This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Fitch and Moody’s Sound Warning on Pakistan Despite IMF Deal

July 4, 2023

Rating agencies Fitch and Moody’s sounded a warning on Pakistan despite its recent eleventh hour $3bn standby aid with the IMF. While it has agreed on the deal with the IMF, the rating agencies note that Pakistan has $25bn in debt repayments over the next twelve months. Fitch said that Pakistan would need “significant additional financing besides the IMF disbursements to meet its debt maturities and finance an economic recovery”. Further it warned that if its current account deficit widened again, then it would raise risks about the financing being insufficient. Moody’s analyst Grace Lim said that it was “uncertain that the Pakistani government will be able to secure full $3 billion of IMF financing during the nine-month stand-by arrangement program”. She added that Pakistan’s ability to secure loans from other bilateral/multilateral lenders continually over the longer-term would be “severely constrained” unless they join a new program with the IMF.

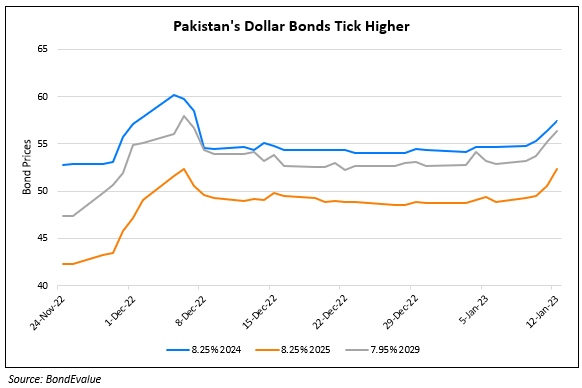

Pakistan’s dollar bonds continued to move higher by over 1.2 points continuing the rally to trade at over 47 cents on the dollar following the IMF’s aid to the nation.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Pakistan Downgraded to Caa1

October 7, 2022