This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

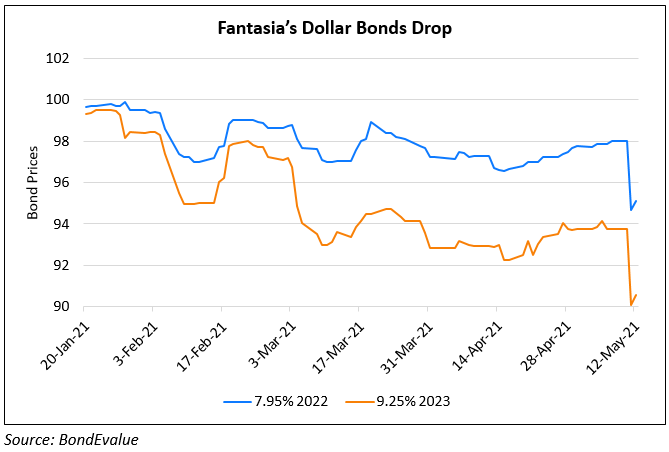

Fantasia Launches Exchange Offer

May 20, 2021

Chinese property developer Fantasia Holding Group has launched a tender offer of up to $100mn for its $500mn 7.375% 2021s. According to IFR, Fantasia is offering cash of $1,000 for every $1,000 in principal amount, plus accrued and unpaid interest for its bonds due in October with a tender deadline of May 28. The results of the tender are expected on June 1. The company is in the process of managing its balance sheet liabilities and optimizing its debt structure and had purchased $8.2mn in principal amount of its offshore bonds earlier in the month from the open market. The offer would be financed from internal resources. UBS and BNP Paribas are the joint deal managers and DF King is the information tender agent.

Fantasia’s 7.375% 2021 yielding 11.58% were down 0.05 to trade at 97.77.

For the full story, click here

Go back to Latest bond Market News

Related Posts: