This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

ESG Bonds – Now on the BondEvalue App

March 15, 2022

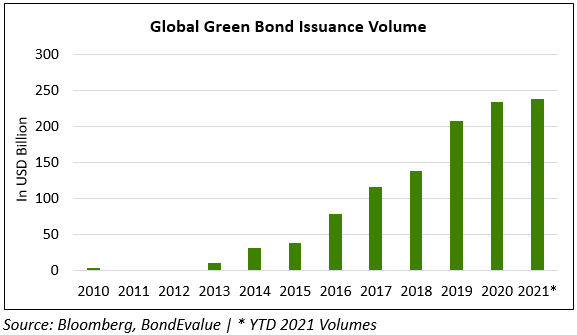

With the growing interest among investors and professionals in ESG bonds – green bonds, social bonds, sustainable bonds and sustainability-linked bonds – BondEvalue has now enriched its data to include key ESG metrics for ESG bonds on the BondEvalue App.

The ESG space has been gravitating towards a standardized approach, where it becomes easier to compare between two bonds of the same type. For this purpose, documentation has become an important element. The following key documents, typically available for most ESG bonds, can help investors better understand, compare and analyze ESG bonds:

- ESG Framework: Issuers publish an ESG framework document such as a Green Bond Framework that outlines the contours of the issuer’s ESG objectives, where the proceeds of these bonds will be used and what would the expected impact be. The framework also tends to point out how it aligns itself with a global standard, like the ICMA’s principles.

- ESG External Review: An External Review provider is an independent institution that reviews and provides its opinion on the issuer’s ESG framework. Think of it like a credit rating agency reviewing an issuer and providing a rating. While external reviewers do not provide a particular rating of the ESG framework, they opine . External review providers can come in two types:

- Second-Party Opinion (SPO): SPO companies publish a detailed document mentioning whether their review of the framework is credible, impactful and aligns with standard principles. The SPO companies generally hold conversations with issuers to understand the ESG impact of their business processes, planned use of proceeds, management of proceeds and reporting aspects. Most prominent companies here include Sustainalytics, CICERO, DNV, ISS ESG, S&P and Vigeo Eiris.

- Independent Assurance Report: These are brief documents that could come in the form of pre/post issuance verification reports. Most audit companies like the Big 4 – PwC, EY, Deloitte, KPMG – typically publish these reports. This report gives a limited assurance conclusion as to whether there is any cause to believe that the assertions of the company do not meet criteria they have mentioned

- Issuer ESG Report: This is usually an annual document made by the issuer reporting the impact of their ESG initiatives. This includes the specific areas where the proceeds from the bonds were used and how much of the funds were allocated across these ESG projects.

To access ESG bonds on the BondEvalue App, click here. For Mobile App users, please make sure to update the BondEvalue App from the Apple App Store or the Google Play Store to access this data.

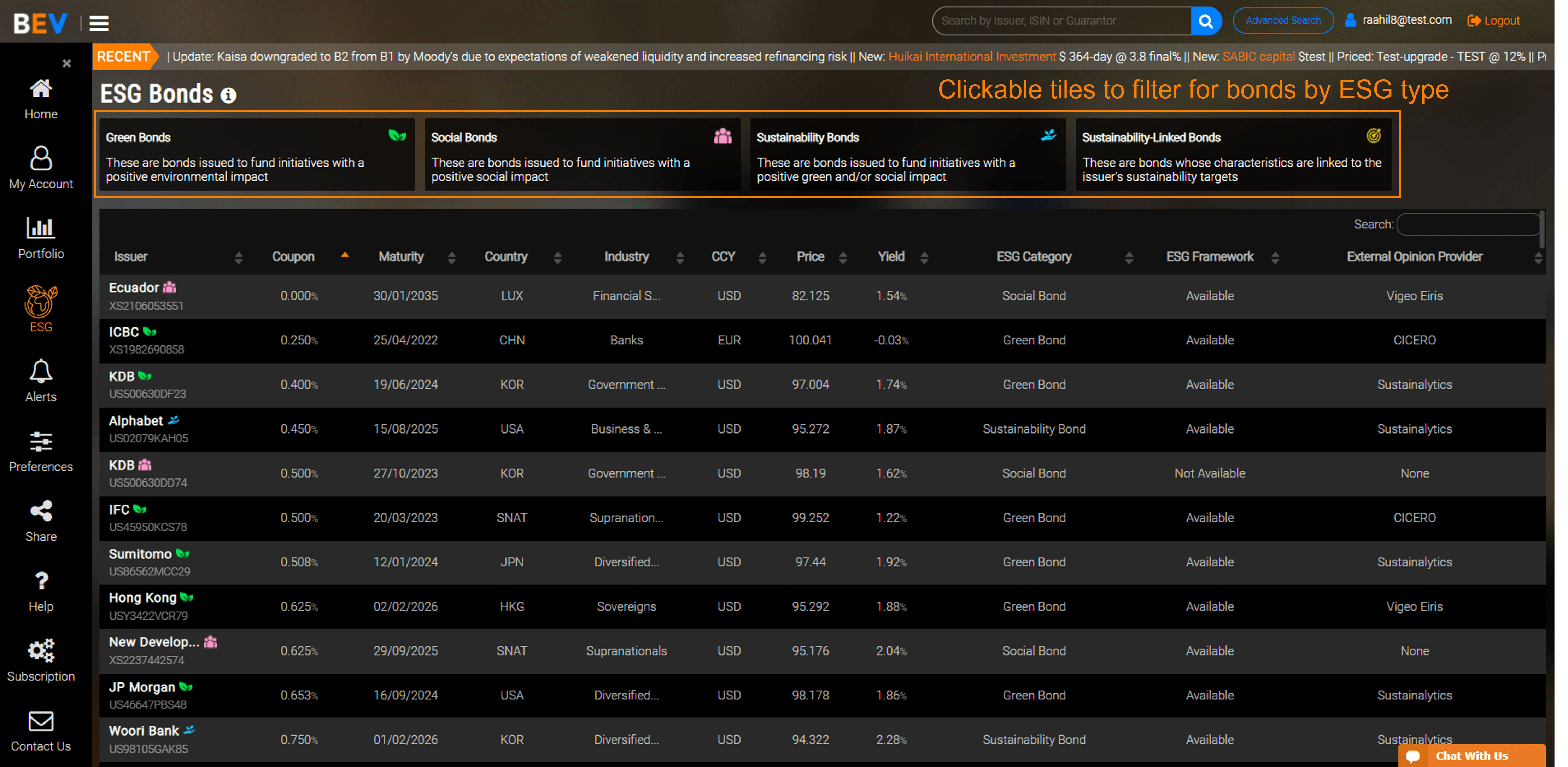

ESG Bonds Page

On the ESG Bonds page, you can access the list of BondEvalue’s ever-growing ESG bond universe. The ESG icon on the left menu (between ‘Portfolio’ and ‘Alerts’) can be clicked to access this screen. A description of the four broad types of ESG bonds is given on the top of the page, followed by the entire list. You can filter the list by ESG bond type by clicking on the Green Bonds, Social Bonds, Sustainability Bonds or Sustainability-Linked Bonds tiles at the top. To remove the filter, you can click on the same tile again to deselect it. You can also search by issuer name, country, industry, ESG category, the availability of ESG frameworks, external review provider etc. to refine the list via the Search box to the top right of the list:

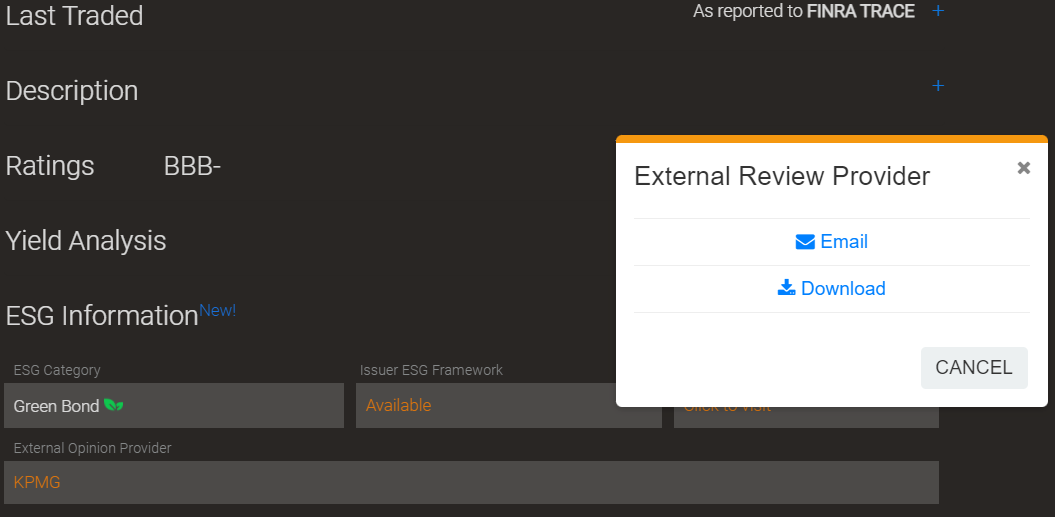

Below is an example of Power Finance Corp’s 3.75% USD green bond due 2027. The green bond symbol is displayed next to the issuer’s name. Scrolling lower, you can see the new “ESG Information” tab where details on the ESG bond are given with the relevant documents. Within the ‘Issuer ESG Framework’, ‘Issuer ESG Website’ and ‘External Opinion Provider’ fields, you can click on the orange text to access the supporting documents.

For Issuer ESG Framework and External Opinion Provider, the supporting documents can be downloaded and/or emailed to yourself to access later.

Similarly, on the BondEvalue Mobile Apps, users can access ESG Bonds as per the screenshots below.

If you would like to learn more about ESG bonds – What are ESG bonds, Types of ESG bonds and Important ESG documents to track, click here.

Go back to Latest bond Market News

Related Posts: