This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

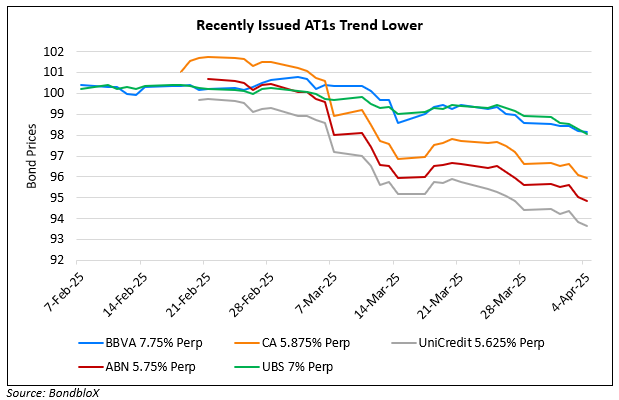

European Bank AT1s Priced in 2025 Drop Lower Since Issuance

April 4, 2025

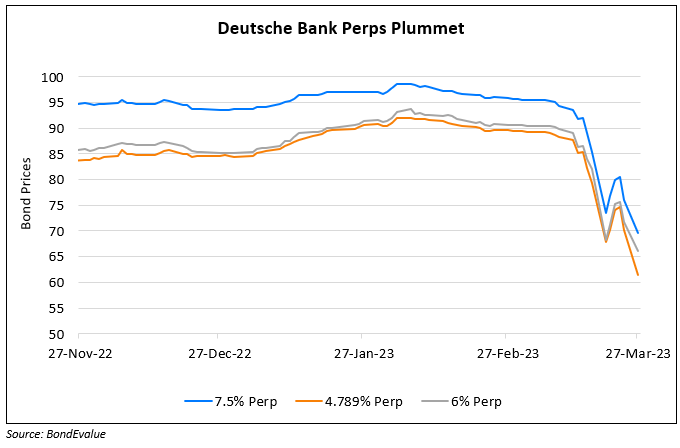

AT1s issued by popular European banks this year have trended lower since issuance, as seen in the chart. A Bloomberg index of European AT1s showed a 2.5% drop in March, with YTD returns turning negative. Bloomberg notes that recently issued AT1s are getting priced at very tight spreads. For instance, take the case of Deutsche Bank which chose to skip the call on its $1.25bn 4.789% Perp last month. Despite this, only a week ago it priced a €1.5bn PerpNC6 AT1 at 7.125%, with a spread of 460bp over the 5Y Mid-Swap. This was its tightest reset spread since 2021, as per Bloomberg. Analysts note that new AT1s which are pricing at tighter spreads, may reduce issuers’ incentives to call them, which could lead to extension risk and less attractive returns. They note that this risk is likely being reflected in secondary markets.

For more details, click here

Go back to Latest bond Market News

Related Posts: