This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Eurozone PMIs Continue to Contract

November 24, 2023

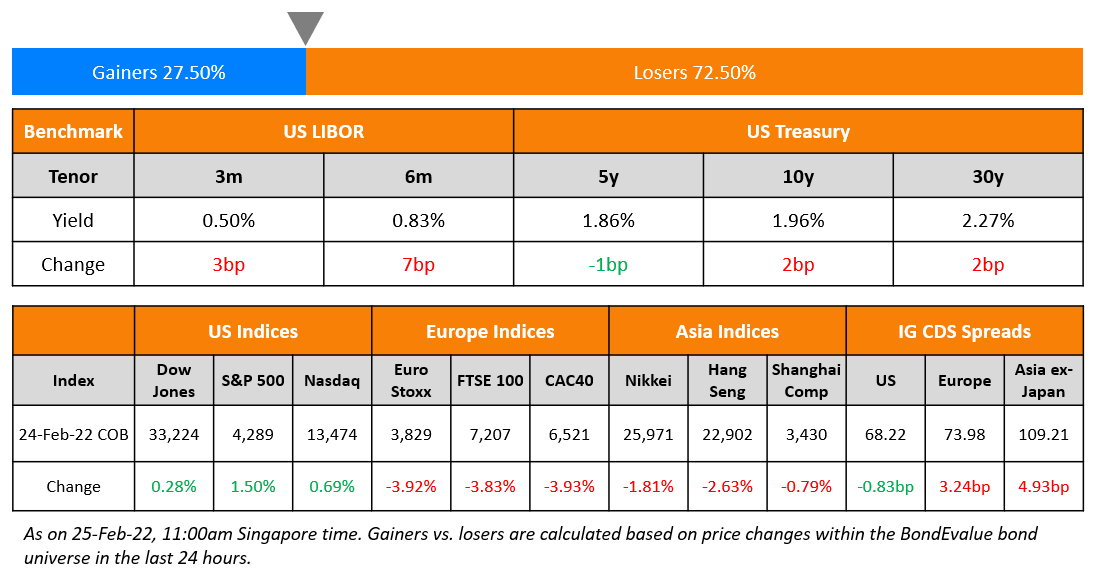

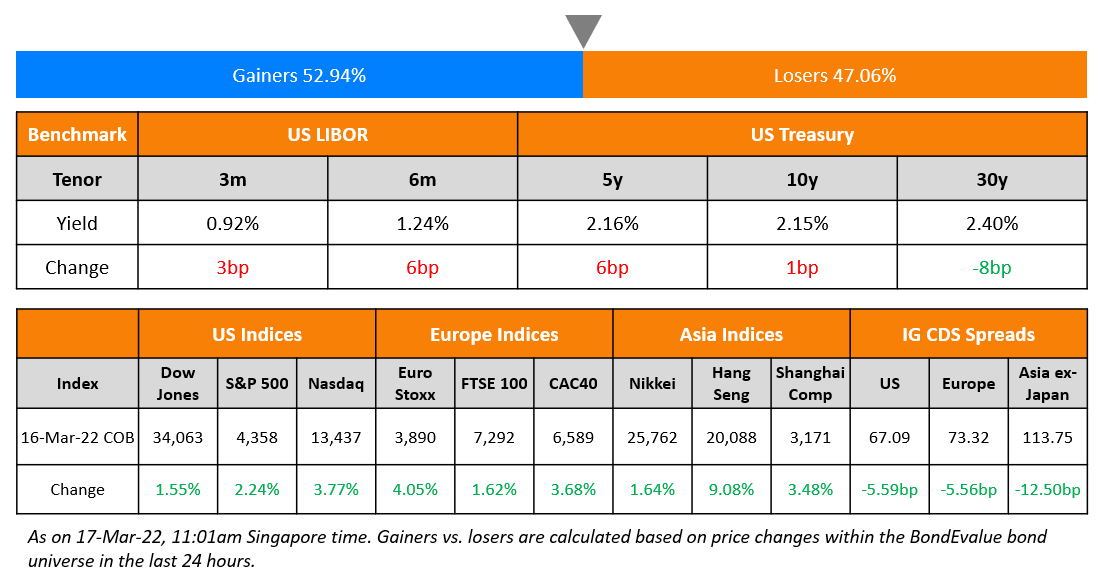

US Treasury yields were higher by 4-5bp across the curve on Thursday. Credit and equity markets were closed due to a shortened week on account of Thanksgiving holidays. Looking at the European markets, the downturn in Eurozone business activity eased in November but remain broad-based. The Composite PMI, ticked up to 47.1 from October’s near three-year low of 46.5, albeit still below the 50-mark. Estimates were at 46.8. Manufacturing activity, which has contracted every month since July 2022, continued to contract in November. The HCOB Eurozone Manufacturing PMI came at 43.8 vs. expectations of 43.5. Services PMI rose to 48.2 in November from 47.8, slightly above estimates of 48.1. European equity markets were slightly higher. In credit markets, European main CDS spreads were tighter by 0.5bp and crossover spreads tightened by 1.3bp. Asian equity markets have opened in the red today. Asia ex-Japan IG CDS spreads were tighter by 6bp.

New Bond Issues

- Luso International $ 10NC5.5 at 7.8% area

Rating Changes

- Ahli United Bank Upgraded To ‘BBB+’ On Stronger Integration With Kuwait Finance House; Outlook Stable

- Moody’s downgrades DWCM’s and Wanda HK’s ratings, outlook remains negative

- Fitch Revises Outlook on Philip Morris International to Negative, Affirms at ‘A’

New Bond Pipeline

- China Citic Bank hires for $ Tier 2 bond

Term of the Day

Modified Dutch Auction

Modified Dutch Auctions are a public offering where an issuer bids to repurchase securities by setting prices in a falling structure at which a holder can tender the securities. The buying price will be the highest at which the issuer can buy all securities it has offered to purchase, or a smaller amount if there isn’t a tender of all securities. With Modified Dutch Auction Tender Offers (MDATOs), the issuer pays one fixed price for the tendered securities. Due to this, some holders will receive more than they bid while others will receive less.

This is a variation of a typical Dutch Auction where the price of the offering is determined as the highest price after all bids are taken. For example, US Treasury bond auctions are based on the same principle – the highest price (lowest yield) submitted will be accepted and then move lower down in terms of prices submitted by the other bidders. For example, if the Treasury plans to issue $10bn worth of bonds at a price of $100 and the highest quote by a bidder is at $102, then they will get their full allocation followed by the price at which the next highest bidder bids and subsequently thereafter in descending order till the allocation is completed.

Talking Heads

On Germany to Suspend Borrowing Limit Again After Budget Shock – Spokeswoman

“With the supplementary budget, the federal government will propose a resolution to the Bundestag to establish an extraordinary emergency situation for 2023”

On European Junk Credit Risk at Lowest Since April 2022

Marco Stoeckle, head of credit strategy at Commerzbank

“Inflation optimism has helped CDS indices tighten to multi-month lows but I think we’re in thin air already. CDS are looking rich again. Picking up protection becomes increasingly attractive the closer they move towards these marks”

Shanawaz Bhimji, head of corporate bond research at ABN Amro Bank

“There is still a weak economy ahead of us, which will make it difficult for high-yield firms to grow out of their debt levels”

On Dollar defensive as markets weigh US rates outlook

ING economists

“We believe that the BOJ may scrap the yield curve programme as early as the first quarter of next, as Japanese government bonds appear to have stabilised … then begin its first rate hike in Q2 2024 if wage growth continues to accelerate next year”

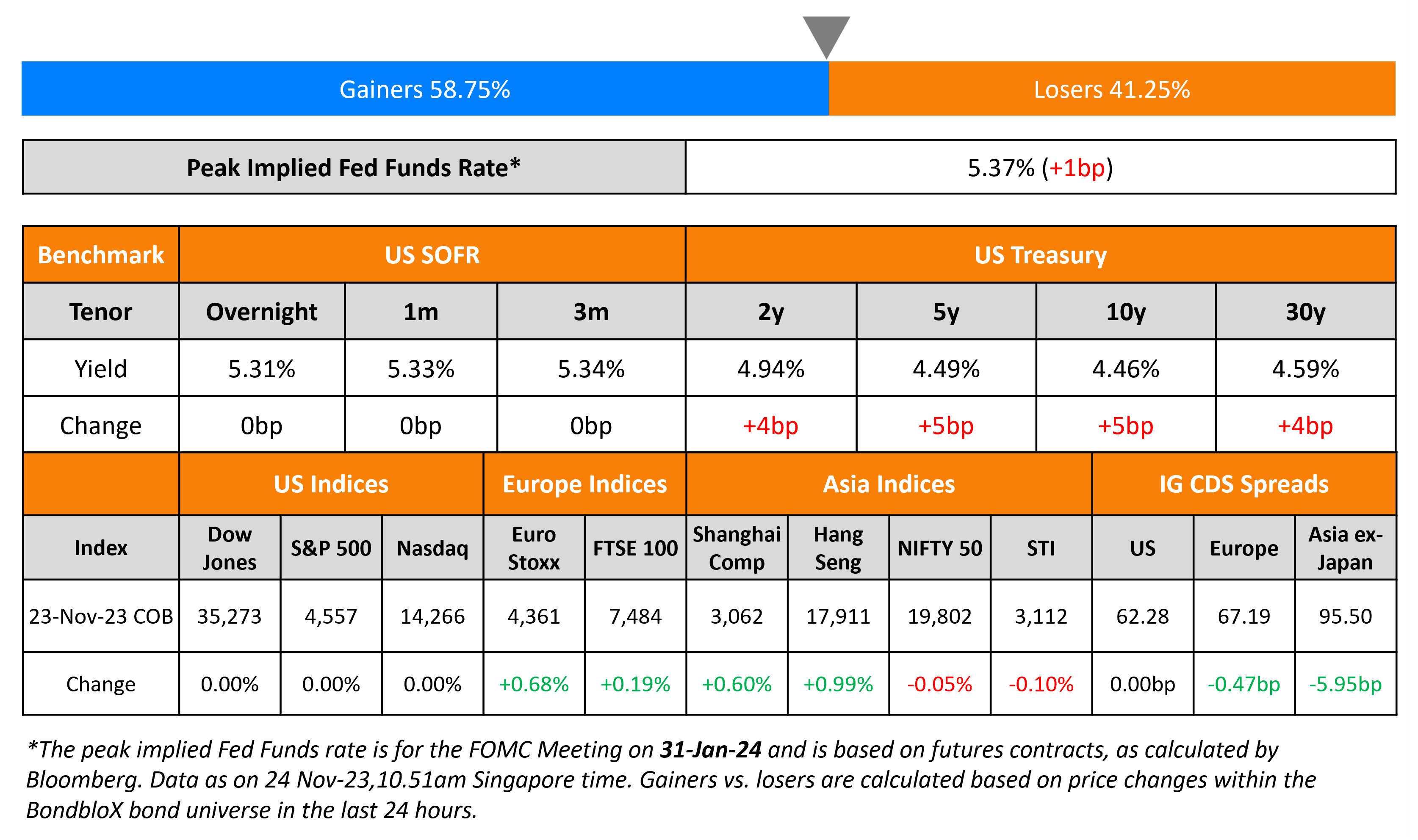

Top Gainers & Losers- 24-November-23*

.png)

Other News

China wealth manager Zhongzhi flags insolvency, $64 billion in liabilities

Go back to Latest bond Market News

Related Posts: