This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Evergrande Bonds’ Short Bets Double; Bonds Inch Up

August 5, 2021

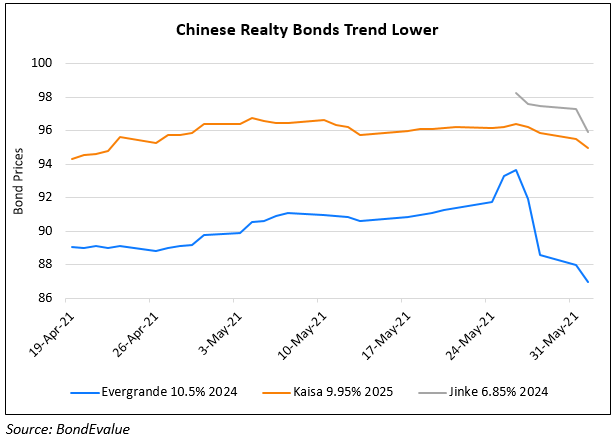

Short sellers more than doubled their bets on the fall of Evergrande’s bonds as per data from Markit. FT notes, “The face value of Evergrande bonds that have been lent out to other investors has risen close to $400mn, more than twice what it was at the start of June…Almost $170m of the company’s $2bn bond that matures in 2022 is out on loan, up from $50m at the start of the year.” Evergrande which makes up 6% of the Bloomberg Barclays Asia HY Index has seen its bonds tumble over 50% in the recently concluded quarter. Whilst bets have increased on Evergrande’s bonds’ fall, it is not the only developer that has seen short interest. FT reports that peers Yuzhou’s and Shimao’s bonds that have been lent are up from less than $200mn since May-end to $280mn and over $400mn respectively this month. Barclays notes that property developers’ bonds have been hurt this year with Chinese developers’ bonds losing 13% on average vs. 2.7% for Asian HY, requiring investors to rethink their view of the sector.

Evergrande’s bonds inched were higher – its 13% 2022s and 13.75% 2023s were up 1 point each to 46.9 and 43.8.

Petrobras bonds were slightly up with its 6.25% 2024s up 0.39 to 112.675, yielding 1.29%

For the full story, click here

Go back to Latest bond Market News

Related Posts: