This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Evergrande Downgraded Two Notches to CCC+ by Fitch following S&P

July 29, 2021

Fitch downgraded Evergrande and its subsidiaries Hengda and Tianji by two notches to CCC+ from B citing diminishing margin of safety in preserving liquidity. Fitch notes that Evergrande’s liquidity is fragile with heavy reliance on renewing short-term banking facilities and trust loans. Further, the rating agency says that any adverse changes to Evergrande’s continued access to trade payables and current robust contracted sales would negatively impact its ability to generate cash flow. However, recent negative news such as China Guangfa Bank’s freeze on deposits and top HK banks deciding against providing mortgage loans may affect stakeholders’ confidence and put pressure on liquidity. Besides, limited capital market access also adds pressure on liquidity. While Evergrande is trying to shrink its balance sheet, it has large trade payables and is subject to execution risk and could damage its business profile over the medium term. Fitch also notes that any material weakening of contracted sales or cash collection could significantly affect the company’s ability to service short-term debt. Adding to this is the pressure to meet the three red lines policy which is also weighing on the developer. The rating downgrade follows S&P’s two notch downgrade to B, earlier this week.

In related news, Evergrande and its Anhui-based unit were sued by Huaibei Mining over a CNY 401.3mn ($62mn) missed payment that is due according to a statement. Huaibei Mining said that the court accepted the lawsuit.

Evergrande’s dollar bonds were lower with most of its bonds now trading below 50 cents on the dollar. Its 12% 2023s are at 48.1 and its 10.5% 2024s are at 46.3, both down over half a point today.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

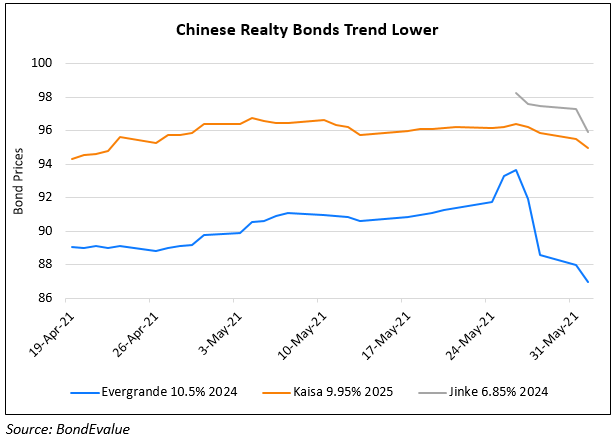

China Property Developers’ Bonds Trend Lower

June 1, 2021

Evergrande Downgraded by Moody’s to B2

July 1, 2021