering a 180bp premium over global stocks’ dividend yields. As seen in the chart below, the yield on the Bloomberg Global Aggregate Bond Index is hovering around the 4% mark while the dividend yield on the MSCI All Country World Index is at 2.2%.

New Bond Issues

- Singapore S$2.3-2.8bn Green tap of 2072s at 3.15% area

Rating Changes

- Delta Air Lines Inc. Upgraded To ‘BB+’ From ‘BB’; Outlook Positive

- Fitch Downgrades Country Garden Services to ‘BB+’; Rating on Negative Watch

Term of the Day

Rising Star

Rising stars are companies that have recently seen credit rating upgrades that pull its rating to investment grade category from its previous junk or high yield category. They are termed as rising stars as their financial and/or operational metrics show an improving trend. The opposite of rising stars are fallen angels, which are issuers that have been recently downgraded to junk category from its previous investment grade rating category.

Talking Heads

On Junk Debt Being Pricey and Shorting Making Sense

Barclays strategists led by Bradley Rogoff

The combination of deteriorating corporate performance plus low risk premiums means it makes sense to look at betting against high yield now.

Christian Hoffmann, PM at Thornburg Investment Management

“You are seeing a deterioration in high frequency data, from consumers to default rates, and there’s a reasonable argument that earnings peaked and things get more challenging from here. If you are putting on a CDS trade, you can get decent liquidity in hopes spread widen.”

On Inflation-Linked Treasuries Facing Key Test After Bruising Month

Michael Pond, head of global inflation-linked research at Barclays

“Flows have been consistently negative for the past year. Retail investors have learned that a one- to 30-year TIPS bond fund is a duration fund and not an inflation fund”

Edward Acton, a strategist at Citigroup

“If the sale does go well, I think it will likely represent a turning point for the medium-term, with valuations in the back-end historically attractive”

On China’s LGFV Insiders Say $9tn Debt Problem Is Worsening

Logan Wright, director of China markets research at Rhodium Group

“The most important variable impacting China’s economic growth over the next two years will be the success or failure of local government debt restructuring… collapse in local government investment would be comparable to the economic impact of the crisis in the property market”

On Strong US data making ‘reacceleration scenario’ possible – Richmond Fed President Thomas Barkin

“The reacceleration scenario has come onto the table in a way that it really wasn’t three or four months ago… “If I got convinced that inflation was remaining high and demand was giving no signal that inflation was going to come down, that would make the case”

Top Gainers & Losers- 24-August-23*

Go back to Latest bond Market News

Related Posts:

1, 2, 3, 4th Fed Hike!

June 14, 2017

Fed Survey Results Supportive of Funds Flow into Bonds

September 10, 2017