This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

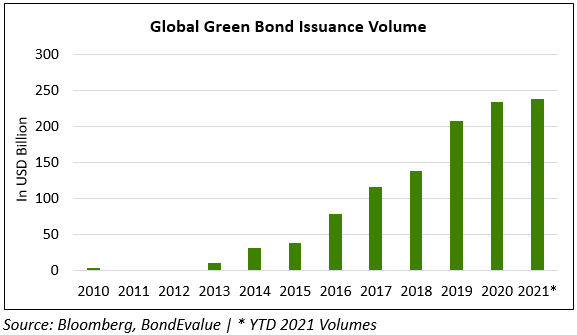

1H Green Bond Issuance Set to Exceed 2020 Full Year’s Issuance

June 24, 2021

The first half of 2021 is set to see global green bond issuance exceed 2020’s full year volume, set for an annual record for the year. Refinitiv data shows that the number of green bonds issued has more than doubled to 605 in 2021 so far vs. 293 in H1 2020, and accounts for 48.7% of the overall $486.3bn in ESG bond issuances this year. Europe has led the rise with $142bn in green bonds issued, ~3x the $51.3bn issued during the same period last year. This is only expected to increase further with the NextGeneration EU programme (NGEU), under which €250bn ($298bn) in green bonds will be issued from 2021-2026. YTD Asia green bond issuance volumes are at $54.52bn, over 3x higher than that of 2020.

Across countries, the US leads with $31.98bn in green bond issuances and a 13.3% market share with China following with $31.81 in new green bond deals and a 13.25% share. Germany is third with $28.19bn with and a 11.7% market share, followed by France at $25.44bn and a 10.6% market share. France was the leading issuer during the same period last year. Joerg Eigendorf, head of communications, social responsibility and sustainability at Deutsche Bank said, “Overall the trend is clear, the demand and supply of ESG financing are fundamentally changing and reaching unprecedented levels…I think it will go faster than we all think and that ESG will be the new normal”.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

ESG Bonds – How Different (or Not) Do They Trade vs. Non-ESG Bonds?

December 18, 2024

Chile Raises $4.25bn via Dual Currency ESG Offering

January 20, 2021