This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Fantasia Reports 1H Earnings, 2022s-2024s Trend Lower

August 30, 2021

Chinese real estate developer Fantasia Holdings Group reported 1H earnings last week with revenues rising by 18.5% YoY to RMB 10.952bn ($1.69bn), net profit up 9.5% to RMB 303mn ($46.86mn) and contracted sales up 60.1% to RMB 28.117bn ($4.35bn). However, total borrowings were higher by 50.5% at RMB 16.85bn ($2.61bn) vs. RMB 11.196bn ($1.73bn) as of December 31, 2020. Fantasia’s total bank balances and cash stood at RMB 31.583bn ($4.88bn), up 10.3% from RMB 28.631bn ($4.43bn) six months prior. Its net gearing ratio (net debt to equity) stood relatively unchanged at 74.8%. Fantasia’s Board did not recommend any interim dividend payments for 1H, in a similar approach taken for the same period last year.

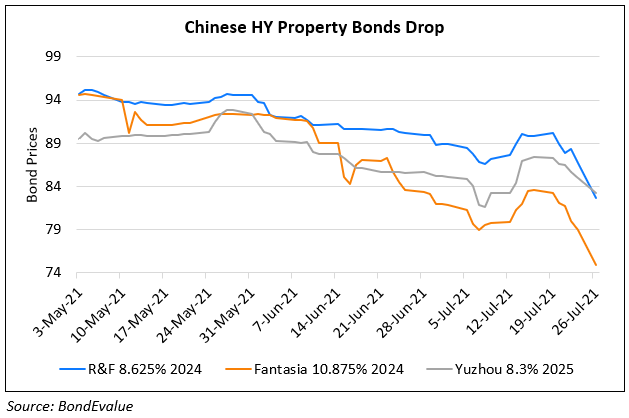

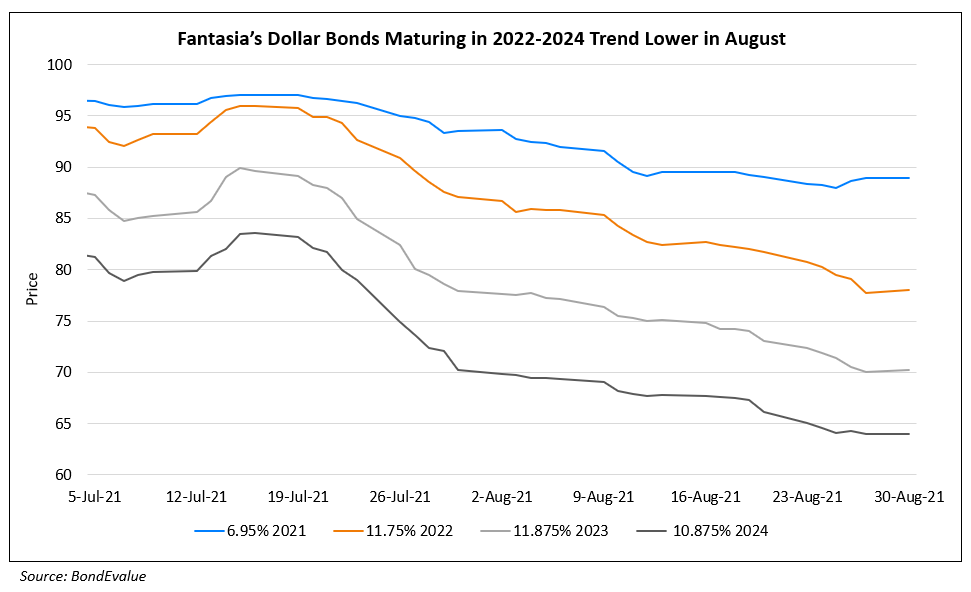

Fantasia’s dollar bonds maturing this year rose after the earnings release with its 7.375% 2021s and 6.95% 2021s up 0.3% and 1% since Wednesday to 96.94 and 88.94, yielding 40.8% and 51.7% respectively. However, its 11.75% 2022s and 11.875% 2023s trended lower by ~1.5% to 78 and 70.25, yielding 58.1% and 35% respectively. According to Bloomberg, while its earnings report showed a sufficient cash position, the divergence between the short-term and longer-dated bonds implies “potentially higher borrowing costs if Fantasia wants to return to the offshore bond market”. Last month, Moody’s and Fitch had revised the outlook for Fantasia to negative on accounts of its reliance on dollar funding despite having sufficient cash. Fantasia is currently rated B2/B/B+.

To read the full earnings report, click here

Go back to Latest bond Market News

Related Posts: